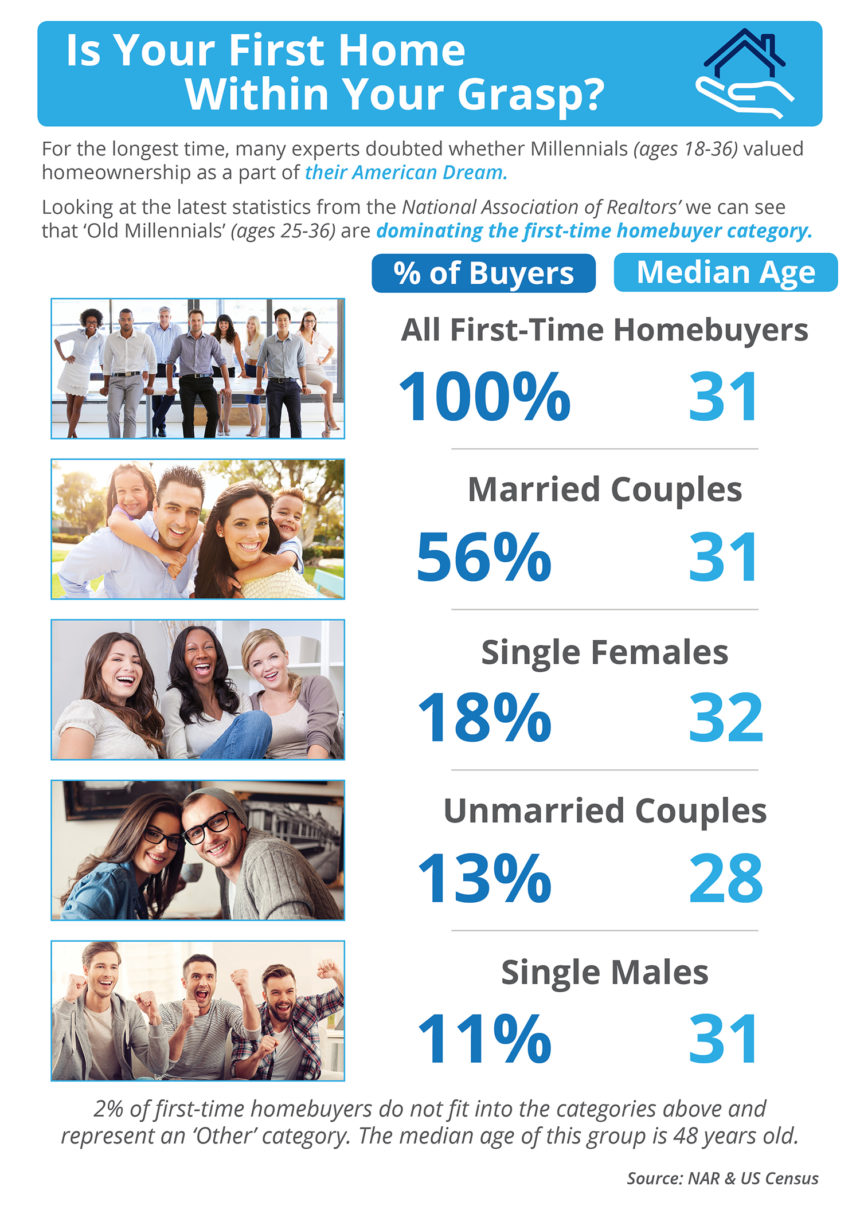

According to the National Association of Realtors (NAR), Millennials make up the largest segment of the first time home buyers.

Besides being the largest generation, there are several reasons Millennials are the majority of buyers buying their first home.

1. Rent Vs. Buy and Net Worth

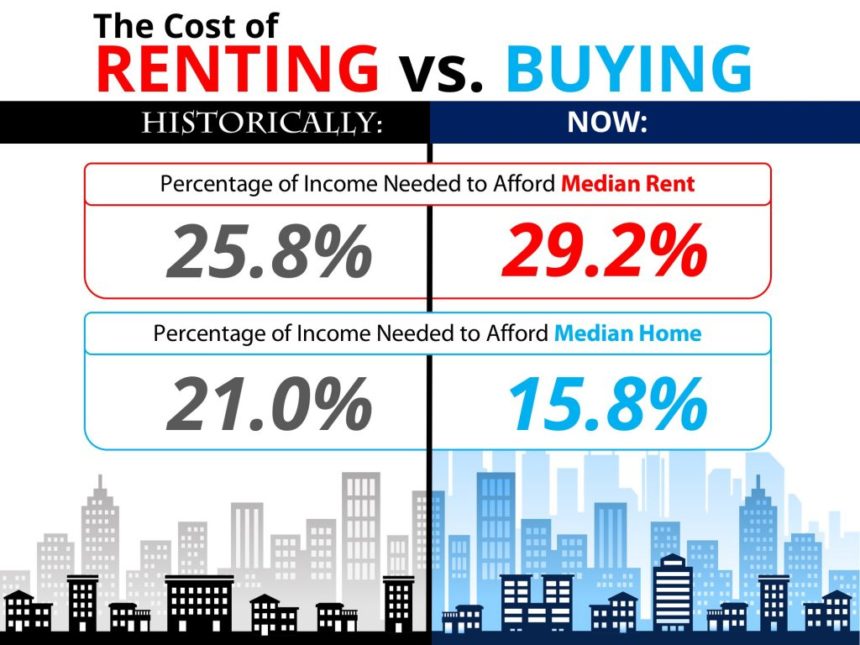

Despite rising home values, in many markets across the US it is cheaper to own a home than it is to rent. Not only are home values increasing, rents continue to increase.

