Charleston SC Homes: Where Interest Rates Are Heading And How They Affect Buyers

When it comes to buying Charleston SC homes for sale, one important aspect is the interest rate on the mortgage. Your interest rate is one important factor that will determine how much your monthly payment will be.

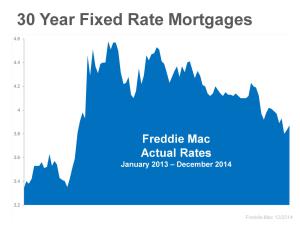

Recent years have seen historical low interest rates, and while current interest rates are not the lowest they have ever been, they are still close.

If you are thinking of buying Charleston SC homes for sale in 2015, then you may want to know what is in store for interest rates for 2015.

Of course, no one has a crystal ball and can predict exactly what will happen. There are several economic factors that affect the going rate, and depending on how they play out will influence where interest rates will go.

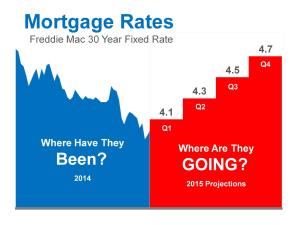

However, we do have projections from industry leading experts and economists to help us see where the might be headed. Based on the expert projections going back to last year, most analysts see interest rates going up in 2015. Before we look ahead to where they are going, let’s take a quick look back to 2014 to see where we have been:

2014 started off with rates below 4%, and over the course of the year rates increased. However, by year’s end rates were again hovering around 4%.

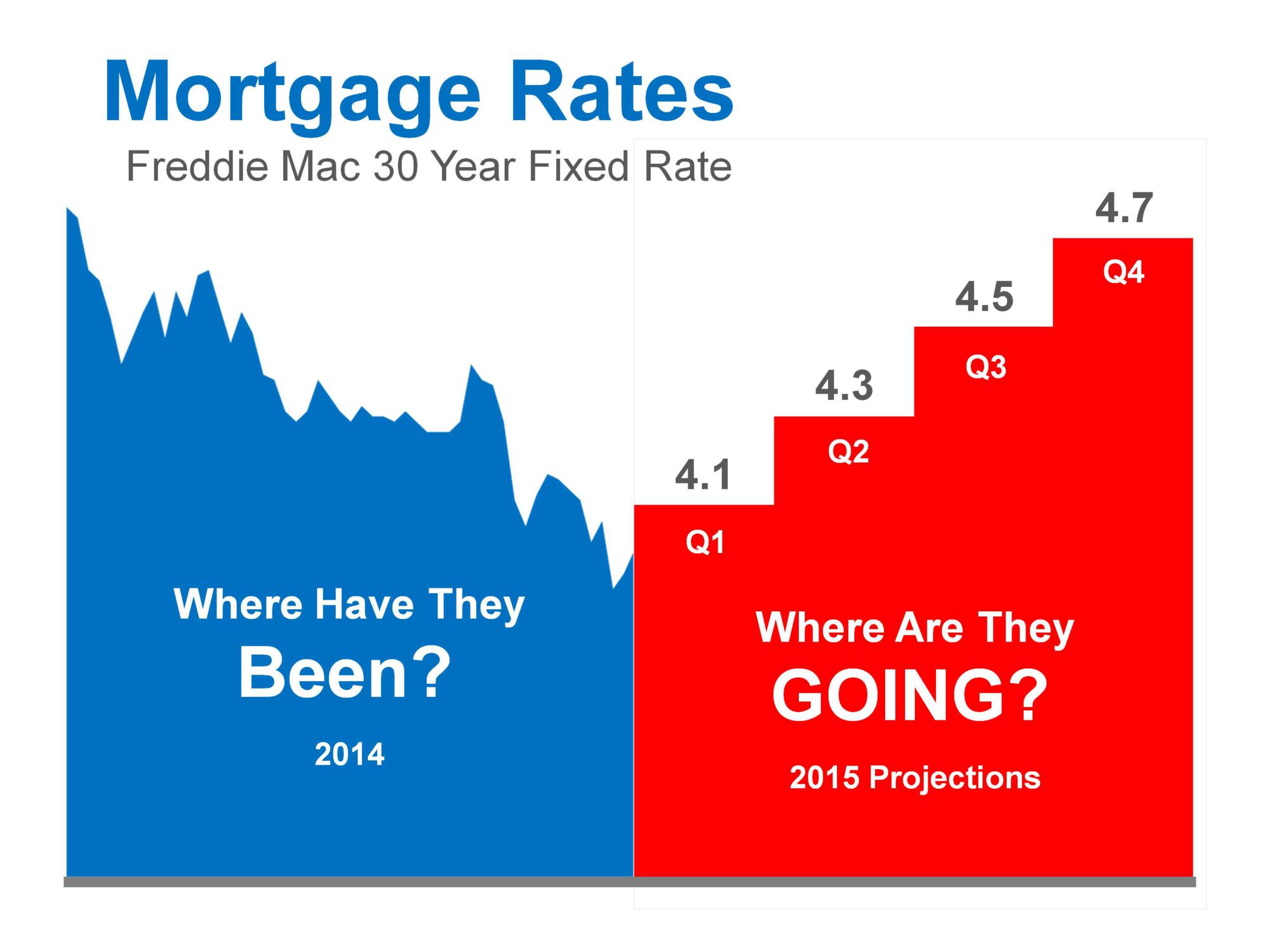

If you look at what the experts have been predicting since last year, they predict that interest rates will go up by almost a full point in 2015.

