First Time Home Buyer Checklist Summerville SC

If you are thinking about buying your first home in Summerville SC, then here is a first time home buyer checklist Summerville SC to help you better understand the process and to know what to expect.

1) Get Pre-Approved!

This is a very important first step, and one you want to do months before you actually buy. By getting your pre-approval early you will know what mortgage options you have.

A mortgage loan officer can also see if there are any credit issues that will keep you from qualifying for a mortgage.

They can also let you know how to go about repairing any dings that will help you qualify for a mortgage, or qualify for better loan options. Plus, you will need a mortgage pre-approval for any offer you make on a house.

If you don’t have one, you could lose out on a house you really like. Pre-approval is a a quick, easy process and costs you nothing.

2) Save Up Some Money!

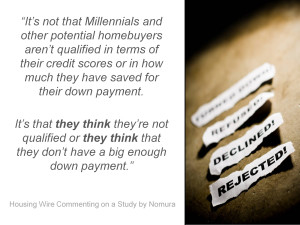

You will need some money for a down payment. How much varies, but there are misconceptions on how much you may need.

You do not need 10% or 20%–in many cases you may only need 3%-5%. If you are active duty military, reservist, or veteran you can get a VA loan which requires 0%, no money down.

You may also need money for closing costs, although you can often have the seller pay those for you. Beyond that, it is a good idea to have some money saved up for when you move in.

You do not want to enter home ownership “house poor”. You will also need money for the earnest money, home inspection, and appraisal. More on those in a moment, but you will roughly need about $2,000 for these, in addition to your down payment.

3) You Have Options For A Down Payment

With FHA loans (very popular for first time home buyers) you can have a relative gift you the down payment. Additionally, the IRS allows parents to give their children a gift each year up to $11,000 tax free.

Be sure to consult with your mortgage loan officer and your accountant to ensure that you do this properly. If not, you may not be able to use the money.

4) Don’t Make Any Big Changes To Your Credit!

While you are in the process of buying a home, do not make any large purchases such as a new car, furniture for the new house, or open any new lines of credit. These can negatively affect your credit and keep you from qualifying for a mortgage, even if you have already been pre-approved.

Don’t make any moves without consulting your loan officer, and only make credit changes that they recommend. Which leads to the next tip….

5) Listen To Your Loan Officer!

Stay in constant communication. