Buying A Home: Is Now A Good Time To Buy?

If you are thinking about buying a home, then you should be paying attention to what is going on in the real estate market.

Here is a look at the latest national numbers to get a feel for what the market is doing, and how it affects you.

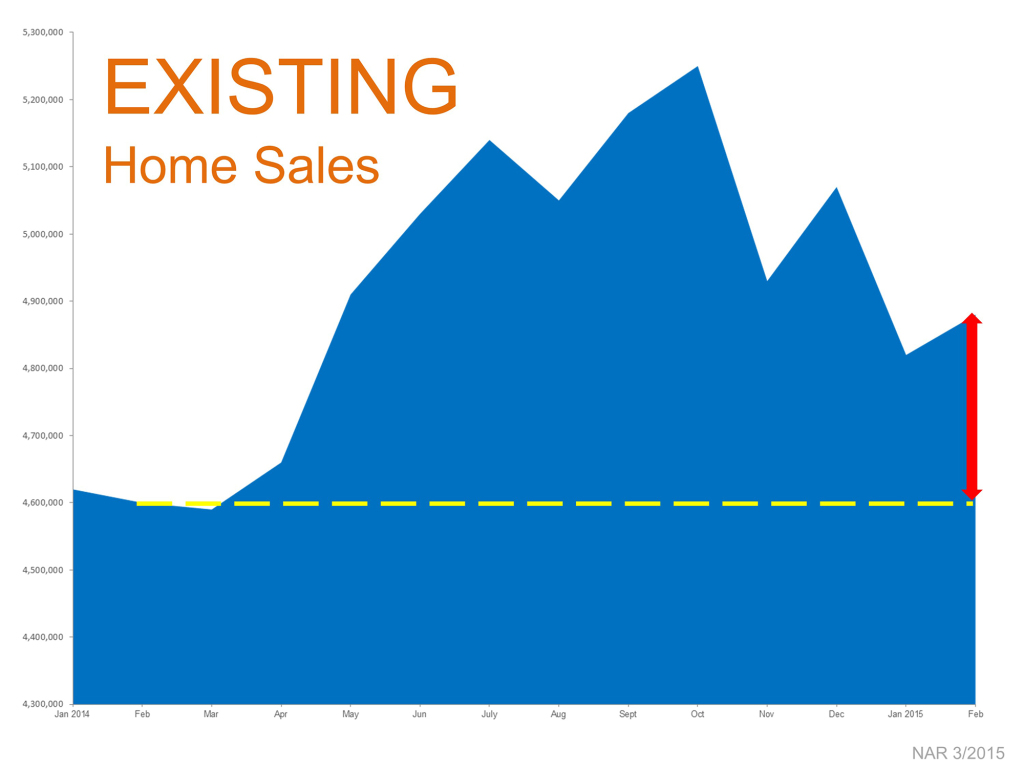

Home sales so far in 2015 are up above where they were in 2014. Towards the end of 2013 and into early 2014 we saw a slide in the number of home sales.

This was partially attributed to the harsh winter weather. So far in 2015, the opposite is true. Buyers are out in full force.

This infographic shows home sales for this February as compared to last February.

This infographic shows home sales for this February as compared to last February.

There is a dramatic difference, more than 300,000 more homes sold in February 2015 over last February.

For whatever reason, buyers hit the ground running at the very start of 2015. Usually, buyer activity heats up as the weather warms up, and we don’t see a lot of buyers until Spring.

2015 has been completely different.

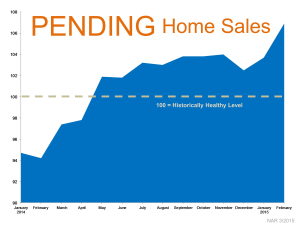

Another indication of this is the number of Pending Sales. These are homes under contract that will close in the next 30-60 days, and they are indicators of future sales.

In February, the number of Pending Sales were the highest since June of 2013.

Here is a look at the Pending Sales for February 2015, compared to February 2014:

Again, the number of Pending Sales this year is dramatically higher than last year. This bodes well for the housing market in 2015.

Again, the number of Pending Sales this year is dramatically higher than last year. This bodes well for the housing market in 2015.

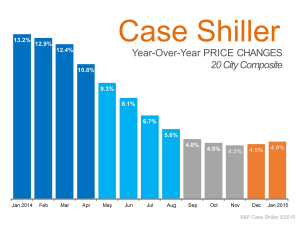

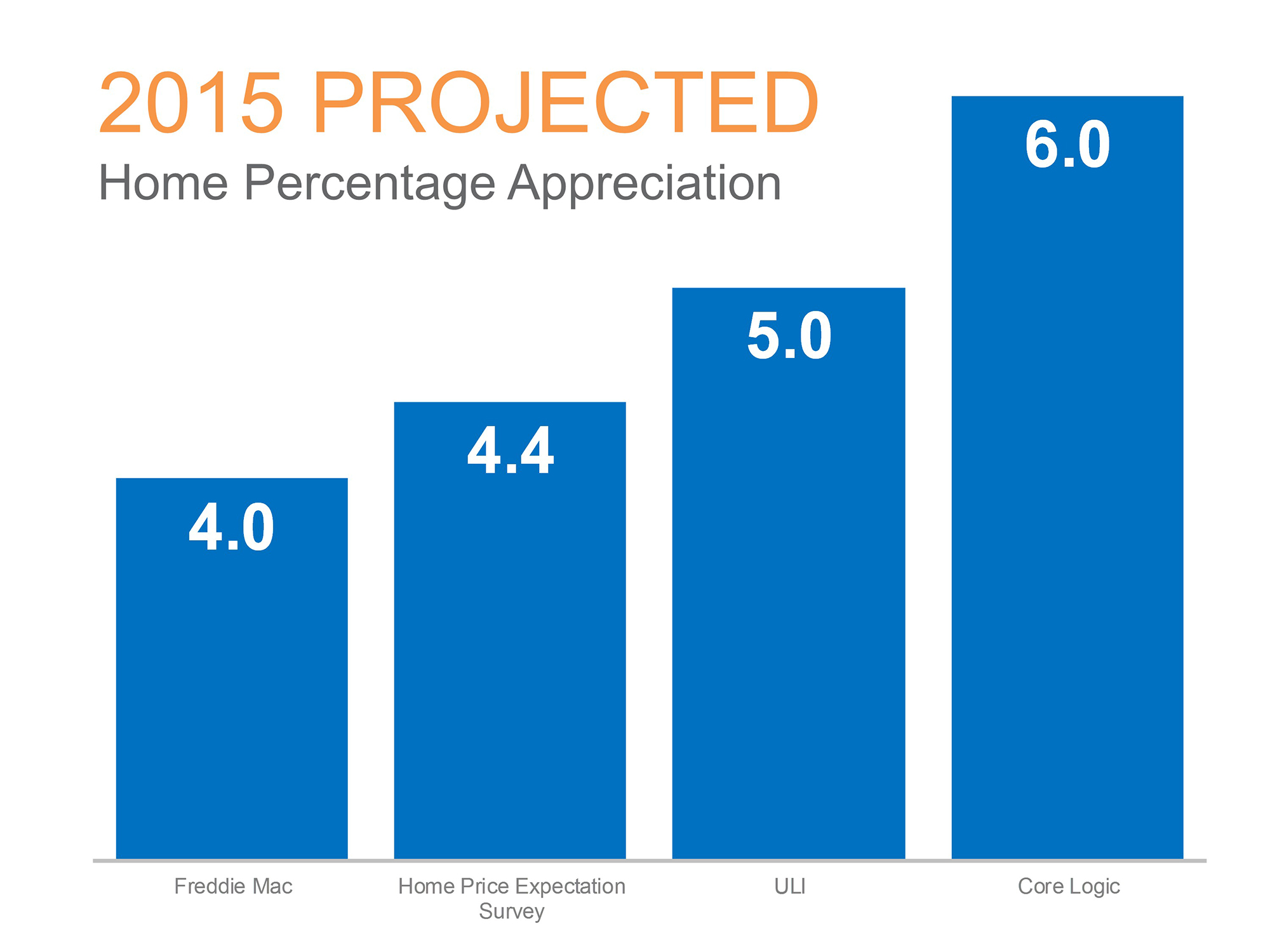

Home values continue to rise in the New Year as well. Home values have been on the rise for the last 3 years, although values aren’t appreciating at the same rate that we saw in 2013 and the first half of 2014.

Part of the reason for the continued rise in home values has been the strong buyer demand. But a bigger factor has been the lack of inventory. Simply put, demand exceeds supply. And, that is basic economics. As a result, this has further driven up home prices.

This is both good and bad for home buyers. Buyers want the security of buying an appreciating asset.

Most people remember what happened after the real estate market crash. Many home owners saw their equity disappear overnight, and were left with homes they owed more on than what they were worth.

The down side of home values continuing to increase is that it can eventually work against buyers.

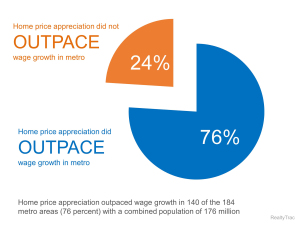

While home values have increased over the last year or so, wages have not increased enough to keep up.

Recent statistics from Realty Trac show that home prices outpaced wages in 76% of the major metro areas.

Recent statistics from Realty Trac show that home prices outpaced wages in 76% of the major metro areas.

This can lead to many would be buyers getting priced out of the market. The home you like today may simply cost too much tomorrow to be able to afford.

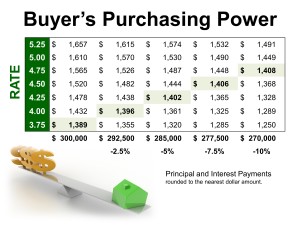

Another factor that is a double edged sword for buyers is interest rates.

Interest rates are near the all time lows, and are at or under 4% currently.

This makes home ownership more affordable for more people. The FHA, which is one of the most popular loans for first time buyers, recently lowered the minimum down payment from 3.5% to 3%.

They also lowered Mortgage Insurance rates as well. The end result is buying a home is more affordable. However, interest rates are expected to increase over 2015, by a full point or more.

With hom

e values on the rise, rising interest rates mean housing will become more difficult to afford. Here is a great infographic that illustrates this.

e values on the rise, rising interest rates mean housing will become more difficult to afford. Here is a great infographic that illustrates this.

Let’s say a buyer buying a home wants to keep their mortgage payment around $1400/month.

This graphic shows what happens as the interest rate increases–the amount of house you can purchase and still keep the mortgage payment (roughly) the same decreases. Bottom line: buyers lose purchasing power.

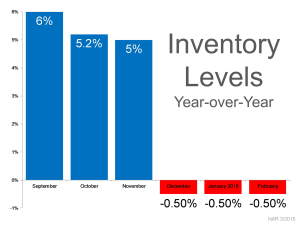

One of the biggest obstacles to buyers in today’ market is the lack of inventory.

This hurts them in more ways than simply having less homes to choose from. It is not unusual for buyers to come across multiple offer situations, which can drive up a home’s price. It is possible that the home you want gets taken before you get a chance to make an offer.

But it hurts buyers even more because this is driving up home prices. I mentioned earlier about home values are continuing to increase, although not at the same rate that we saw in early 2014.

But it hurts buyers even more because this is driving up home prices. I mentioned earlier about home values are continuing to increase, although not at the same rate that we saw in early 2014.

Home values continue to increase, yet home inventory is actually decreasing.

So far in 2015, each month has seen a decline in inventory levels compared to a year ago.

As a result, we are seeing the rate of appreciation for homes starting to tick up again. The appreciation rate had started to get reigned in to more sustainable, normal rates. However, the lack of inventory is causing the rate of appreciation to climb upwards.

This is not reason to panic, but it could have an even bigger impact on housing if this continues.

This is not reason to panic, but it could have an even bigger impact on housing if this continues.

For buyers, buying a home sooner is a smarter move than waiting. In this case, waiting will cost you.

For more helpful information for buying a home, check out my Pam Marshall Realtor website.

Leave a Reply