Outlook For Charleston SC Real Estate

Every quarter, Pulsenomics publishes the Home Price Expectations Survey. This is a survey of over 100 top economists, industry analysts, and investment strategists to project what will happen in the real estate market in the upcoming years.

The most recent survey was published for the 4th quarter of 2016 and here is what we learned.

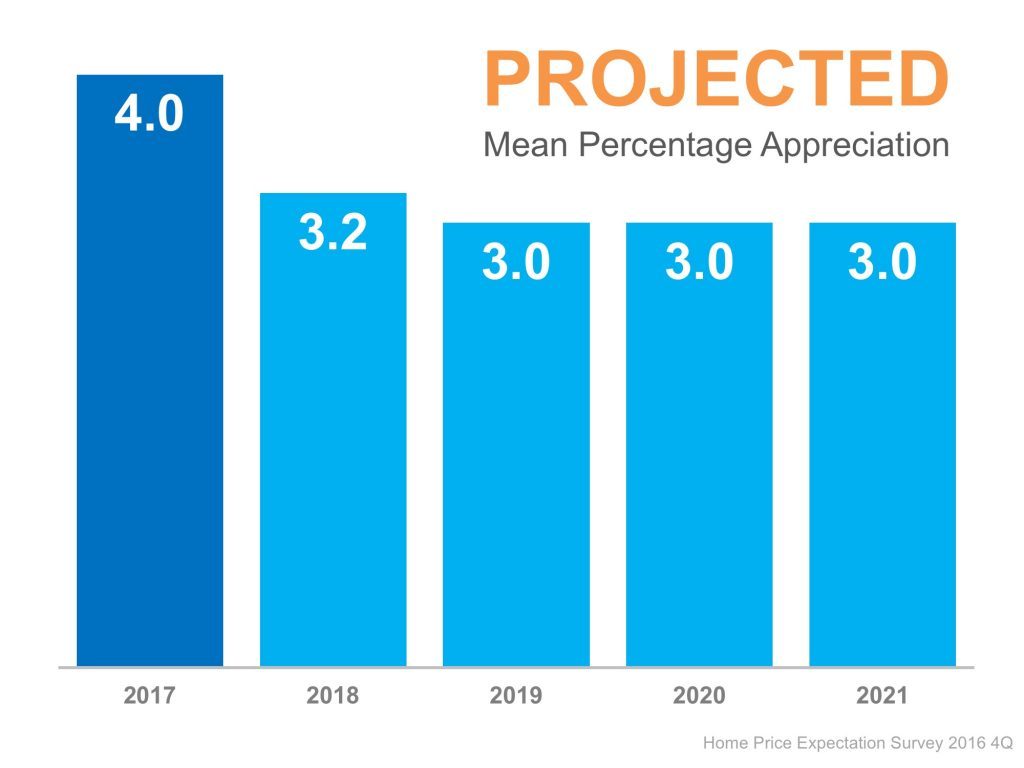

The panel projects that home values will increase 4% over 2017. In the following years they project values to continue to increase at 3.2% (2018), and then 3% annually through 2021.

These projections are the mean of all projections–half of the projections were higher, the other half lower.

That is, this is not the average of all projections.

