If you are currently renting, then the thought has probably crossed your mind on whether or not you should continue to rent or buy a home.

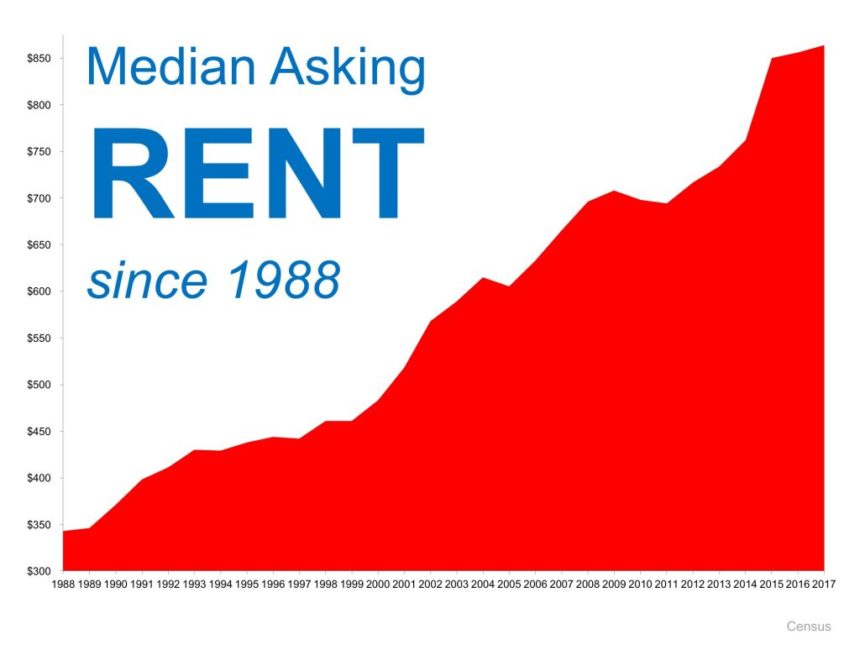

Chances are you have felt the pain of increasing rents, limited availability, and the joy of having to move.

Chances are you have felt the pain of increasing rents, limited availability, and the joy of having to move.

The current real estate market is fairly hot–home sales have been continuously increasing, as well as home values, over the last few years.

We have moved past the big crash, the real estate market has recovered, and the market is doing quite well.

The ultimate decision of rent vs. buy really comes down to a personal choice–what is the best decision for you?

However, let me provide you with some good information that will show you that from a financial standpoint, buying a home is the best decision for renters to make.

Rent Or Buy: The Costs

Did you know?