The next graph shows what Freddie Mac predicts will happen to interest rates in 2015:

The graph compares the 2015 projections to rates from 2014. These projections certainly seem realistic when you see that the same levels were hit in 2014.

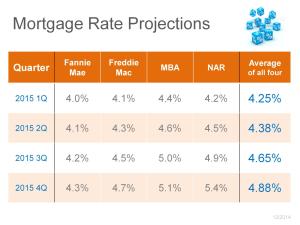

Next is a look at what Freddie Mac, Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors are predicting for interest rates in 2015:

This graph shows each organization’s projections for 2015 interest rates for each quarter, as well as the average of all 4 projections.

For home buyers, the big question is how an increase in interest rates affects them.

Most people understand that a mortgage will cost more, but even with that simple explanation, it is still hard for buyers to fully grasp just how that affects them.

Another factor that buyers don’t take into consideration is the fact that home values are continuing to rise. These two factors–rising interest rates and rising home values–mean that buyers are left with less purchasing power.

The house you like today will cost you more every month because of rising interest rates. But, you will also pay more for that house down the road than if you buy it now, and that will also increase your monthly payment.

It could also cost you that house. If that house continues to rise in value, it may hit a point where you simply can’t afford it anymore.

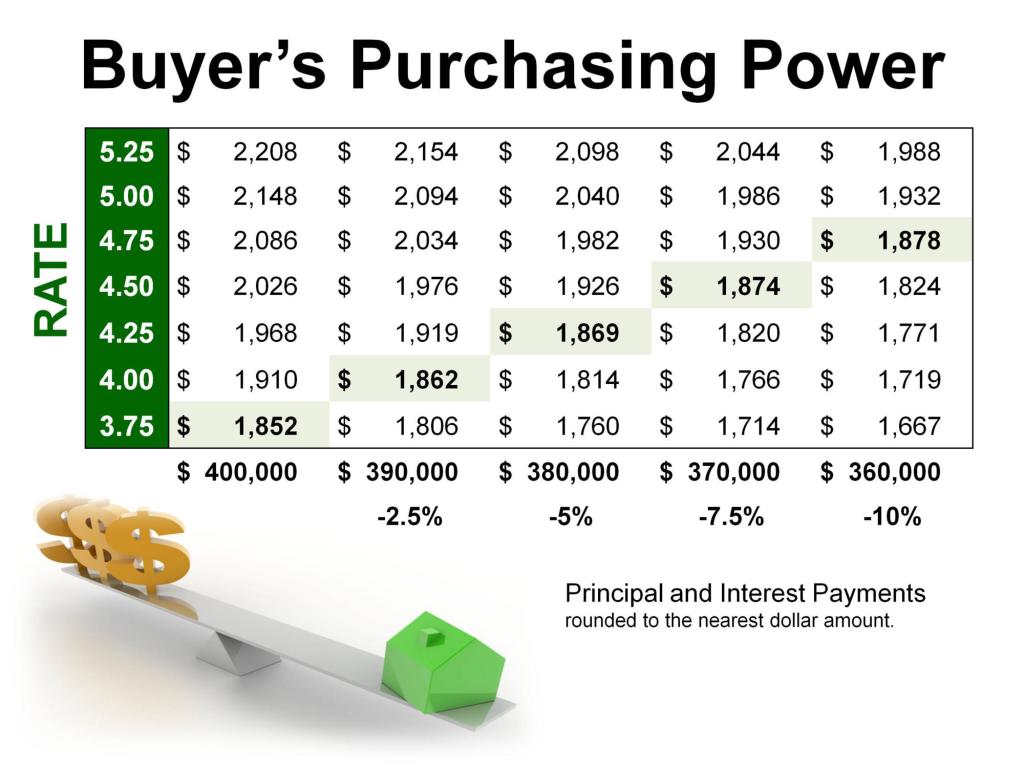

The next graph does a great job of illustrating this. Let’s say a home buyer wants to keep their monthly payment around $1800 a month.

This graph shows how as interest rates and home prices increase, a buyer loses buying power. This graph shows the sacrifice a buyer would need to make in order to keep a monthly payment around $1800/month:

As interest rates rise, then the price range for the buyer drops in order to keep the monthly payment where the buyer wants it to be–between $1850-$1900. This is basically a double whammy for buyers.

