Charleston SC Homes For Sale: Debunking Common Buyer Misconceptions

If you are shopping for Charleston SC homes for sale, then you will probably need a mortgage. Today I am looking at the latest real estate data to see where rates stand right now and where they may be headed in the future.

Based on projections over the last year, rates were expected to be higher than they are right now. 2015 so far has given us a pleasant surprise, but by most projections, the rates should be heading upward.

Currently, rates are just below 4% which is still close to their all time low.

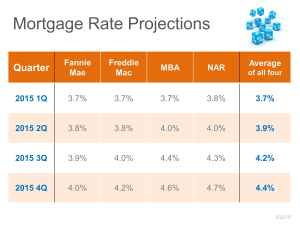

Here is the latest projections for 2015:

These projections are from industry experts such as Fannie Mae, Freddie Mac, the Mortgage Bankers Association and the National Association of Realtors.

Both the MBA and NAR project rates jumping up a full point by year’s end.

This is on par with what all of these experts were predicting for 2015 most of last year.

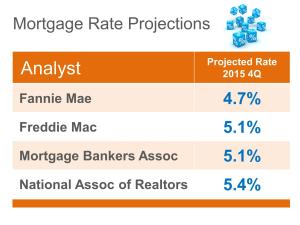

Here is a look at their 2015 projections back in November:

This is good news for home buyers.

Interest rates are still expected to increase, but not nearly as much as what had been projected.

Now these projections by no means are set in stone–just notice the difference 4 months makes.

However, these are leading experts in the industry. While you can’t totally predict the future of any market, these folks have the most insight and knowledge.

While this is good news for buyers, the average buyer may not fully understand the full impact of this news.

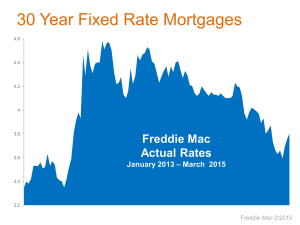

To understand where you are, you have to understand where you have been. So, for comparison sake, here is a look at actual Freddie Mac interest rates since the beginning of 2013:

Interest rates hit their all time lows in late 2012 and into 2013.

Interest rates hit their all time lows in late 2012 and into 2013.

However, while the most recent rates look much higher than the earlier rates, you have to keep the proper perspective.

Rates were as low as 3%, even lower, just a few years ago.

They did climb above 4% over the last year to year and a half, but today they are still under 4%.

Some buyers have the misconception that they “missed out” on the low interest rates.

However, that perception is very wrong and could be a costly mistake (more on that in a bit).

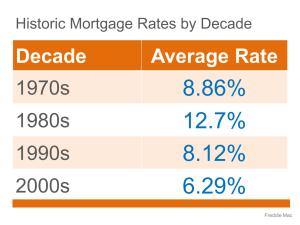

Again, it is important to keep the proper perspective. Now is still a great time to buy from an interest rate perspective, especially when you consider that rates around 3%-4% (and even 5%) are historically rare.

Here is a look at the average mortgage interest rate for the last few decades:

As you can see, by the historical perspective, no one has “missed out” other than the people that continue to sit on the fence rather than buy a home.

As you can see, by the historical perspective, no one has “missed out” other than the people that continue to sit on the fence rather than buy a home.

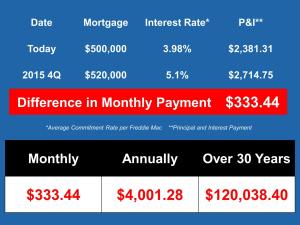

While all of this is good news, for the average buyer it simply comes down to “yeah this is great news, but what exactly does it mean to me?”

Most everyone understands that lower interest rates mean lower monthly payments and less money spent on interest over the life of the loan.

But it is much easier to lay it out visually, so here are some examples:

One thing you will notice about the above graphs–the mortgage amount goes up as does the interest rate. This is factoring in home values continuing to rise as well.

Which means the cost of buying a home will continue to rise in two ways in 2015: rising interest rates and home values continuing to appreciate.

The longer you wait, the less house you will be able to afford.

Charleston SC Homes: Big Misconceptions Buyers Have

One of the biggest misconceptions buyers have I already covered–thinking that an increase in interest rates means they “missed out” on their buying opportunity.

