Charleston SC Real Estate: Millennial Buyers Are Out There And They Want To Buy

When it comes to Millennial Generation buyers and Charleston SC real estate, there’s good news and bad news. The Millenials are important because they represent a big wave of potential homeowners. However, there are a few things holding them back.

When it comes to the goal of home ownership, Millenials are serious about becoming home owners.

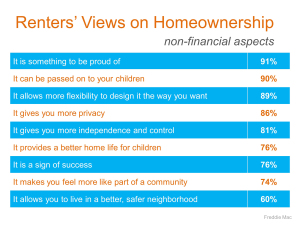

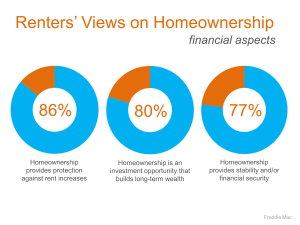

In a recent Freddie Mac survey of renters, reasons for home ownership were identified.

There were both financial and non financial reasons cited to own a home.

Non financial reasons included more control over the living situation, more privacy, and the ability to live in a better community.

Among the top financial reasons were stable, consistent housing costs and building long term wealth.

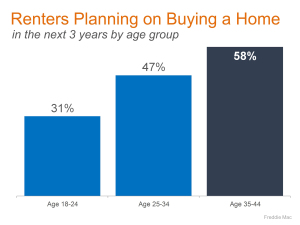

The survey also identified renters that wanted to become home owners in the next three years (broken down by age groups):

The majority of both Generation X and the Millenials are aiming to buy a home, and to do so in the next few years.

Of course, there were some respondents that stated they planned to continue renting instead of pursuing home ownership.

However, the reasons to continue renting are interesting.

It’s not that they simply enjoy throwing away money month after month, but rather the money itself.

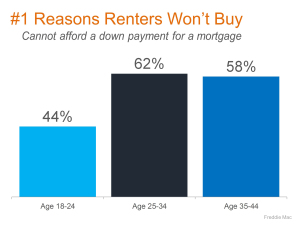

Many cite the lack of a down payment, the perception that they cannot afford the monthly payment, or bad credit.

Another reason cited was not wanting the responsibilities of owning a home.

However, this reason was more prevalent amongst older (55+) renters, and financial reasons were a bigger issue for younger renters:

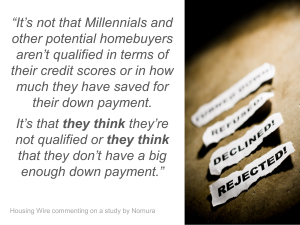

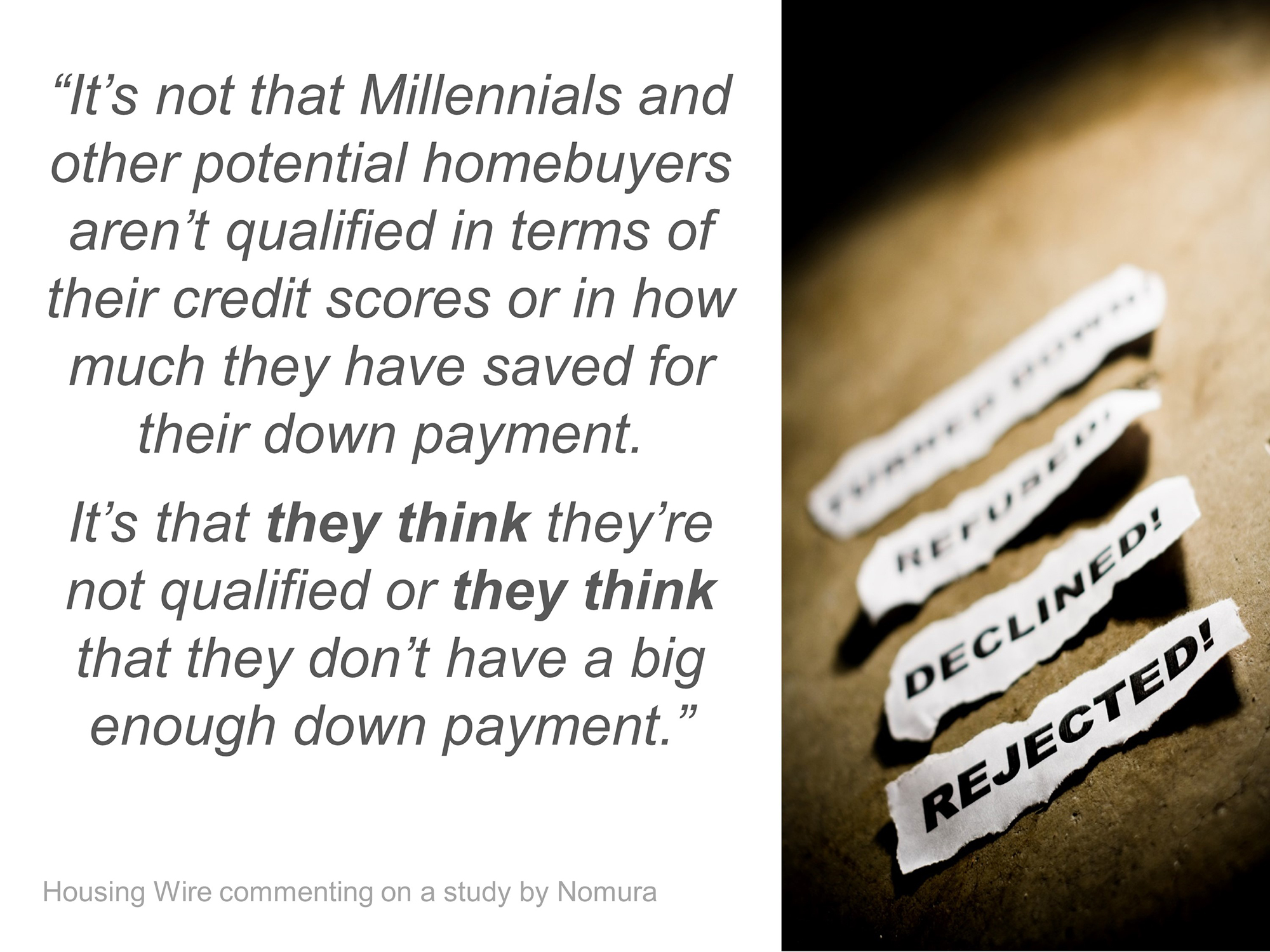

Unfortunately, it isn’t necessarily financial restraints that are keeping more potential Millennial buyers from pursuing home ownership. Rather, it is misconceptions about the financial requirements of owning a home:

A recent HousingWire.com report shed light on the real issue: not a lack of financial means, but the perception of what it takes to own a home.

A recent HousingWire.com report shed light on the real issue: not a lack of financial means, but the perception of what it takes to own a home.

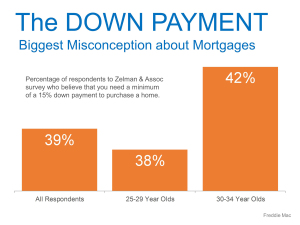

There are misconceptions prevalent among the Millenials that at least 15% is required as a down payment on a home.

They do not think their credit is good enough to qualify.

Many simply do not realize that given the current market conditions, in many cases a mortgage is more affordable than rent.

The down payment misconception appears to be a big obstacle, even though it shouldn’t.

A survey by Zelman & Associates showed that too many Millenials held the false belief that it takes at least 15% for a down payment.

Hopefully, recent news from the FHA is getting out there.

The FHA reduced the minimum down payment required for an FHA loan from 3.5% to 3%.

They also announced a reduction in Mortgage Insurance premiums. FHA loans are very popular with first time buyers.

For those that go the conventional route, 5% down payment is usually all that is required. Then there are VA loans for Active Duty, Reservists, and Veterans of the Military which require 0% down payment.

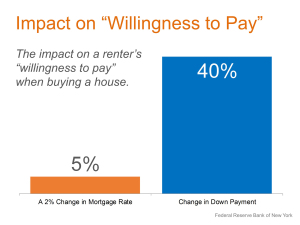

Down payment is such a big issue for Millenials, that a sharp rise in interest rates wouldn’t have as big an impact on a their willingness to buy.

This is evidenced in a report by The Federal Reserve Bank of New York.

In this survey, respondents were asked if a dramatic change in interest rates–a drop from 6% to 4%–would increase their willingness to pay for a new home.

Only 5% said that change would motivate them to buy.

However, a drop in the down payment from 20% to 5% increased their willingness to buy by 40%.

Credit issues shouldn’t be a road block to home ownership either. By sitting down with a mortgage Loan Officer, you can begin the pre approval process.

Many would be buyers qualify and don’t even realize it.

But, if there are issues with credit, the Loan Officer can identify the issues, and lay out a plan to correct and improve those issues in the least amount of time.

By being a little proactive, potential buyers can eliminate the credit issue. Most credit repair issues can be resolved in just a few months. In some cases it might take a year, or a little longer. But, it is important to connect with a Loan Officer and not attempt this alone. They can really guide you and get you into a pre approval in the quickest, most efficient manner without any missteps or unnecessary aggravation.

Why is it so important to get the right information out there and destroy these misconceptions?

The Millenials represent a large number of potential home buyers. The current real estate market is doing well, but it could really explode in 2015 by simply adding in buyers that want to buy think they can’t.

And there are a lot of potential buyers out there.

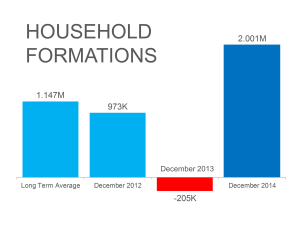

Recent information from the US Census shows that new household formations are starting to skyrocket:

New housing formations in December not only were well above previous years, but well above the historical average.

This isn’t just people that bought a new home.

This is people that moved out of Mom and Dad’s house, or moved into a place of their own.

In other words, many of these new households are renters. Renters that could be buyers.

This is some of the good news. But there is more:

Between October 2013 and October 2014, 46% of all buyers were first time buyers.

Hopefully, the word is getting out their to dispel the misconceptions.

But there still is a large segment of potential home buyers that need to hear this information so they can make an educated decision as far as buying a home.

Stay tuned as I continue to update with the latest stats, data, and information regarding real estate.

On a local level, if you are thinking of buying in Charleston, it is important to have a real estate agent represent you. Especially for first time home buyers. Best of all, it costs you nothing. Just make sure to choose the right agent.

For all your Charleston SC real estate needs, visit my Pam Marshall Realtor website.

Leave a Reply