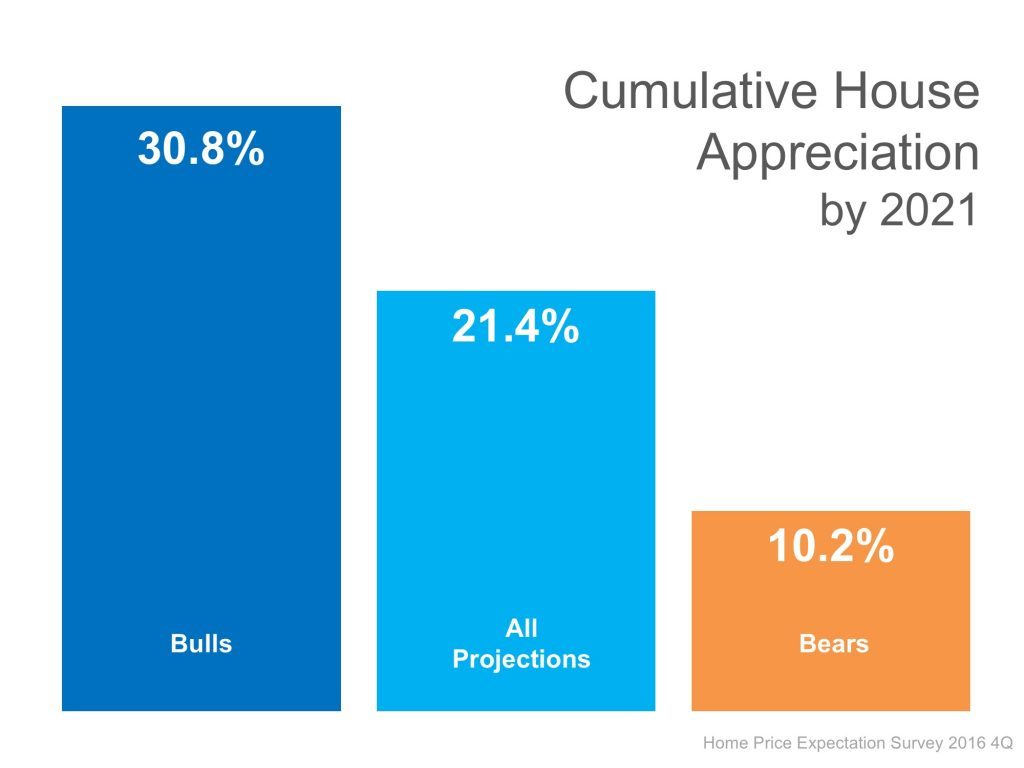

It is interesting to note the projections of the most optimistic (the bulls) as well as the most pessimistic (the bears):

Even the most pessimistic (or most conservative) experts still project that we will have a cumulative increase of appreciation of 10.2% through 2021.

Healthy Growth Projected

What is important to take away from these latest projections is the fact that the mean projections are within the 3%-4% range that is considered a healthy, sustainable rate of growth.

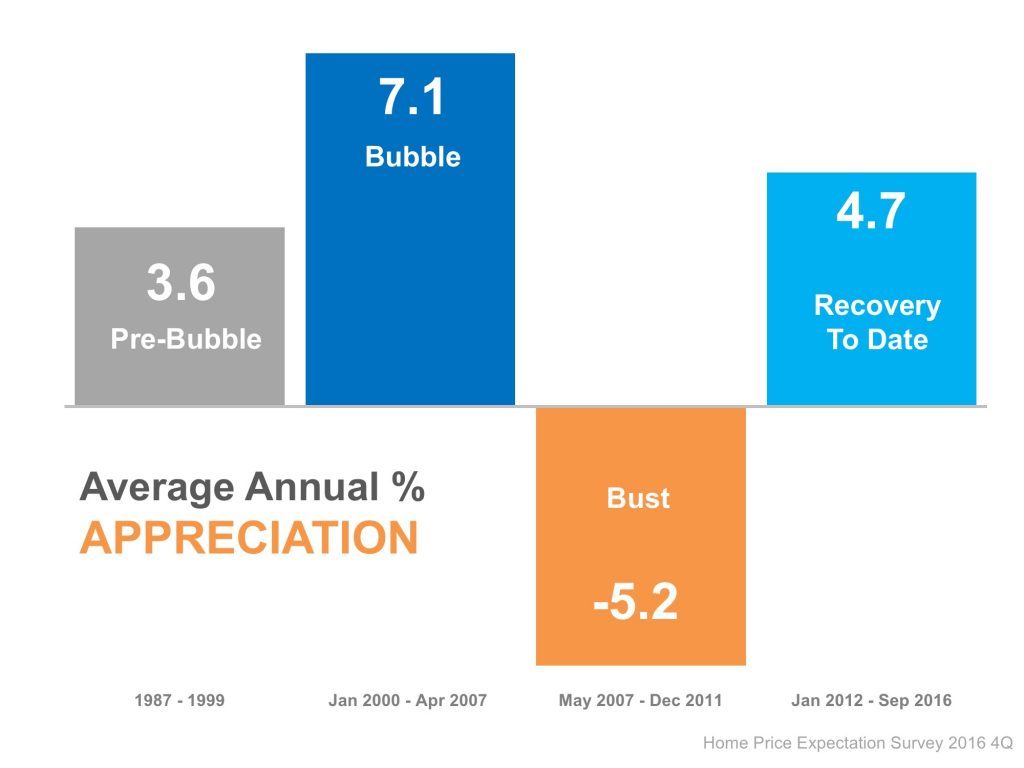

If you look back to history, you will see that we had a long run of healthy growth (averaging at 3.6% annually) leading up to the real estate bubble of the early 2000s.

Then, real estate values shot up, at an average annual rate over 7% which led to the crash.

Of course after the crash values dropped, but since we have recovered we have seen growth average at 4.7% annually.

That is a nice recovery and absolutely needed, but 4.7% is a little high. It will be nice to see that pace slow a little bit closer to 4%. It is possible to have too much of a good thing–the bubble proved that. So, as they say, slow and steady wins the race.

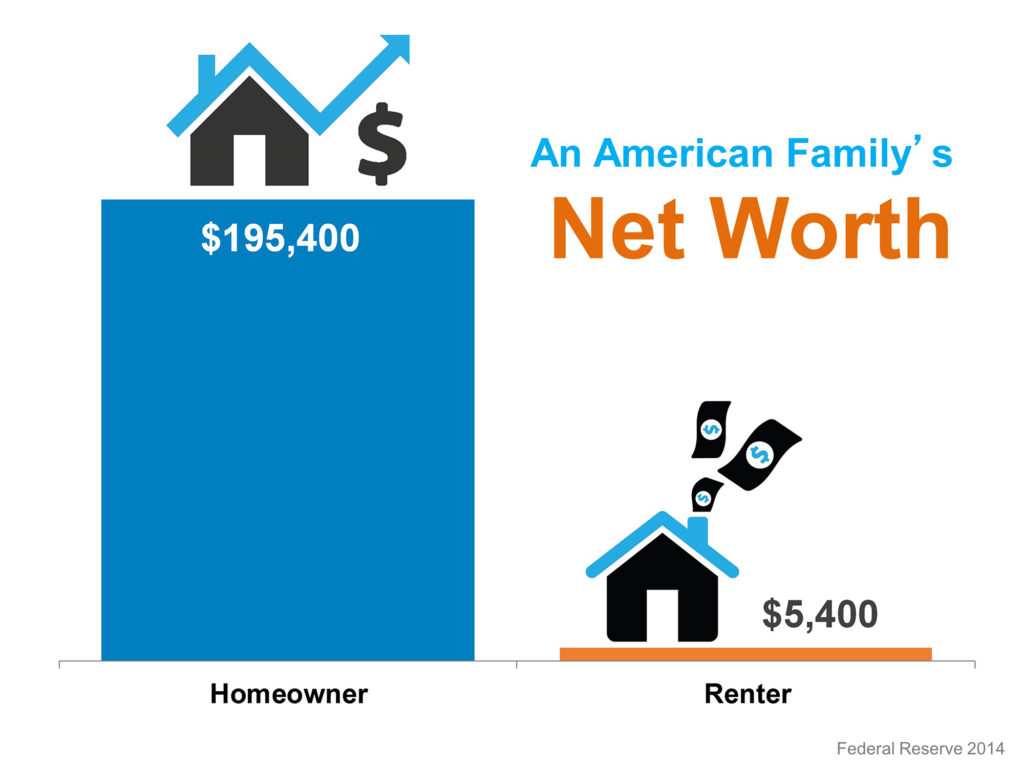

Home Owners Have Higher Net Worth Than Renters

What kind of impact can this have on home buyers and home owners? Home ownership provides Americans with one of the oldest wealth building tools that exists.