Home values are continuing to increase both nationwide and in Charleston. Here is a look at the Average Sales Price for all properties in the Charleston MLS from the last few years:

Charleston has been appreciating at a nice, steady level.

If you break down the numbers to specific cities and neighborhoods (you can see these breakdowns on my blog), you will see that the numbers are much higher.

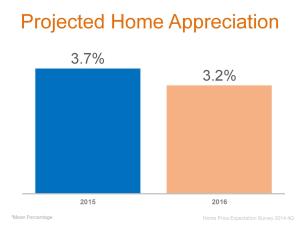

Overall, Charleston is right in line with the national numbers. Here is a look at projections for home appreciation in the next couple years:

So, home buyers can see they have two factors working against them.

Another mistake buyers make is trying to time the market, waiting for the perfect time to make a move.

However, the only way you can truly identify the perfect time is in hindsight.

If you are trying to time the market, you will miss out. Real estate has historically been a good investment. The recent market crash we saw a few years back is in the past, and real estate has already made a great recovery.

However, many would be buyers are still skeptical. That’s a shame, because they are going to miss out. 2015 is a great time to buy a house, especially in Charleston.

Our real estate market continues to be strong, and if you look at the graph above for Average Sales Price, you will see that overall, Charleston is appreciating at a nice, healthy rate. In a “normal” real estate market, the average appreciation rate is 3%-4%.

Parts of Charleston saw double digit appreciation rates in 2013, and while these areas still saw appreciation in 2014, the rate of appreciation slowed to single digits. This is good news–it is a sign that the market is stabilizing into a sustainable rate of growth.

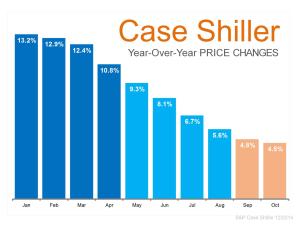

Double digits cannot be maintained for long, and will lead to a crash. However, the more steady rates can be maintained over time and that is what is happening to real estate. Here is proof of that:

This graph compares price changes year-to-year for each month of 2014. The year started very hot, but it settled down.

Of course, the media screamed that home values were down–but this is very inaccurate.

Home values were not appreciating at the high rates of 2013, but home values continued to increase, just not at the same rate.

Home values were still up–but those headlines don’t grab your attention.

There is another reason buying makes more sense–it beats the alternative. Renting will cost you more, especially over time.

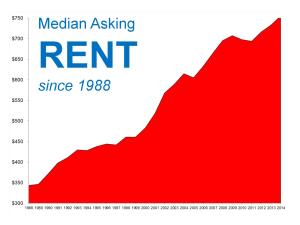

Let’s face it, rents will increase over the next few years, a mortgage payment will be locked in for 30 years. Just to illustrate this, here is a look at the median rents over the last 30 years:

Do you remember the last time a landlord lowered your rent? Exactly.

Do you remember the last time a landlord lowered your rent? Exactly.

This payment will continue to rise, but your mortgage payment will stay the same.

Imagine if your monthly housing expense was the same now as your first apartment–big difference.

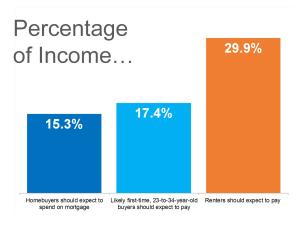

The next graphic will really drive this point home. This looks at the percentage of income for a mortgage versus rent–it also breaks down the percentage for the Millenials, a key home buying demographic:

2015 is a great time to buy a home. It is important for homebuyers to keep in mind that interest rates and home values are continuing to rise, and that works against buyers.

2015 is a great time to buy a home. It is important for homebuyers to keep in mind that interest rates and home values are continuing to rise, and that works against buyers.

However, as always it is important to keep things in the proper perspective.

Buying now is better than waiting–by doing so, you let the appreciating home values work for you and not against you.

However, this post isn’t meant to be a “NOW is the time to buy” or “If you don’t buy now you will be blowing your golden opportunity” type of post.

Interest rates are still near their historic lows, and even with a rise in rates in 2015, that is still the case.

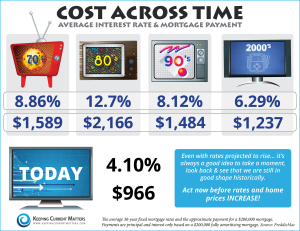

For many of the younger generation, they may feel they have already missed out because interest rates are no longer at the all time low. This falls back to trying to time the market. However, this last graphic will put things into perspective:

This looks at the average interest rate over the last few decades so you can see that it is still a good time to buy real estate.

In fact, we are still in the best time in over 40 years to buy real estate, from the perspective of interest rates.

If you are thinking of buying Charleston SC homes for sale, then it is important that you choose the right real estate agent to represent you and help you find the right house.

Make sure to visit my Pam Marshall Realtor website for helpful information, videos, and home buying guides to help you in your search for Charleston SC homes.

Leave a Reply