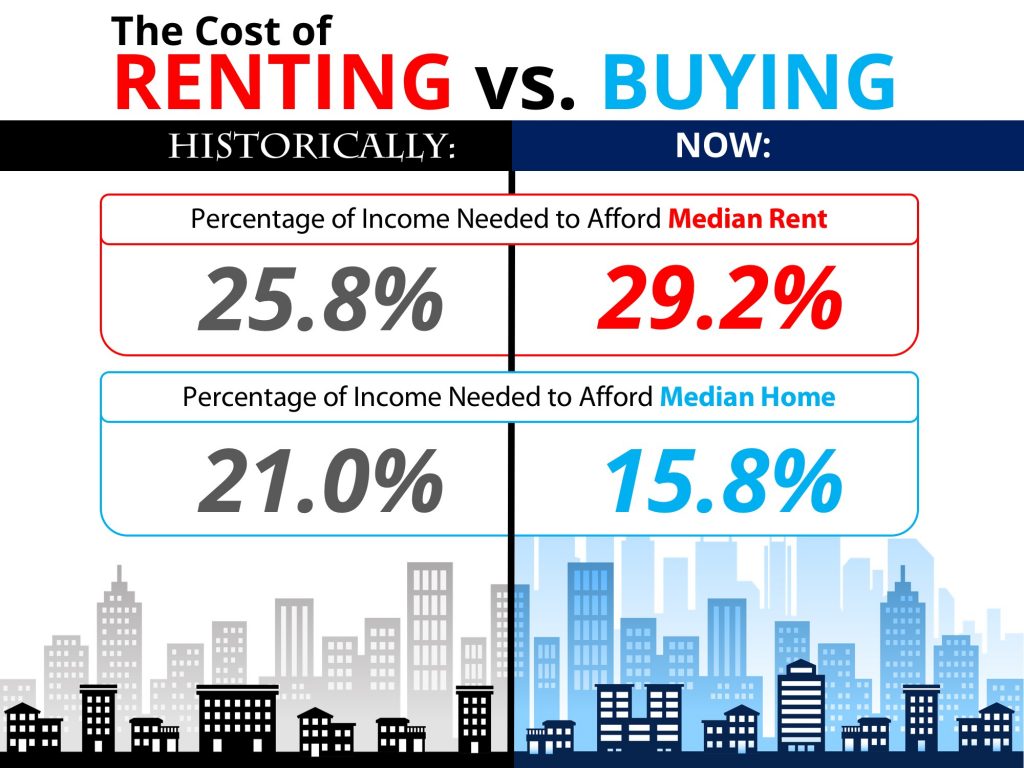

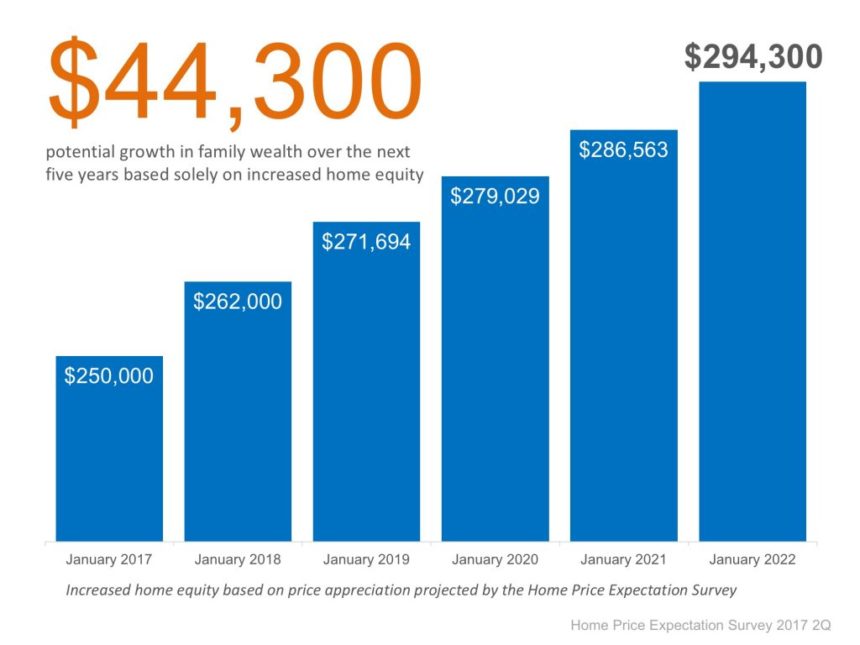

Historically speaking, spending money on a mortgage will cost you a lesser portion of your paycheck than renting?

In today’s market, that gap is even larger.

Historically speaking, rent eats up almost 26% of your take home pay.

A mortgage on the other hand would take 21%.

However, the numbers in today’s market are much different:

In today’s market, there is a 14% difference between how much of your hard earned income you keep when you rent vs. buy.

There’s an old saying: “Whether you pay rent or own, either way you are paying a mortgage”. If you are renting, you are paying your landlord’s mortgage.

They get the benefit of increased equity. You get nothing.

Rent Or Buy: Home Owners Have A Greater Net Worth Than Renters

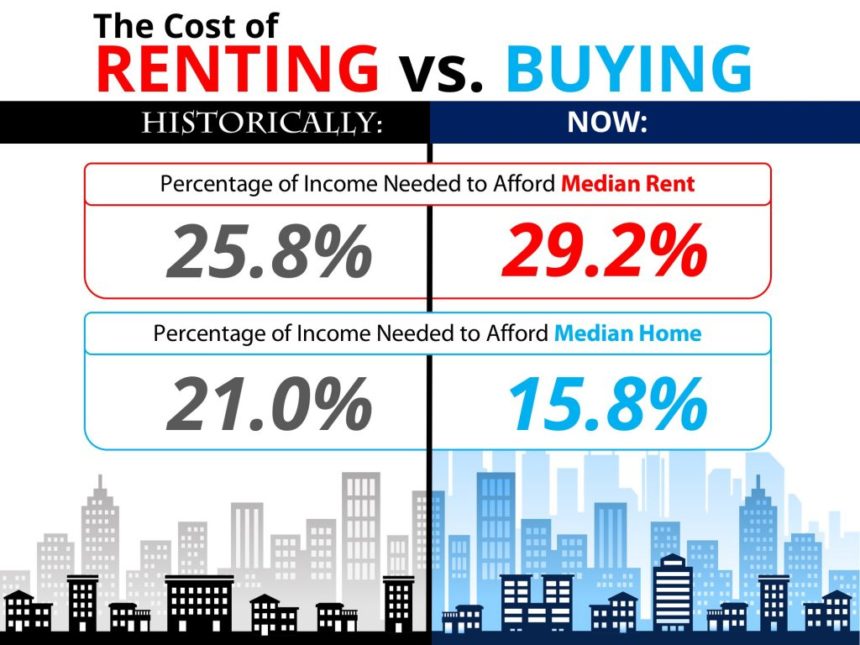

Speaking of equity, if you are living in a home that is increasing in value, hence increasing equity, why wouldn’t you want to benefit from that?

Recent numbers show that the average net worth of home owners is 45 times greater than the net worth of renters,

This next infographic does a great job of illustrating the affects of growing equity increasing net worth:

Rent Or Buy: Are Homes Affordable?

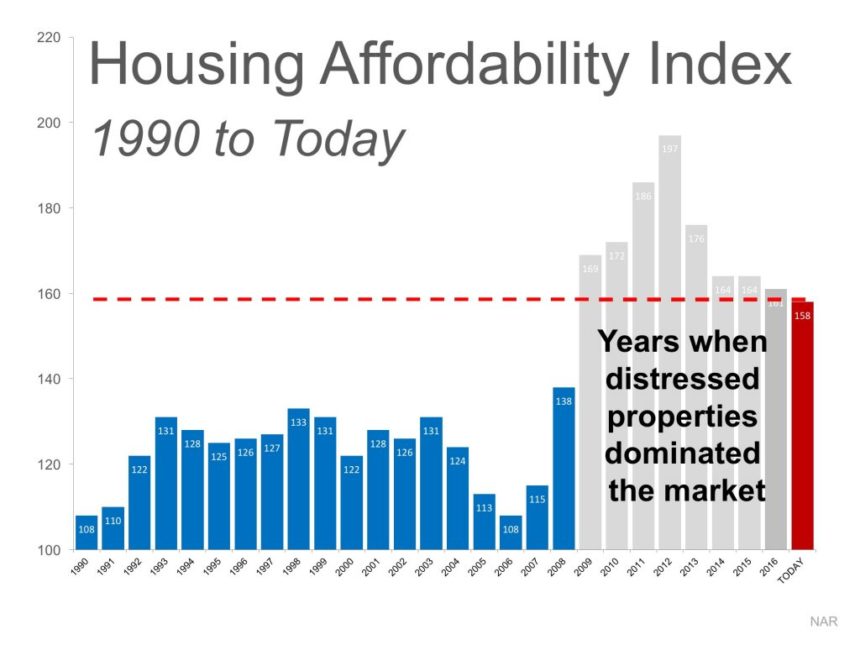

I covered home affordability in greater detail (here and here), but right now many factors are contributing to make homes more affordable despite home values continuing to increase.

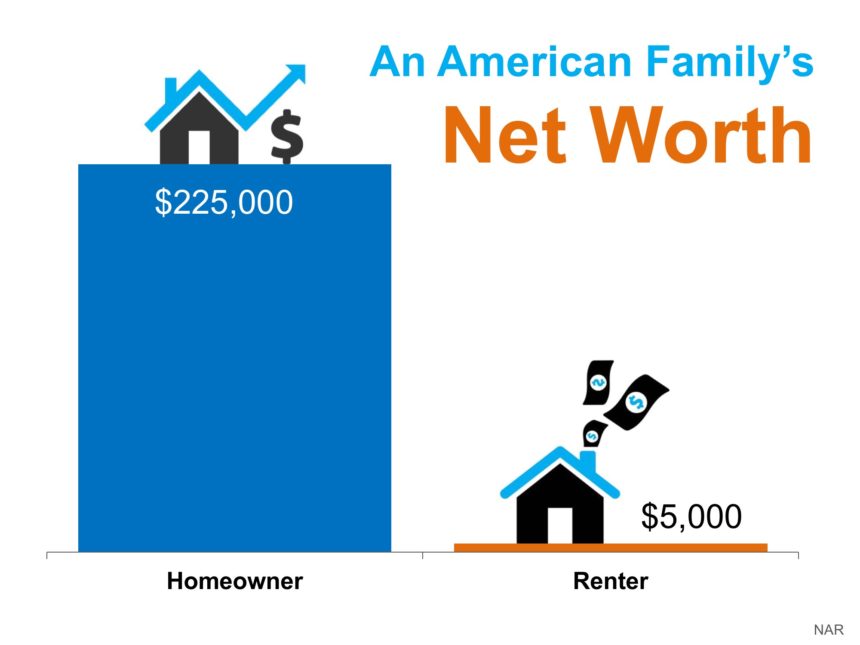

But increasing home values are a good thing.

For one, they give buyers confidence that they are making a sound investment decision. Historically speaking, home values continue to go up.

Just like the stock market, they will have their ups and downs, but on average, real estate has appreciated at 3%-4% annually over time

Secondly, increasing home values are one half of the equation to building equity in a home (the other is paying down the mortgage each month).

As far as affordability, homes are more affordable than they have been in decades.