It makes more sense to buy a home in Charleston than it does to rent.

Historically, it has been the case that a mortgage eats up less of your monthly income than renting does.

Today, buying your first home is even cheaper than renting compared to the historical averages:

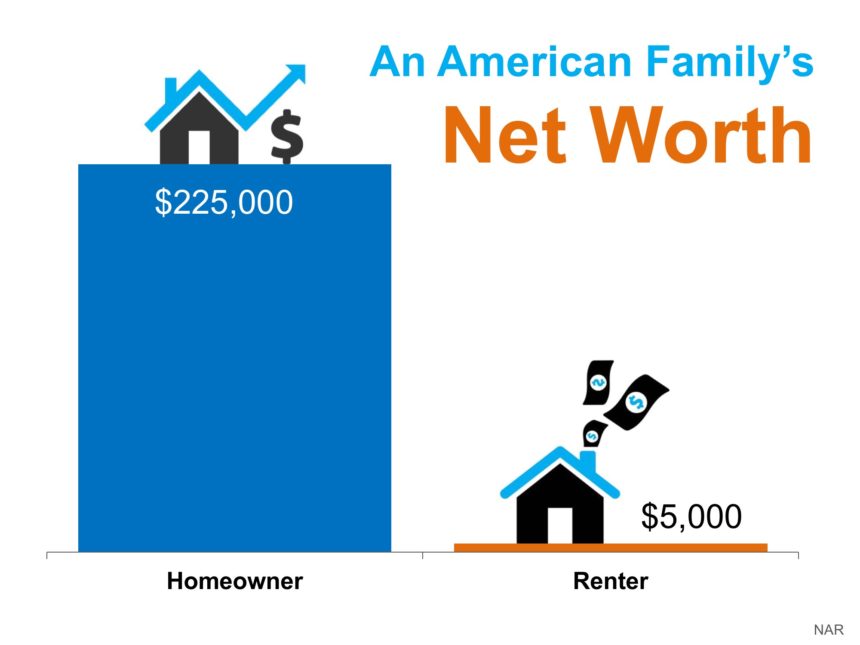

Buying your first home will also allow you to create wealth. The average net worth of a home owner is now 45 times greater than a renter:

In fact, recently millionaire David Bach was featured in a CNBC article, and he said the biggest mistake Millennials are making is not buying their first home, because buying real estate is “an escalator to wealth.”

“If millennials don’t buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter.”

In his bestselling book, “The Automatic Millionaire,” Bach does the math:

“As a renter, you can easily spend half a million dollars or more on rent over the years ($1,500 a month for 30 years comes to $540,000), and in the end wind up just where you started — owning nothing.

Or you can buy a house and spend the same amount paying down a mortgage, and in the end wind up owning your own home free and clear!”

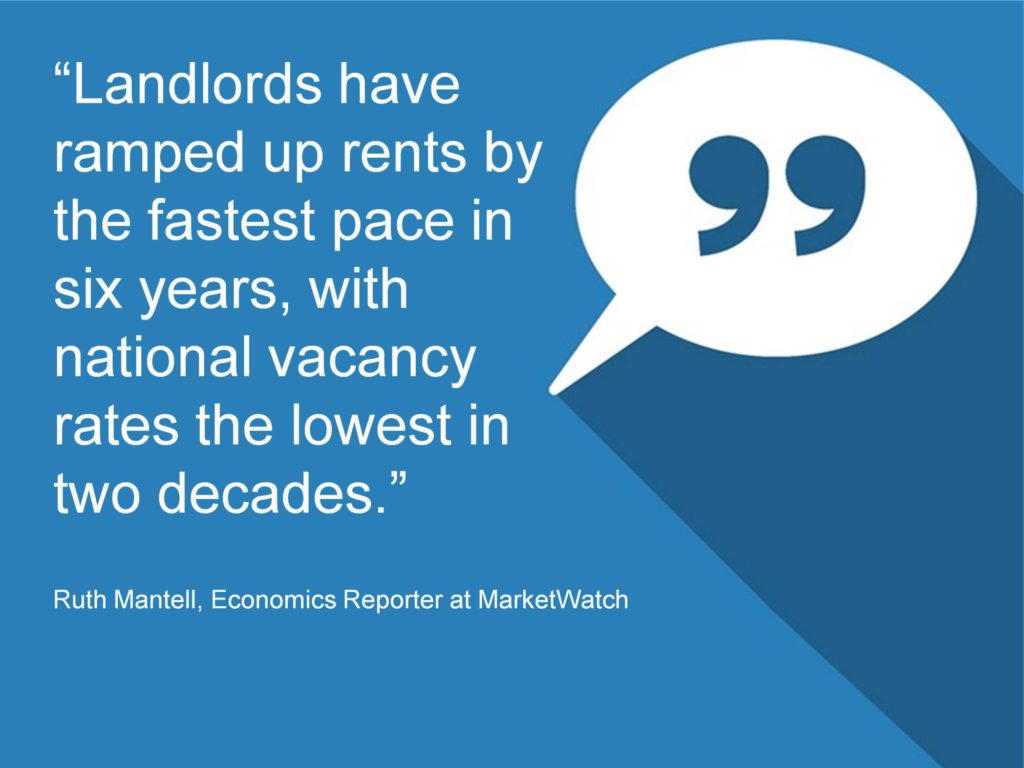

The hot housing market has not been limited to increased home values. Rents have also skyrocketed:

Keep in mind that with a mortgage payment, your monthly housing payment remains constant. Rents go up over time, and you are basically throwing away all of that money.

2. Low Interest Rates And The Economy

Millennials are seeing that buying their first home makes a lot of financial sense, and not just from a rent vs. buy standpoint. It makes financial sense in other ways as well.

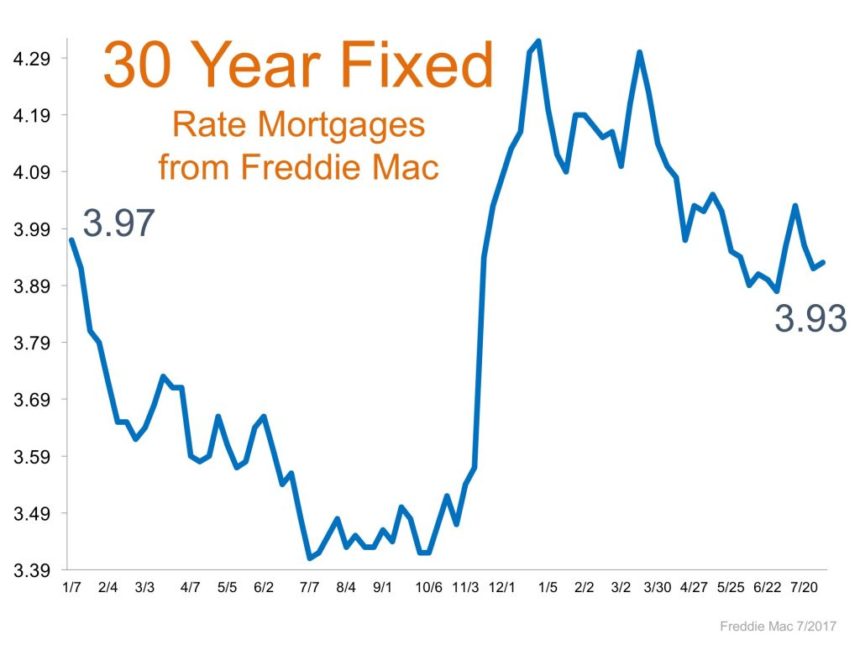

Despite rising home prices, homes remain affordable because of historically low interest rates, job and wage growth, and an overall strong economy.

Interest rates remain low, helping to offset rising home values:

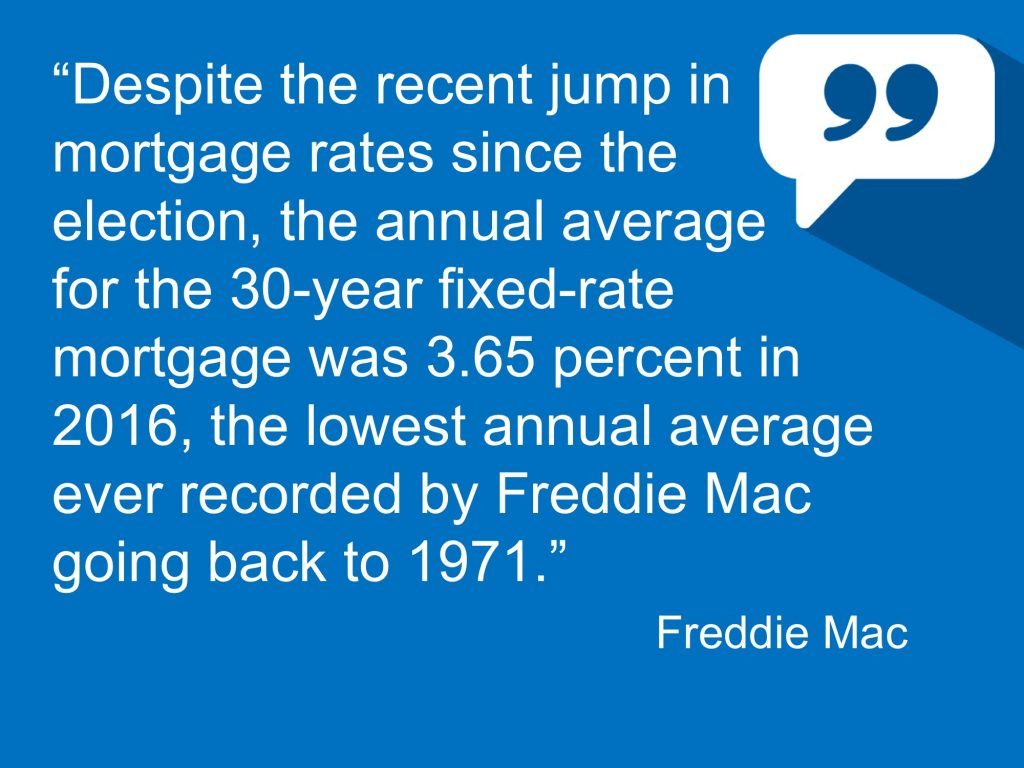

In fact, they are not too far off from 2016, which saw the lowest recorded annual rate since Freddie Mac began tracking them in 1971:

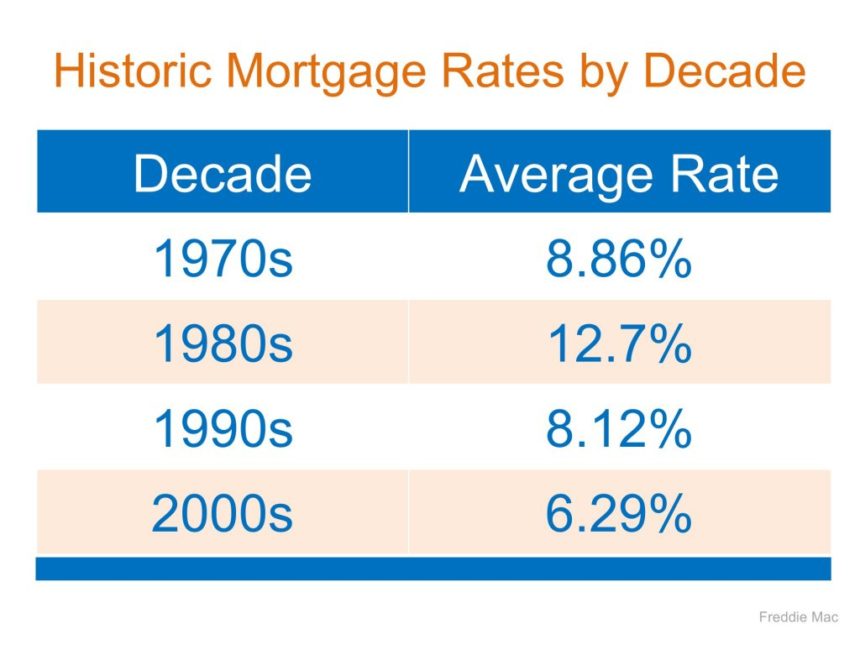

Needless to say, mortgage rates remain low compared to previous decades, going back over 40 years:

Historically low interest rates have made homes more affordable for today’s buyers than in previous markets:

Another contributing factor is the health of the overall economy, and increasing consumer confidence.

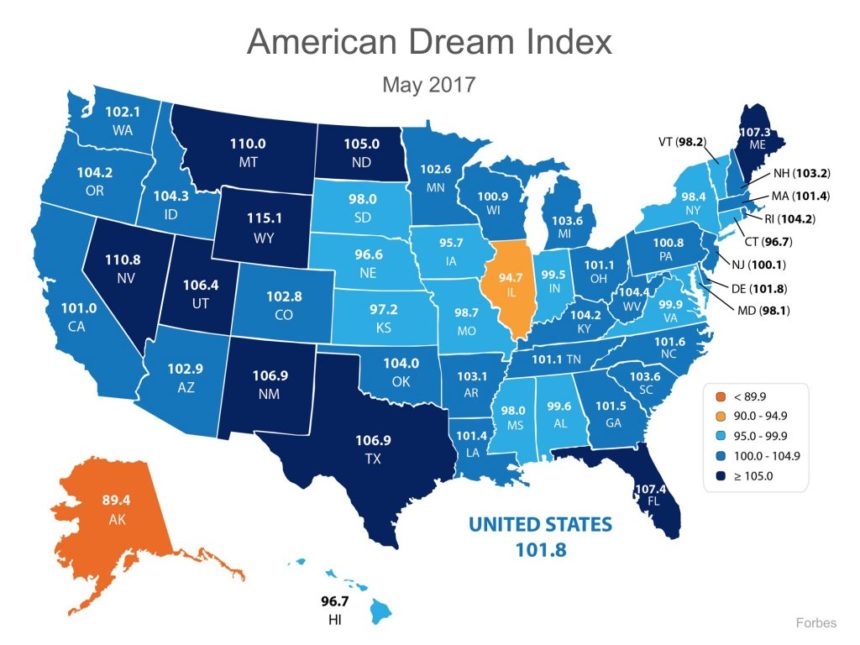

Forbes created the American Dream Index back in January to track American’s confidence in the economy.

The most recently released report saw that index increase for the fourth straight month:

Consumer confidence hit the second highest level in 16 years in July:

All factors combined make the outlook for the housing market in the coming years very bullish:

3. Home Affordability Increasing

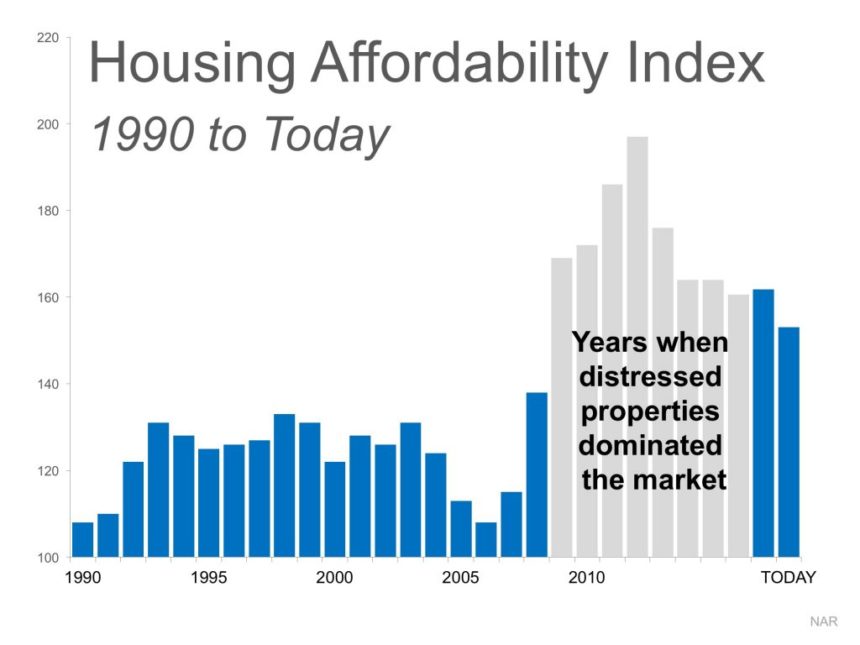

Because of the factors listed above, home affordability is at the highest it has been in decades:

Yes, those numbers were higher during the real estate boom and bust, but that was because there were so many distressed properties–short sales and foreclosures.

These homes brought down the values of surrounding homes, contributing to the market crash.

Compared to those years homes are not as affordable, but today’s market is a much healthier market and homes are more affordable than they have been in many years.

Bottom line, buying your first home is still very affordable in the current market:

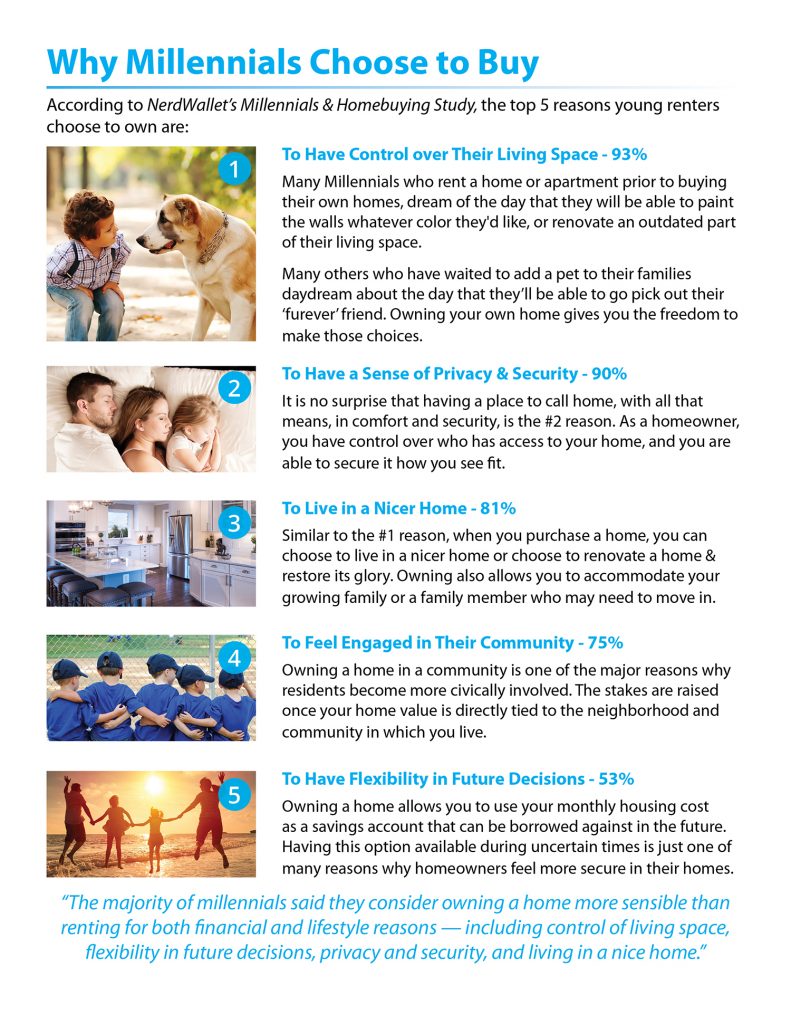

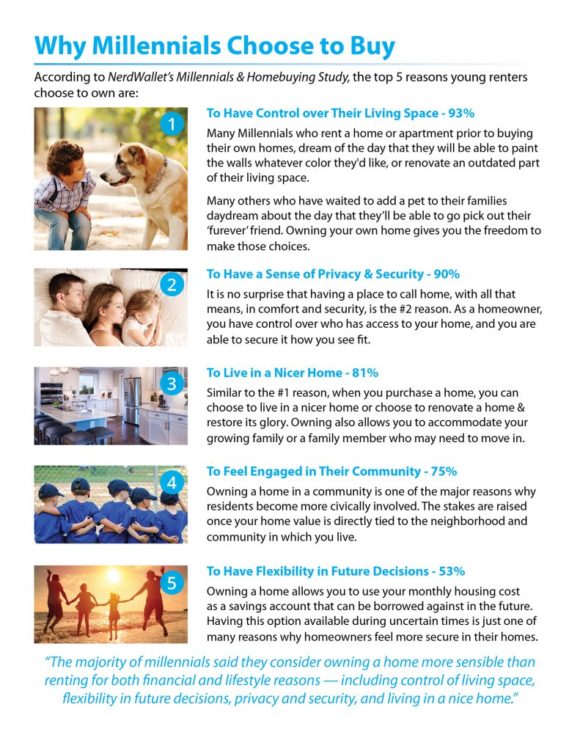

4. Emotional Reasons For Buying First Home

The financial reasons for becoming a first time home buyer certainly make sense.

But the decision of buying your first home is an emotional one–we buy emotionally, then use the logic to rationalize and support the emotional decision.

That is certainly the case with Millennial home buyers.

A big part of the number one reason is the freedom to have a pet, or have many pets.

A recent article from USA Today’s Sydney C. Greene (“Millennials Are Influenced More By Dogs Than Marriage, Children When Buying A Home“) pointed out that a big reason Millennials are choosing to be first time home buyers is because of their dog.

The article cites a recent survey by Sun Trust and found

“33% of Millennials were influenced more by dogs than marriage or children when purchasing their first home. The desire for more space and opportunity to build equity were the only two factors that topped having room for a dog.

Among Millennials who have never purchased a home, 42% said their dog, or desire to have one, would influence their future home-buying decisions. The survey said this suggests dogs might also influence purchase decisions of potential first-time homebuyers”

Low Inventory Impacting Millennial First Time Home Buyers

Many Millenials are holding off on becoming a first time home buyer.

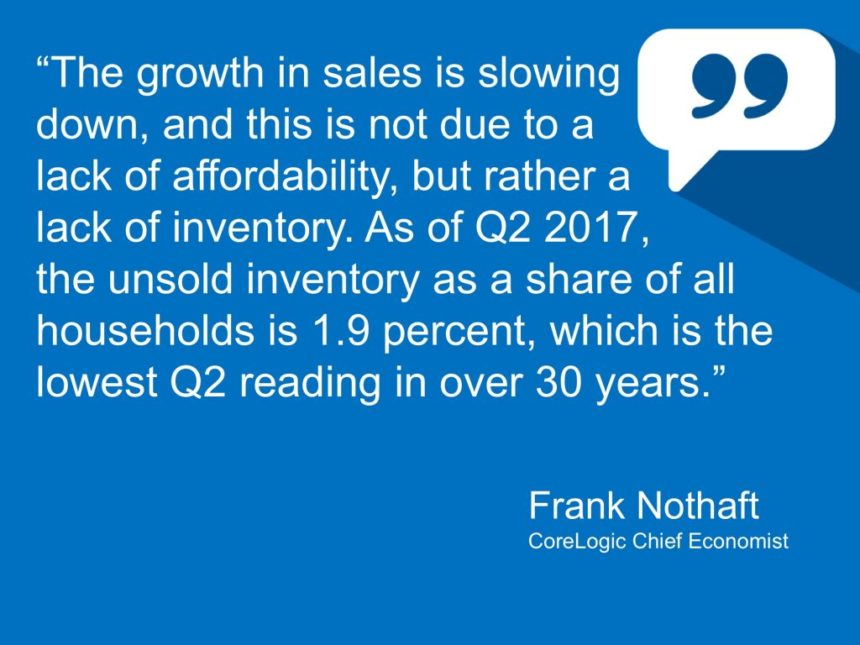

Part of this is because despite the strong demand for houses, inventory levels remain at historic lows–there simply aren’t enough available homes.

Inventories hit a 30 year low in the second quarter of 2017:

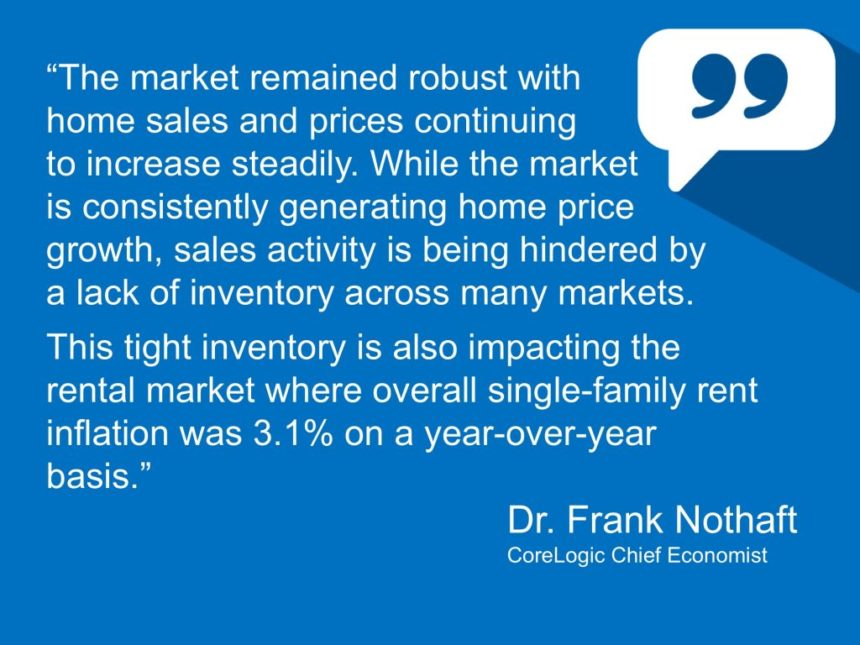

Tight inventory is also impacting would be first time home buyers by increasing rents:

Millennial First Time Home Buyers Disqualifying Themselves.

Another problem for Millennial first time home buyers is the fact that many disqualify themselves by mistakenly believing what it takes to buy a home.

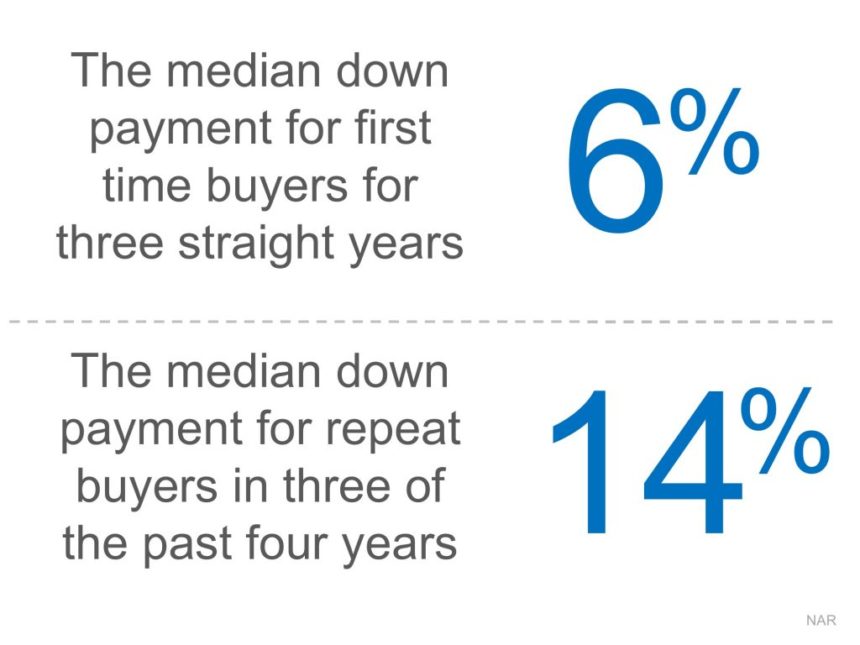

Too many still believe that you need nearly perfect credit or at least 10% to 20% (or more) for a down payment.