Another big misconception is that some buyers still think that they need at least 10% for a down payment. This is simply not true.

Recently, the Federal Housing Association (FHA) announced some very good news. First, they were reducing the required minimum down payment from 3.5% back to the 3% that was common prior to the real estate bubble.

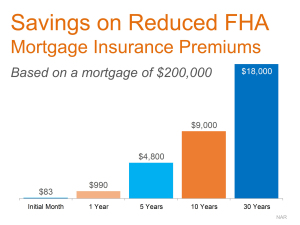

They also announced a reduction in Mortgage Insurance that is required with FHA loans. FHA loans tend to be the most common loans for first time buyers, so this news means home ownership is more affordable to more people.

Even if you do not go with an FHA loan, Conventional loans only require a 5% down payment in most cases.

Here is a look at the impact of lower Mortgage Insurance rates can have for buyers:

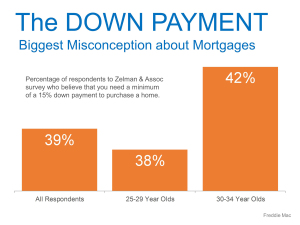

As for buyers still thinking that they need at least 10% down, that perception still prevails, despite the evidence out their that it is simply a myth.

As for buyers still thinking that they need at least 10% down, that perception still prevails, despite the evidence out their that it is simply a myth.

A recent Freddie Mac report based on a survey by Zelman & Associates shows that many would be first time buyers still think a down payment of at least 15% is required to purchase a house:

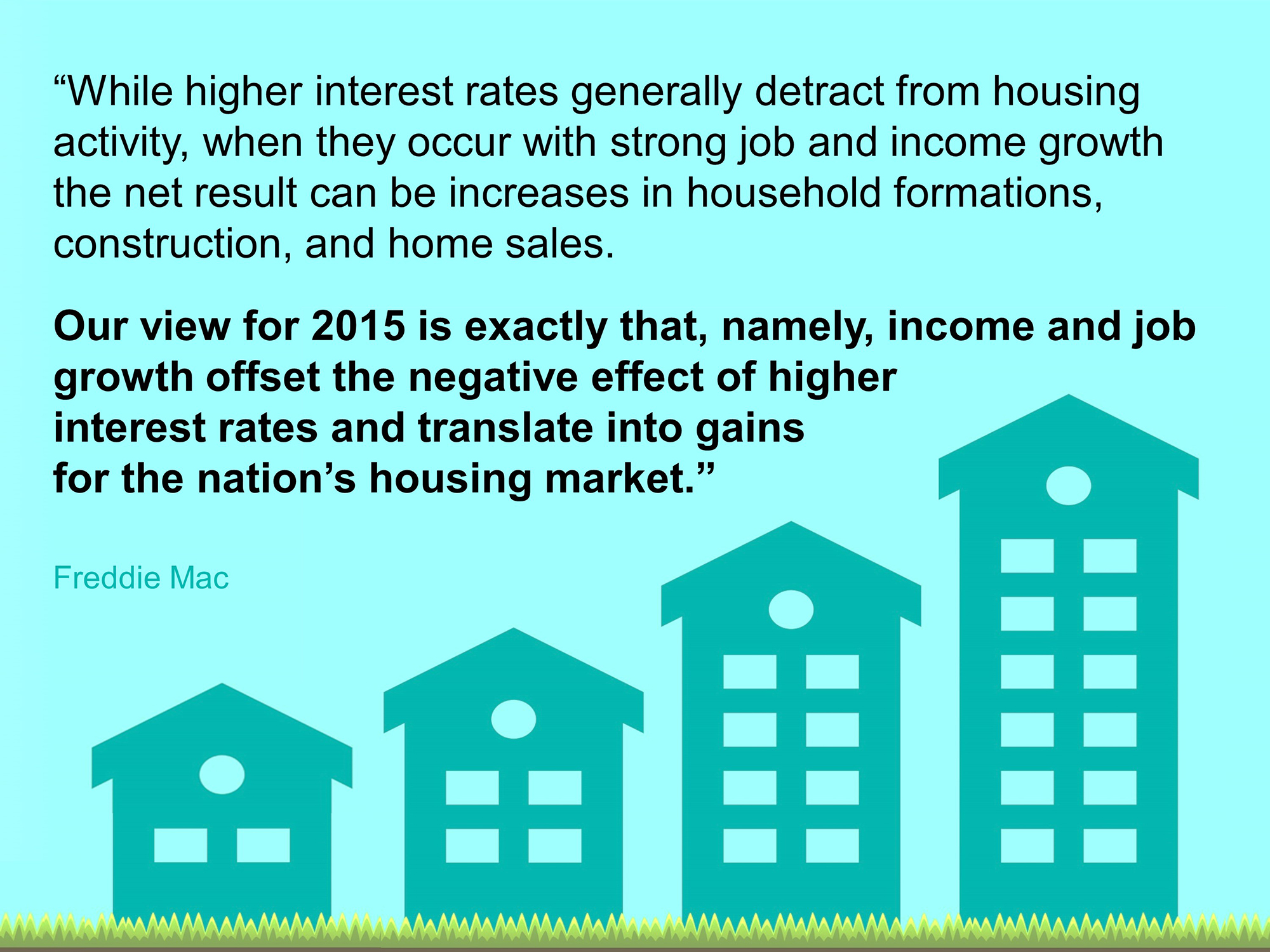

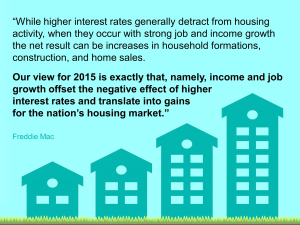

Finally, the other misconception out there is that higher interest rates will slow down the housing market, causing home prices to stagnate.

For many buyers, the fear is if the market slows down, then it would be better to hold off on buying.

After all, why buy a house if values will not continue to increase?.

While it is true that rising interest rates can hurt home values, that is not always the case.

Our economy is doing very well, and continues to grow. In this climate, the housing market can continue to grow. But you don’t just have to take my word for it, here is some proof:

This quote is from Freddie Mac and helps debunk this misconception.

There are some other indications that the economy is doing well to further strengthen confidence in the housing market in 2015.

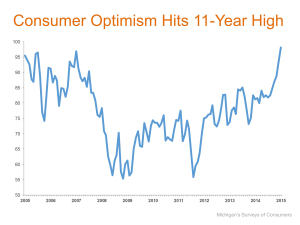

First, consumer confidence is at an 11 year high:

This should not be taken lightly.

Usually, the average consumer is the last person convinced that the economy is doing well–they usually do not believe in the economy until well after the fact that it is doing well.

Here’s further proof, courtesy of Rachel Emma Silverman of the Wall Street Journal:

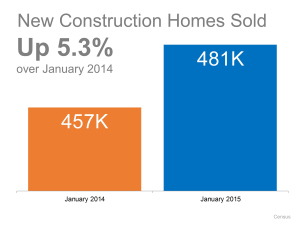

And just to hammer home this point, the Freddie Mac quote above mentions new construction, so here is a comparison of New Home sales from January 2014 and January 2015:

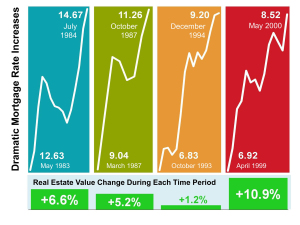

And to just really put this misconception to rest, here is another graph that shows what happened to real estate values when there was a dramatic increase in interest rates over a short period of time.

This graph shows the 4 such occurrences over the last 30 years:

Keep in mind that the worst projections for 2015 have us increasing a full point, maybe a slight bit more.

The lowest increase in the graph is over 1 and a half points.

The bigger point–each time saw real estate values increase.

Buying a home can be an intimidating process, especially if it will be your first time.

But it doesn’t have to be.

A little education can go a long way to helping alleviate the stress, especially when it is from misconceptions that simply aren’t true.

Working with the right agent is another way to ensure that you will learn what you need to know to make you an educated buyer. Plus, an agent that will answer your questions and help explain the process so there are no surprises.

If you are looking at buying Charleston SC homes for sale, then bee sure to check out my Pam Marshall Realtor website.

Leave a Reply