Charleston Houses: Down Payment And Credit Myths Keeping Some Buyers Out

If you have thought about buying Charleston houses, there may be some misconceptions holding you back.

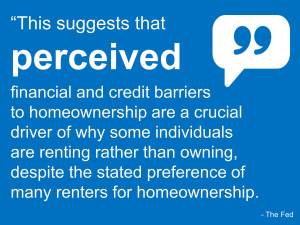

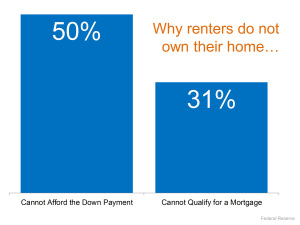

The Federal Reserve recently released their annual Economic Well Being Of US Households report.

This report surveyed renters to see why they weren’t buying a home.

The two biggest obstacles?

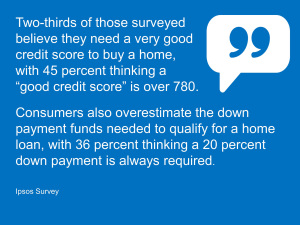

There seems to be a common thought that you need 20% for a down payment.

There is another misconception among many would be buyers that their credit isn’t good enough to qualify for a mortgage.

These myths couldn’t be further from the truth.

In reality, you only need 3% for a down payment.

If you are in the military, active duty or reservist, or if you are a veteran you can use a Veterans Administration backed loan that will not require a down payment at all.

In the last 6 months both Freddie Mac and Fannie Mae announced that their minimum required down payment would be reduced from 3.5% to 3%.

These two government agencies back many of today’s home loans, especially loans for first time home buyers.

If you choose to use a Conventional loan, then you only need 5% down payment.

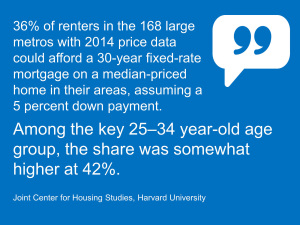

Still, even in today’s market too many potential buyers believe they need 20%.

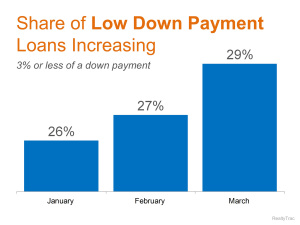

In reality, 3% (or less) down loans are increasing their share of the marketplace.

The most recent numbers suggest that these loans account for a third of the market.

Today’s market is a good market to purchase in.

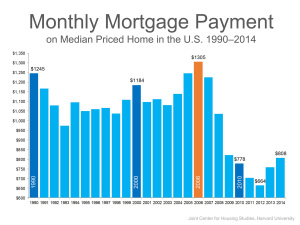

Mortgage rates are still near their all time lows, making this one of the most affordable times to own a home.

The graph below shows what the average monthly mortgage payment over the last 25 years:

In most cities, it is actually cheaper to purchase a home as opposed to renting.

In fact, the rental market is as hot, if not hotter, than the housing market.

Rents continue to soar, and there is limited availability of places to rent.

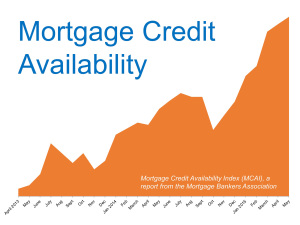

Mortgage credit availability continues to increase, making it easier to qualify for a mortgage.

Too many people mistakenly believe that you must have near perfect credit to get a mortgage.

A recent survey found that two-thirds of the respondents believed that you must have “very good credit” to qualify for a mortgage.

45% of the respondents defined a “very good credit score” as 780 or better.

In reality, you do not need a score that high.

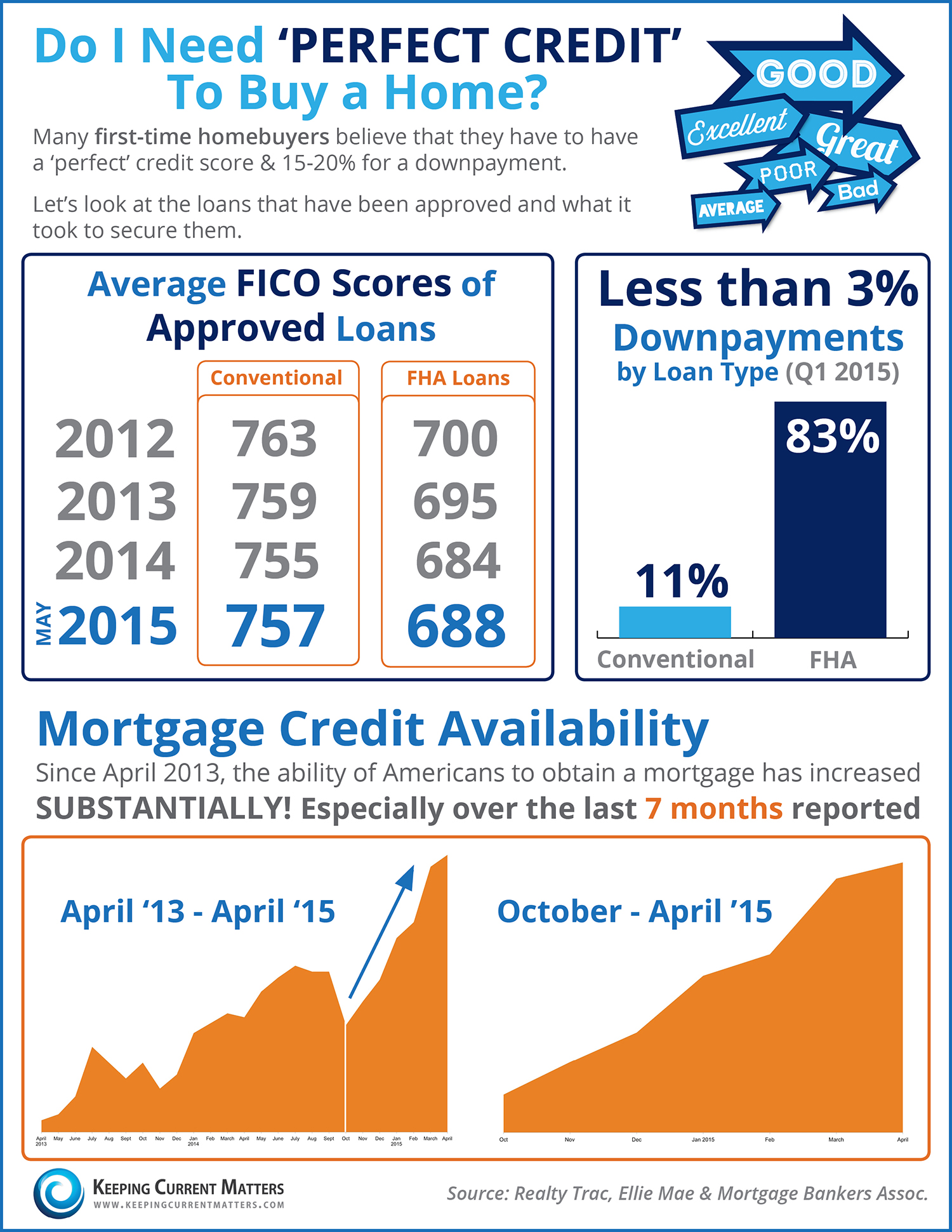

Here is a look at the Average Fico Score on approved loans, both Conventional and FHA:

As you can see, those scores are below the 780 score that is the perceived requirement.

In the case of FHA loans, it is almost 100 points less.

It is important for more renters to realize what is actually happening in the market, and what is truly required to purchase a home.

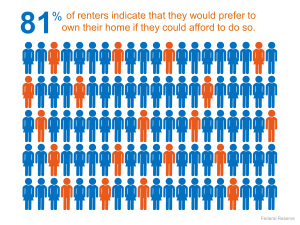

The desire to own a home is there.

The Federal Reserve survey found that 81% of renters would rather own their own home.

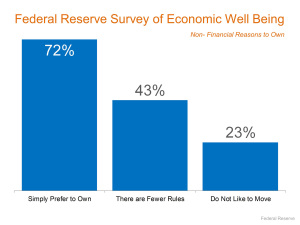

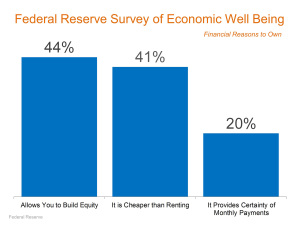

The survey also identified economic and non economic reasons for owning a home.

From the results you can see that the American Dream to own a home is alive and well.

However, while the desire exists, not enough people are getting the message about what is actually required.

Financial reasons to own a home included building wealth, cheaper than renting, and certainty of payments.

Rents continue to increase, and will continue to do so in the future.

However, with a mortgage your monthly payment is set for the next 30 years.

If you are tired of renting, then you should look into buying.

The best step is to talk to a mortgage loan officer to get pre approved. They will let you know your options and where you stand as far as qualifying.

Don’t think you have enough for a down payment? FHA loans allow family members to “gift” you a down payment.

Worried about your credit?

A mortgage loan officer will identify any issues you have. If you don’t qualify, then they can set up a “to-do” list of steps you can take so that you can purchase a home.

The best step to take, and the easiest, is to visit my website.

Everything you need is there so it is a true one stop shop. You can get contact info for mortgage pre approval, you can search homes for sale, download buyers guides, and there are educational videos and articles about the home buying process.

You can also sign up and get a free list of homes that match your exact criteria emailed to you and constantly updated.

Home ownership is closer than you may think, and if you are interested in Charleston houses, go to my Pam Marshall Realtor website and get started today.

Leave a Reply