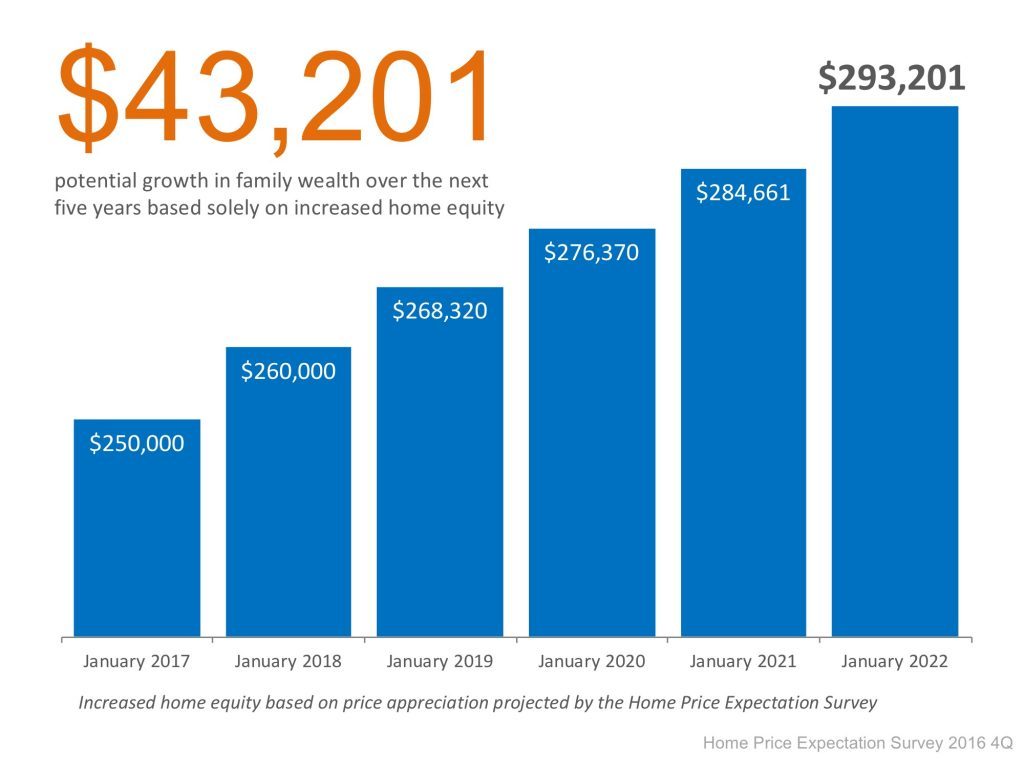

For example, using the mean projection of appreciation for the next couple years (21.4%), this is what a home buyer that purchased a $250,000 house in January of 2017 could be looking at in equity accumulation:

That’s over $43,000 of wealth built up in 5 years. Certainly that is no guarantee, but simply an illustration of the potential that exists. But for a first time home buyer, that has to make home ownership extremely attractive. Consider the alternative:

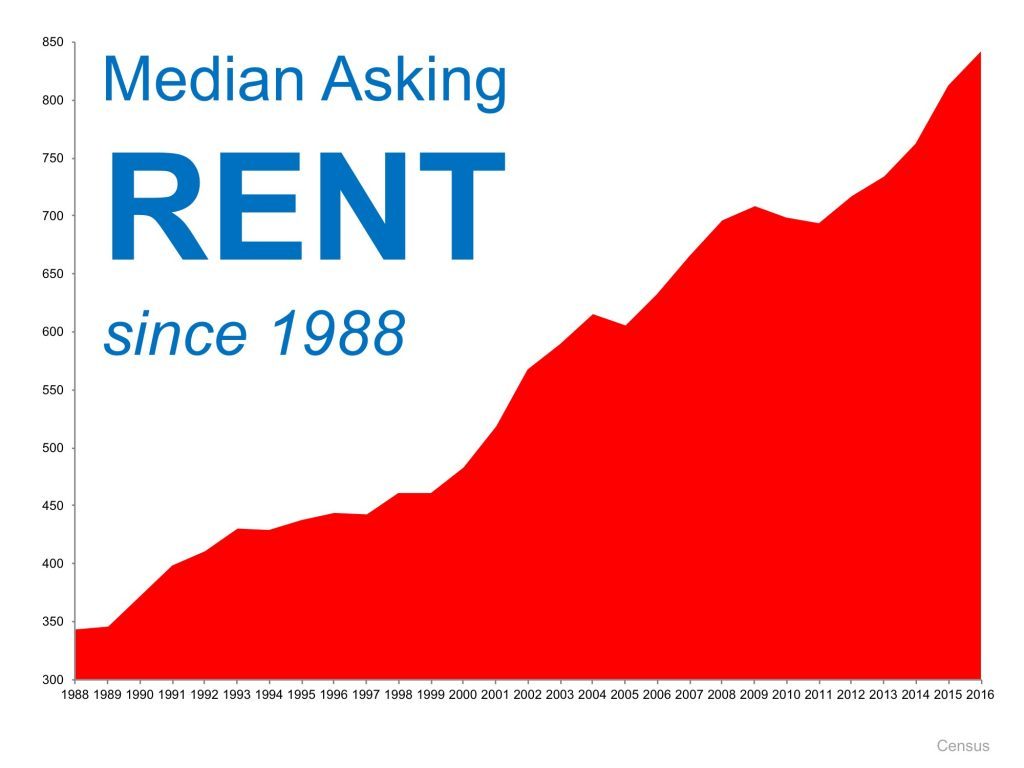

We can’t 100% guarantee that home values will continue to increase over the next 4 or 5 years. But we can guarantee that rents will–as history has shown us.

A mortgage will keep your monthly housing payment locked in for 30 years–what do you think rents will look like in 30 years (the graph certainly gives us a good idea)?

The following slide is dated–it is from the Federal Reserve from 2014–but it still illustrates the point. The difference between the net worth of a home owner versus a renter.

Stay tuned for more information about the latest market numbers–both nationally and locally.

In upcoming posts I am going to go into detail about the 2016 real estate market numbers and see how Charleston compared.

If you are looking to buy or sell Charleston SC real estate, then be sure to visit my Pam Marshall Realtor website.

Leave a Reply