In Realtor.com’s recent article, “Home Buyers’ Top Mortgage Fears: Which One Scares You?” they mention that

“46% of potential home buyers fear they won’t qualify for a mortgage to the point that they don’t even try.”

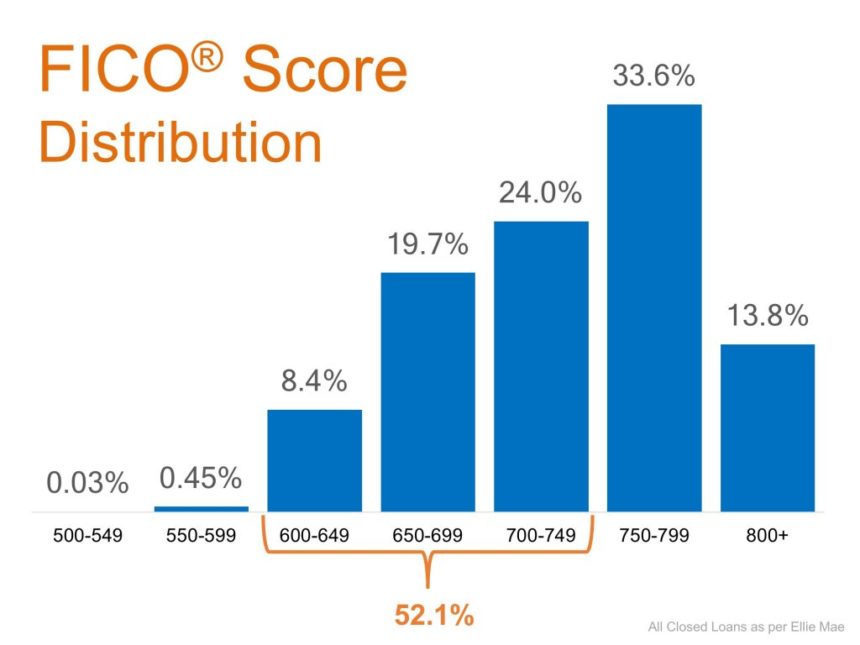

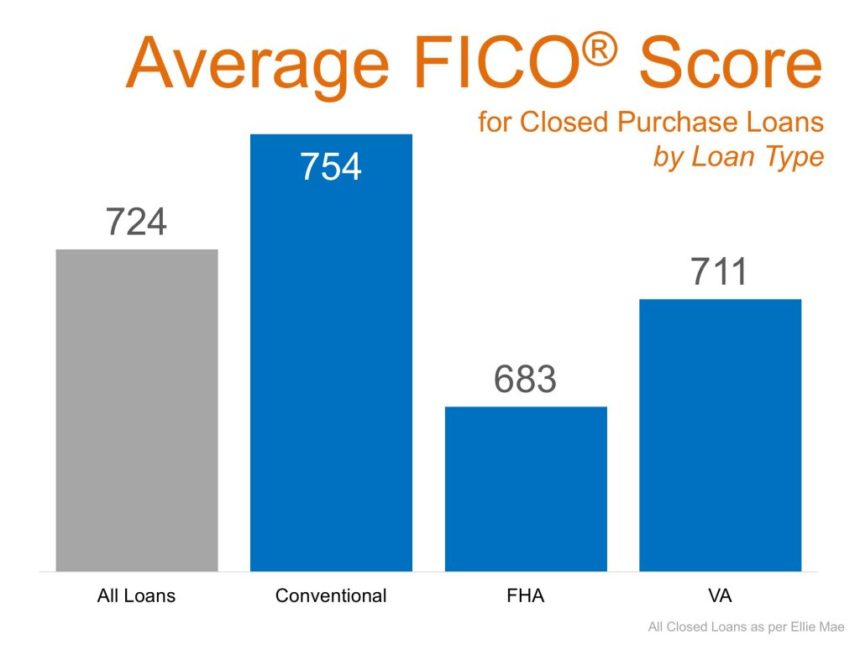

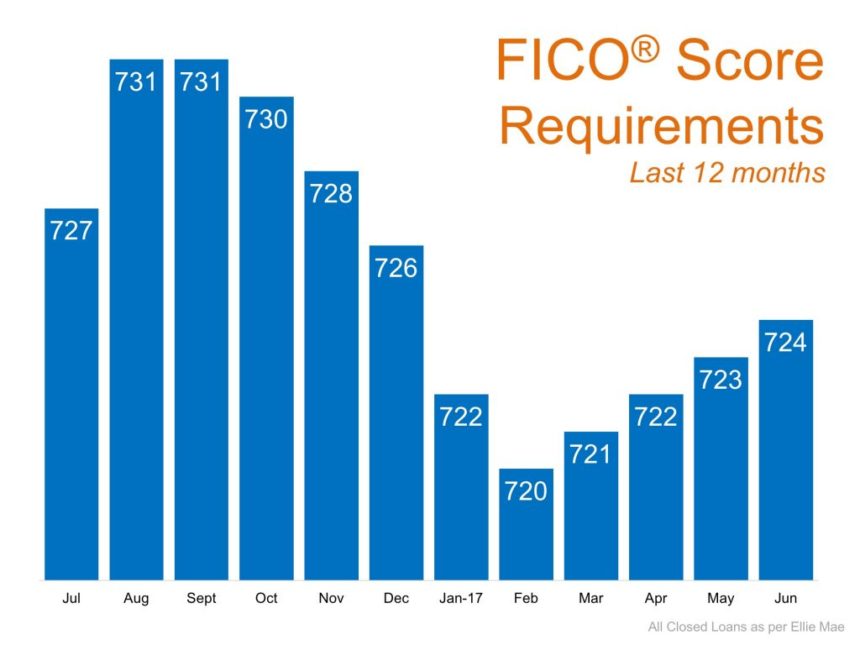

The most recent stats for closed mortgages show that you do not need a 750 or 800 credit score to get approved for a mortgage:

Although the average FICO score has increased slightly in 2017, it remains lower than last year:

Thanks to several low down payment loans, including the FHA Loan, many first time home buyers are able to buy with a minimal down payment:

FHA Loans have always been a popular option for first time home buyers, and they’re especially popular with Millennial buyers.

Ellie Mae’s Executive Vice President of Corporate Strategy Joe Tyrrell explains:

“It is not surprising to see Millennial borrowers leverage FHA loans because they typically offer lower down payments and lower average FICO score requirements than conventional loans. Across the board, we’re continuing to see strong interest in homeownership from this younger generation.”

The Cost Of Waiting

Many Millennial first time home buyers are delaying their purchase either because they want to save up a larger down payment or they want to improve their credit score.

As seen by the above infographics, this is not necessary.

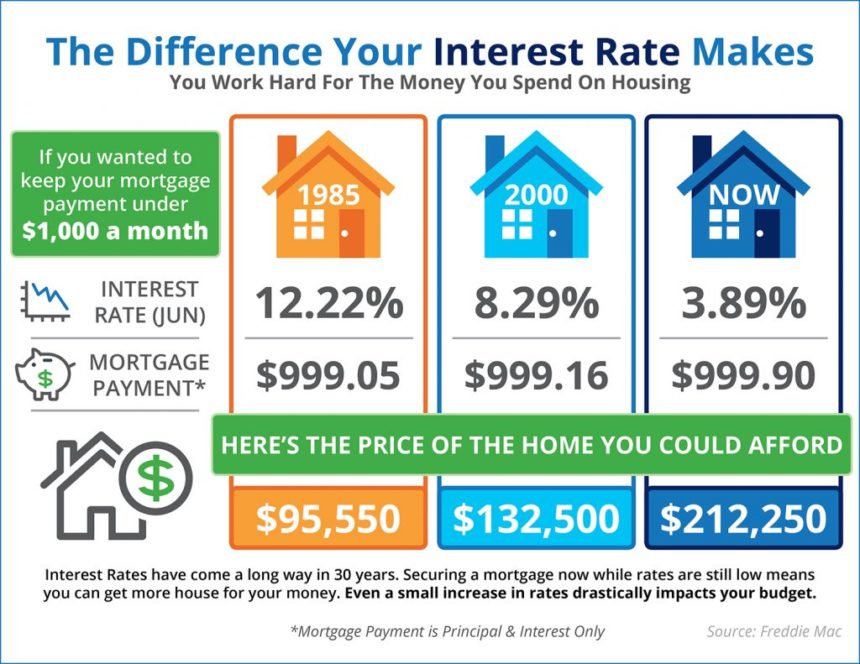

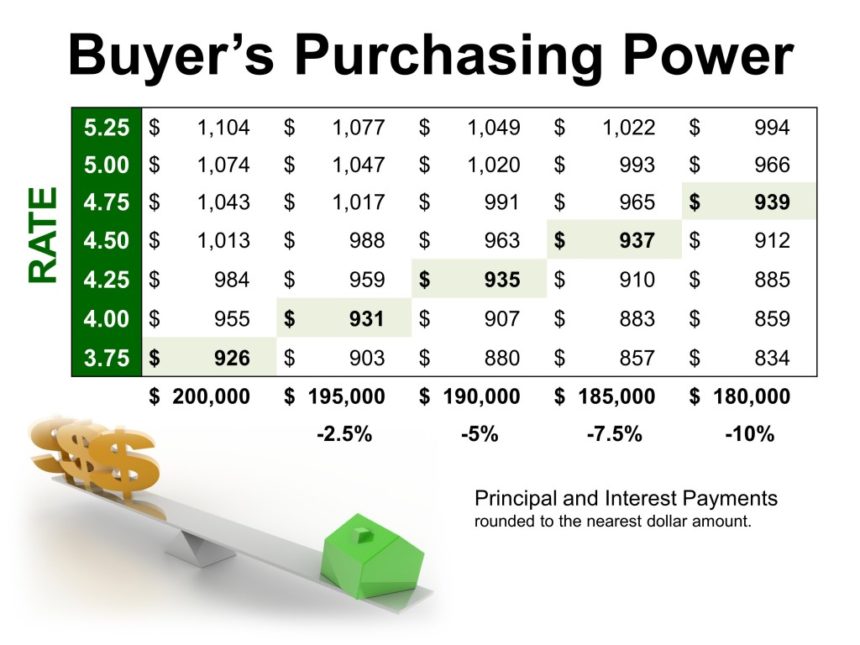

With increasing home values and the potential for interest rates to increase, holding off on buying your first home will not only cost you more money, but it means you will be able to afford less house.

Say you want to keep your monthly payment under $1000. Here’s how rising interest rates impact your purchasing power:

Free Millennial First Time Home Buyer Guide

Click on the image below and you can download your free Millennial First Time Home Buyer Guide!

Keep up with the latest real estate stats, news and trends by following me on this blog or this blog.

You can also follow me on Facebook and Twitter.

Be sure to check out my Pam Marshall Realtor website.

Leave a Reply