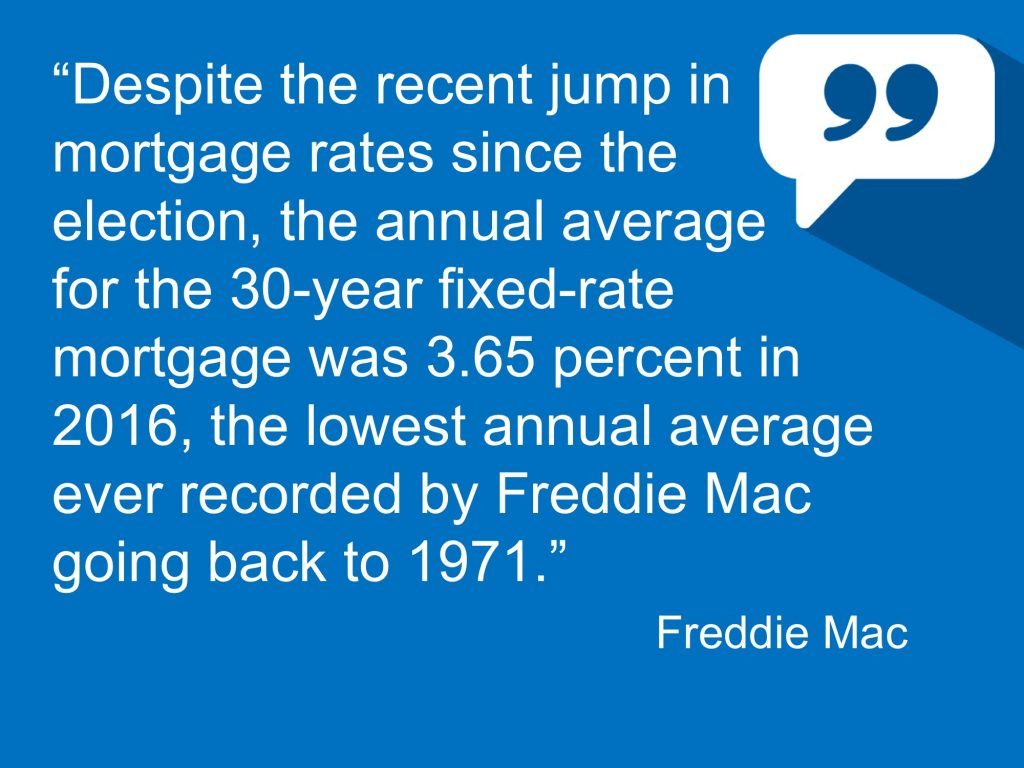

Mortgage Loan interest rates are near their historical lows, which we hit last year:

Rent Or Buy: Which Is Cheaper?

If you have researched whether to rent or buy a home, you will come across many articles, studies, and reports that will show examples of places throughout the country where it is cheaper to rent or cheaper to buy a home.

But what about some solid numbers for here locally?

I used a great resource for looking up rental numbers and trends to find the average rent in Charleston SC for 2017.

According to the site, the average rent for an apartment in Charleston is $1169/month.

The average square feet for that rental is 913.

Currently, the median home price for Charleston is $258,870.

Interest rates are around 4% currently.

So, if you take the median home value, and take out a mortgage at 4% for 30 years, you are looking at a monthly payment of $1236/month.

Of course, that example assumes no down payment, which is possible if you use a VA Loan.

But, assuming you would use a minimum down payment of 3%, then the amount you would mortgage would be $251,110.

So, that amount at 4% would make a monthly payment of $1199/month.

Those payments do not factor in taxes and insurance payments, but I don’t want to confuse the bigger point.

For roughly the same as the average rent payment in Charleston, you can afford a median priced home.

Which one do you think will have more bedrooms? More square feet? A bigger yard? Won’t include a landlord?

Of course, that is the median home price in Charleston. There are available homes for less.

In fact, there are currently 1,007 homes listed for sale in Charleston for less than $258,870.

That does not include town homes and condos, which add 569 more options.

Mortgage Vs Rent

One thing to keep in mind when comparing rents to mortgages is what will happen to your payments over the next few years.

Your mortgage payment is locked in for the next 30 years, meaning it will not change.

Even if it is cheaper to rent right now, how do you think they will compare in 5, 10, 20 years?

In the example above, the average rent for a Charleston apartment is $1169/month.

The monthly mortgage payment on the median Charleston house $1199/month.

That is an apartment compared to a house. Yes, it is slightly cheaper to rent the Charleston apartment. How much do you think that apartment will rent for in 5 or 10 years?

It certainly won’t be $1169/month.

If you purchased the Charleston home, your monthly housing payment will still be $1199.

As history has shown us, rents continue to increase.

Rent Or Buy: Buying Misconceptions

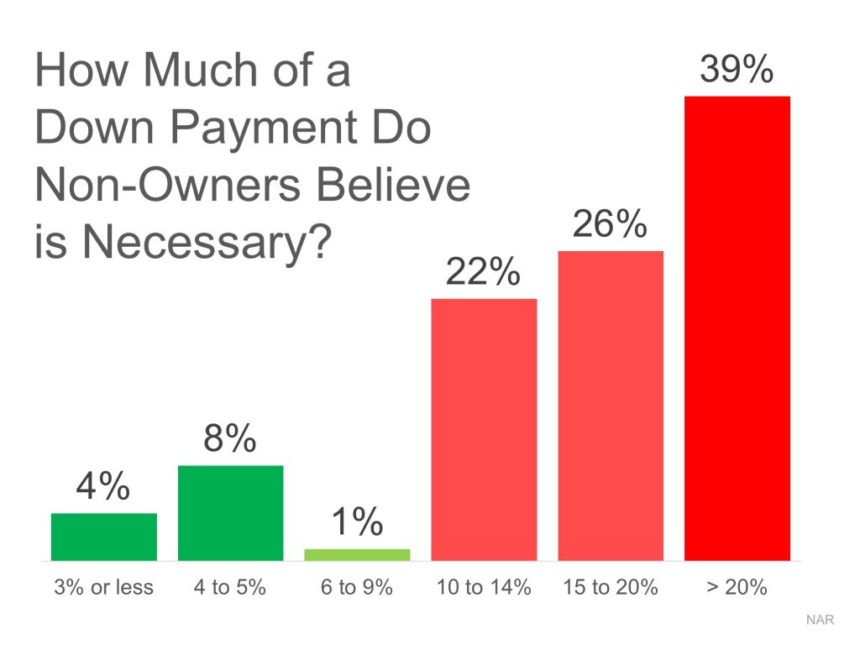

I covered these in greater detail here, but there are some misconceptions that exist as far as what it takes to buy a home.

Too many people mistakenly believe that you need 10%, 20%, or more for a down payment. That is simply not true.

If you are a veteran or current military personnel, you can take advantage of a VA Loan with 0% down.

If that does not apply to you, then you can take advantage of several first time home buyer loans, such as the FHA loan, which require as little as 3% down.

Plus, you can have family members or even the seller of the home contribute to the down payment.

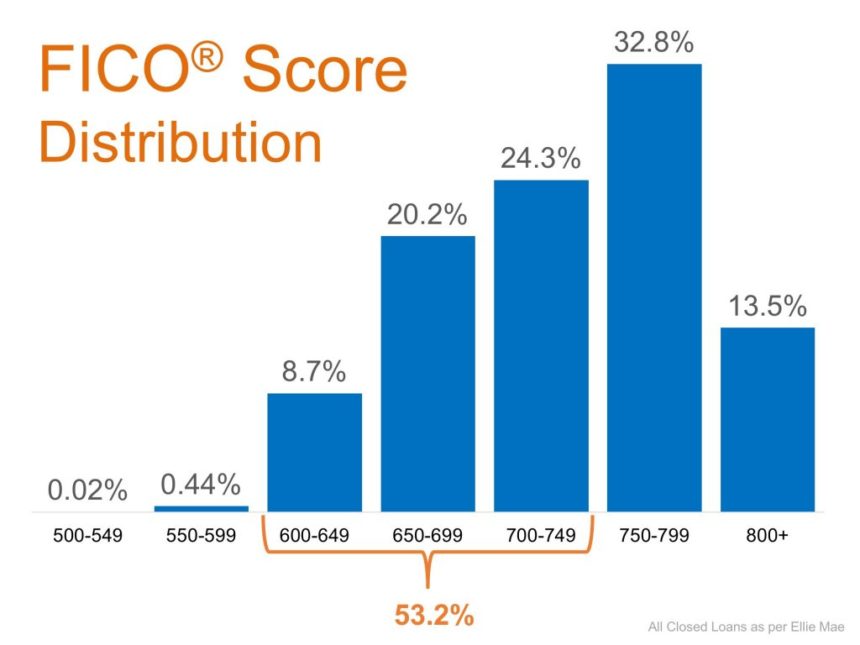

There is also a misconception that you need nearly perfect credit to qualify for a mortgage. That is also not true.

Here is a look at the average FICO score for the most recently approved mortgages across the country:

Rent or Buy: How Much Do I Need To Buy A Home?

It will vary depending on how much the home costs, where it is located, as well as other factors.

Once you meet with a mortgage loan officer to get pre-approved (this should be your first step, by the way!), they can help give you a better idea of how much it will cost.

But for a rough idea of what it takes in Charleston, SC, here is a helpful breakdown

Rent Or Buy: Choosing The Right Agent

It is important that you know the difference between a list agent and a buyer’ agent:

Not all agents the same, You need one that has the patience to work with first time buyers, will answer questions you have, and take time to explain the process of buying a home.

Many agents don’t have the patience– if you aren’t buying right now, you are not a priority.

You can keep up with the latest real estate news and trends at this blog or this blog.

You can also download one of my free real estate guides:

Be sure to visit my Pam Marshall Realtor website.

Leave a Reply