Interest Rate Outlook For 2017

One important factor in real estate in general, and specifically the Charleston SC real estate market is interest rates. Where are they heading in 2017 and what impact will it have?

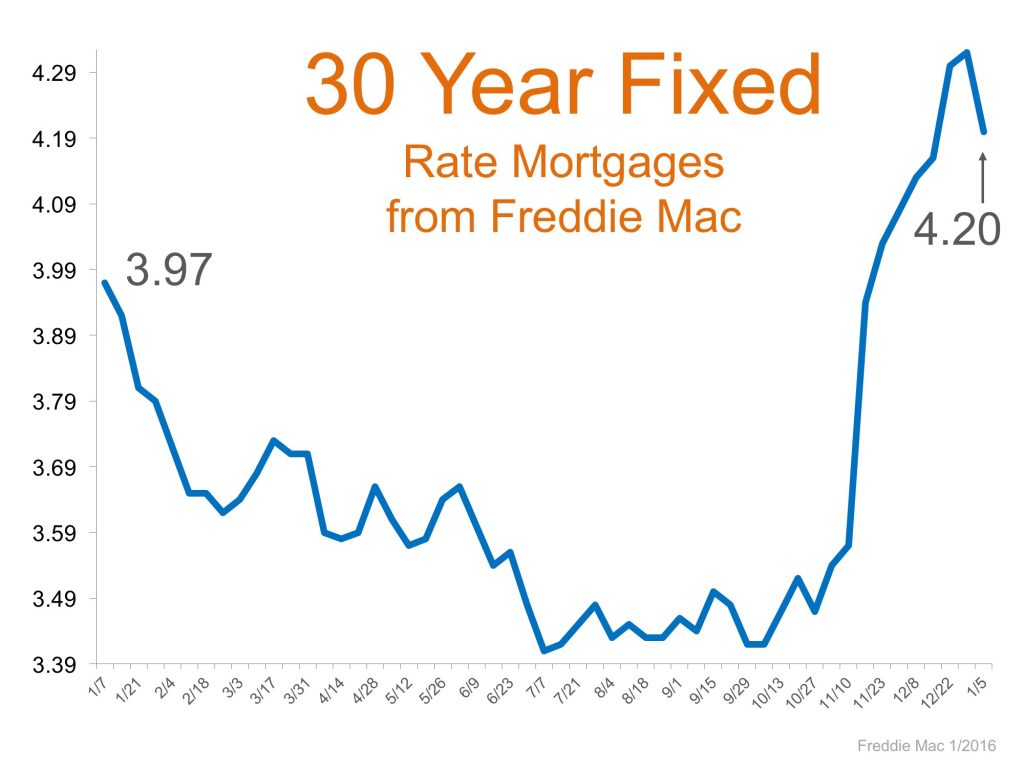

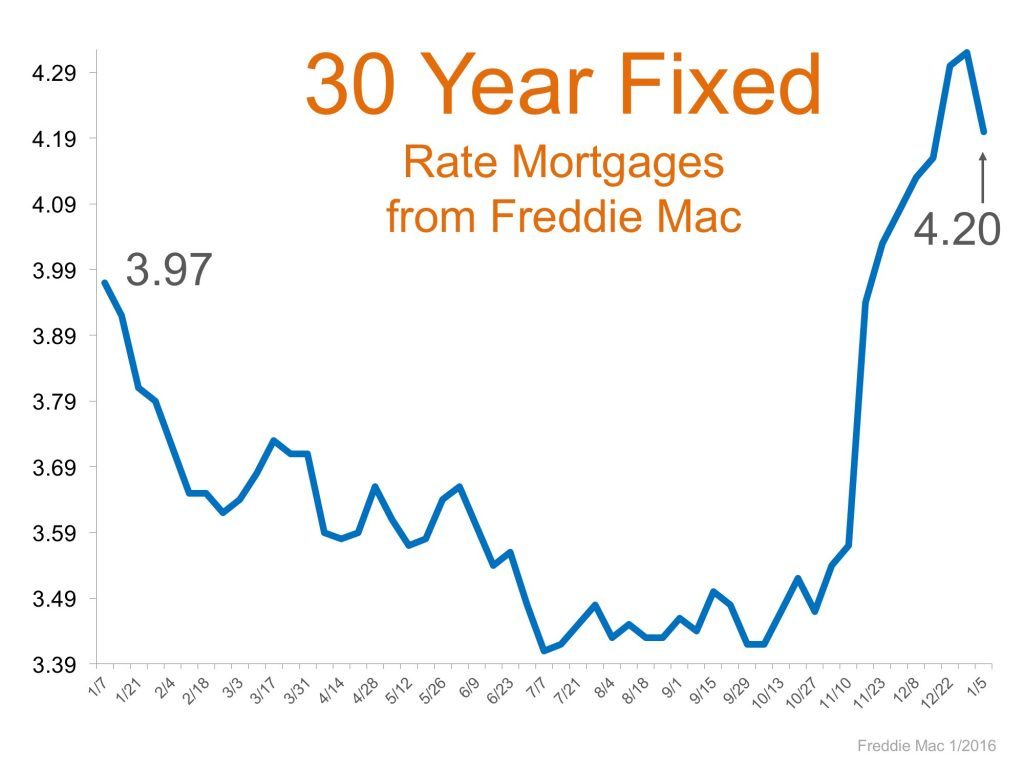

2016 saw interest rates drop throughout the year, but they have increased at the beginning of 2017.

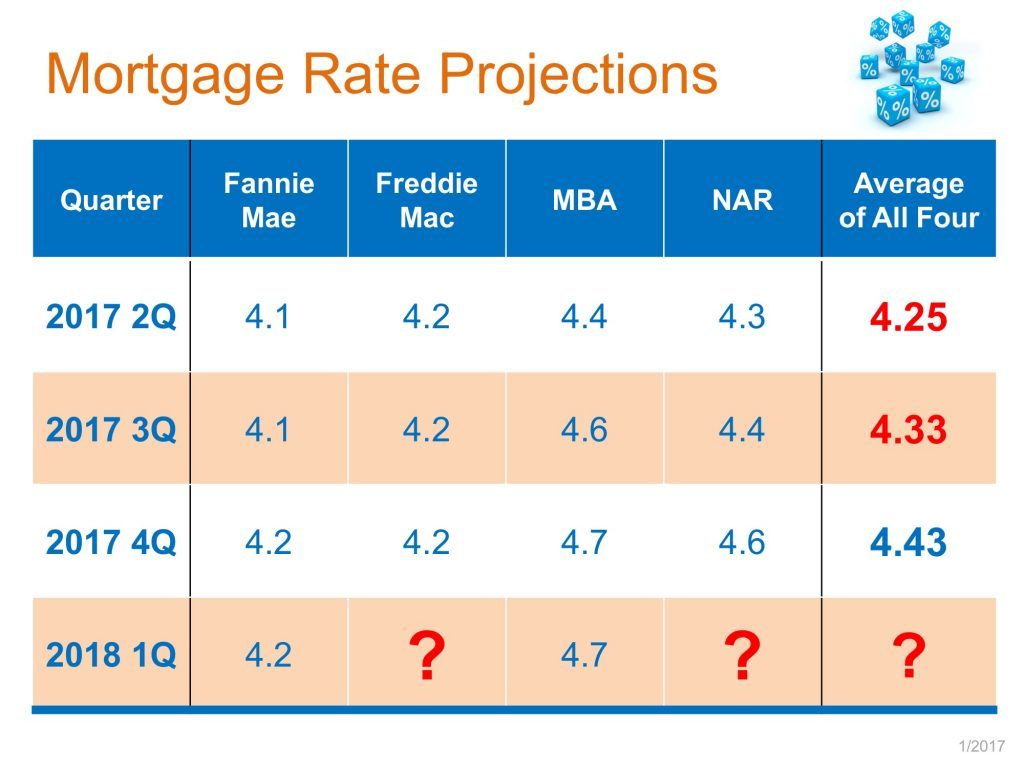

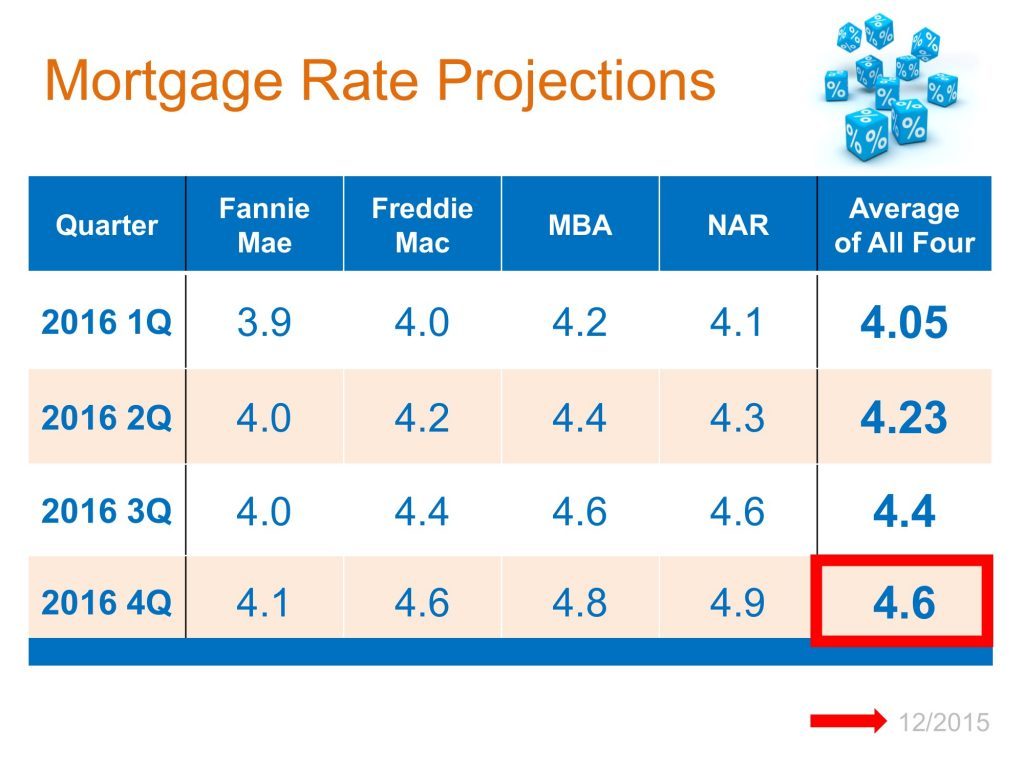

The most recent projections for the New Year are incomplete. Freddie Mac and The National Association of Realtors (NAR) have yet to release their projections–they are still trying to finalize their respective projections.

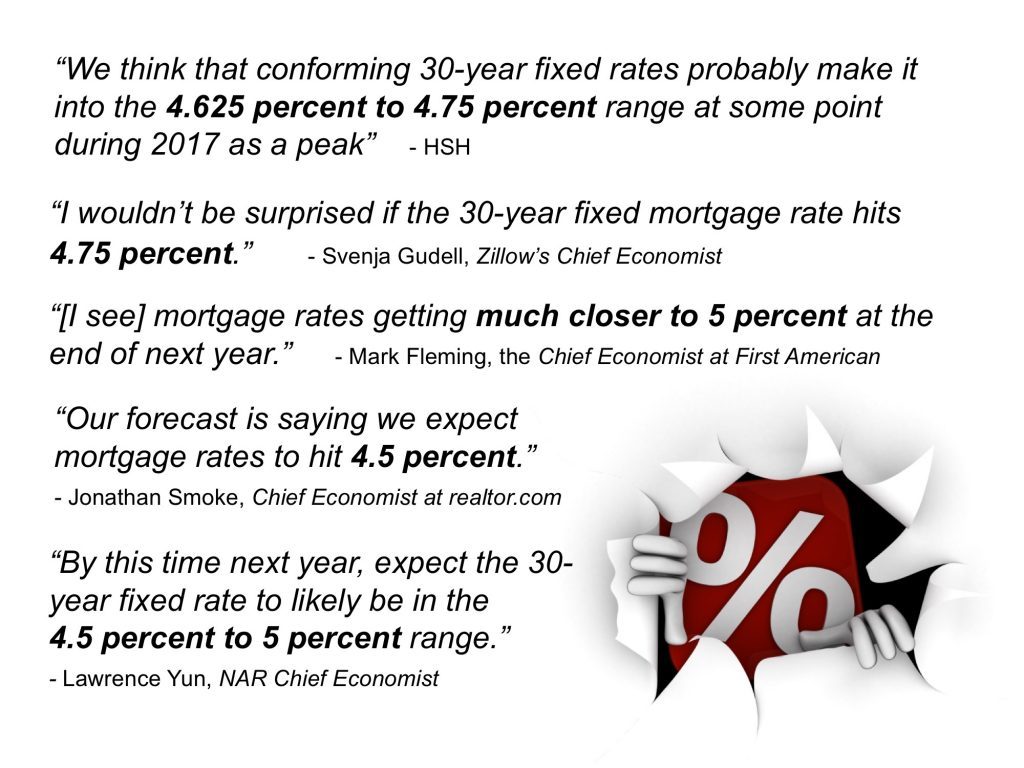

However, it seems that many analysts are looking for interest rates to push upward towards 5% by

year’s end.

year’s end.

It’s possible that we could see a 1% increase in rates over the next 12 months.

Even if this happens, it could be good for real estate. It is also important to maintain the proper perspective.

While mainstream media may portray rising rates as the kryptonite to a strong real estate market, that simply is not true.

Historically speaking, 2016 saw the lowest annual average interest rate ever recorded by Freddie Mac (since they began recording them back in 1971).

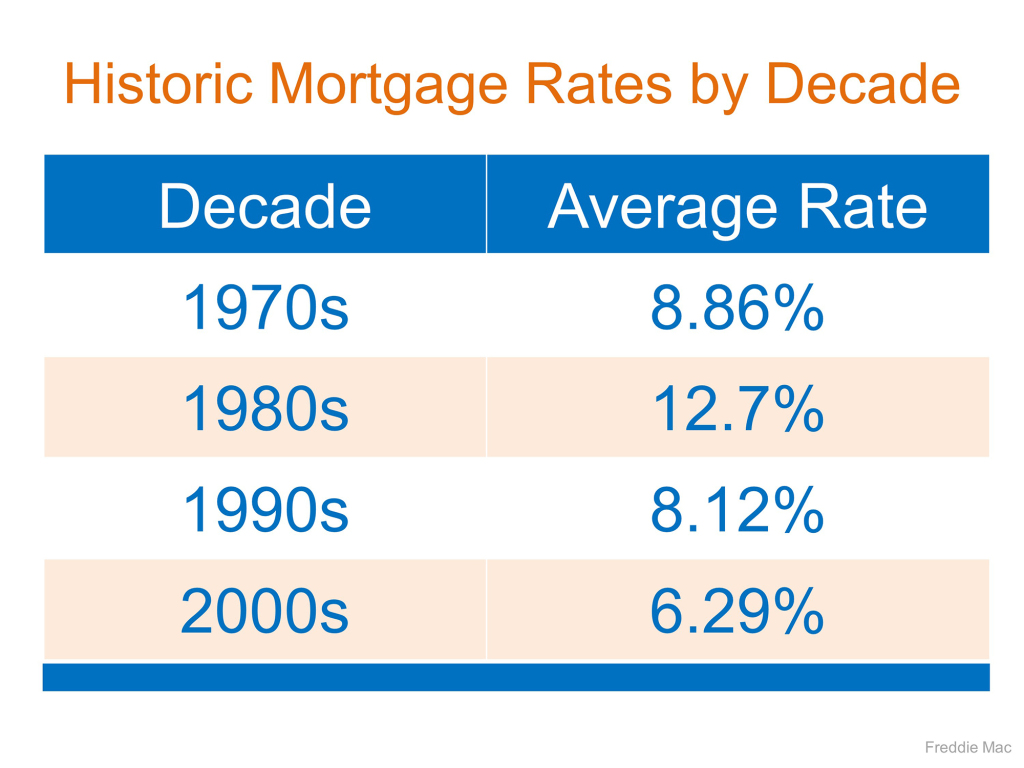

The next graphic shows the average interest rate per decade over that period.

In other words, even if rates increase, they are coming up from their historical lows.

There is no guarantee that rates will increase by 1% or at all.

Here is a look at the interest rate projections from this time last year, and as you can see, interest rates still have yet to hit these projections.

Will Rising Rates Cool Buyer Demand For Charleston SC Real Estate?

Would it cool off the strong buyer demand that we’ve seen (and are continuing to see)?

More than likely it will increase buyer demand–buyers will be motivated to act sooner to avoid rising rates.

But even if they do increase to 5%, that wouldn’t have a tremendous impact on buying power.

Take a $200,000 house as an example. At 4% interest rate, the monthly (P&I) payment would be $954.83.

At 5% interest rate that payment increases to $1,073.64, a difference of $118.81/month.

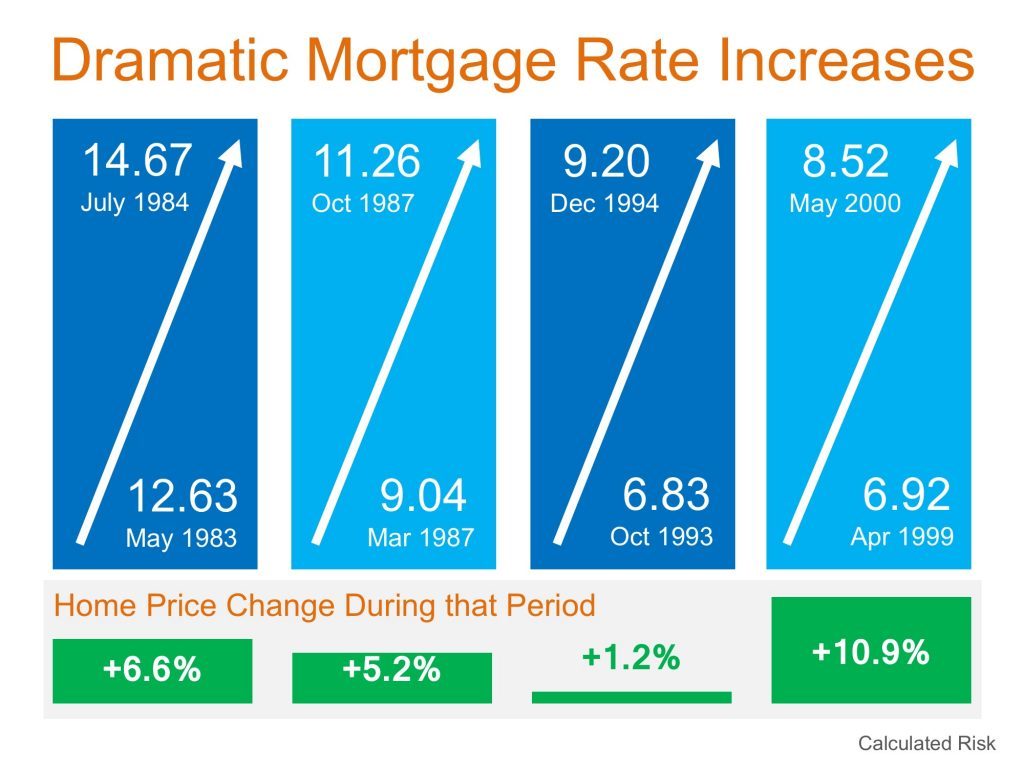

History also has shown that a dramatic increase in interest rates does not have a negative impact on the real estate market.

The next graphic shows how the most dramatic interest rate increases over the last 40 years have impacted the housing market.

In each instance, interest rates jumped up by over 1% in a year or so or less.

In each instance, home prices continued to increase.

History is an important teacher and shows that we shouldn’t panic if interest rates increase in 2017.

How Will Interest Rates Impact Sellers In The Charleston SC Real Estate Market?

What kind of impact will increasing rates have on home sellers? If rates rise, we could see many home sellers decide not to sell because of what is know as “Interest Rate Lock”.

If rates increase past a certain point, many home owners will decide that staying put is the better option simply because they have a better interest rate than what is currently out there.

Many home owners either purchased their home in recent years or refinanced and are now enjoying rates in the 3% range, even below 3%.

Moving into a new home with a higher interest rate above their current rate is a motivating factor to stay put.

However, in the current market it makes sense to make the move with interest rates still close to their all time lows. (I cover Interest Rate Lock in greater detail in this post).

Sellers are a more important factor to the Charleston SC real estate market in 2017 than interest rates–lack of inventory is the biggest hurdle to real estate.

Of course, down the road interest rates could certainly impact a home owners decision of whether or not to sell, so it is important to keep an eye on both going forward as they are certainly tied together. (I cover more about sellers outlook for 2017 here).

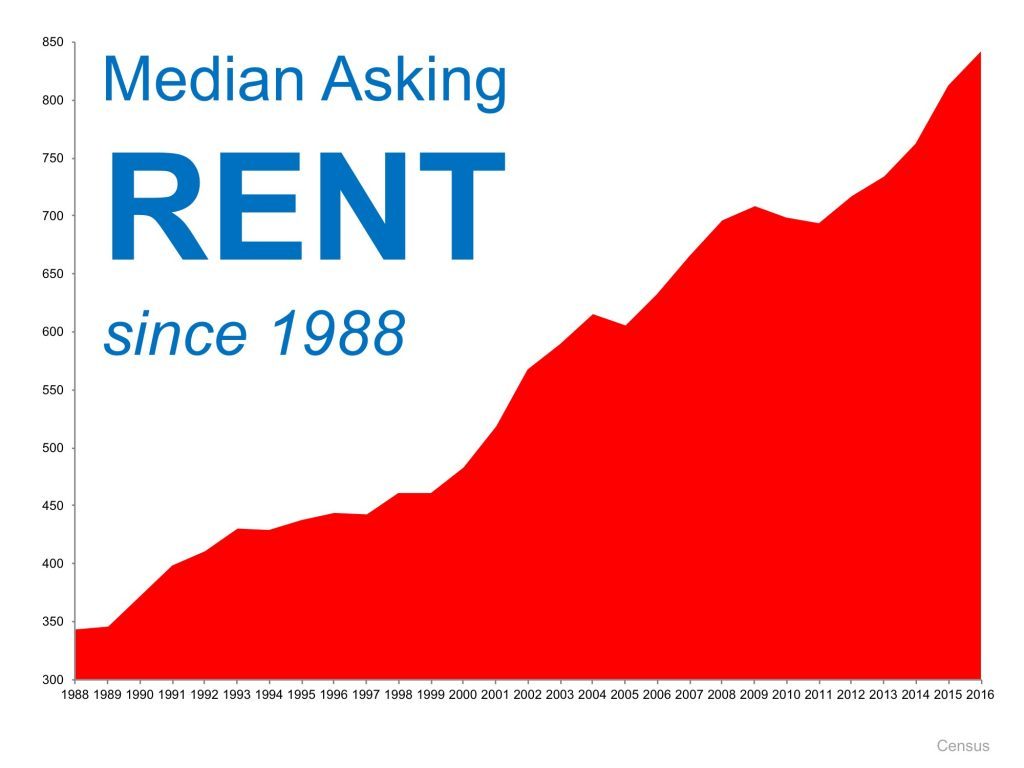

Would be first time buyers may or may not be too concerned about interest rates as long as they do not affect their buying power. However, one thing they should be concerned with is the fact that rents are definitely going to increase in 2017.

In most American cities it is cheaper to buy than rent. It would take a dramatic increase in interest rates for that to change–something that likely would take years to happen, and not overnight.

Plus, with a mortgage your monthly housing payment is locked in for the next 30 years without increasing. That’s not the case if you rent, as history clearly shows.

It is certainly important to keep an eye on interest rates in 2017. However, it is also important to maintain the proper perspective on rising rates and how they can impact the market.

Buyers and sellers should be educated about the facts and not rely on the mainstream media’s sensationalist and chicken little knee jerk reactions to any increase in interest rates.

Information and knowledge are powerful, but as long as we can use history as a guide and dig a little deeper than the headlines to find out what is really going on, then buyers and sellers in the real estate market can make truly educated decisions that are the best for them.

To keep on top of the latest news and trends, stay tuned to this blog. You can learn more about the Charleston SC real estate market by visiting my Pam Marshall Realtor website.

Leave a Reply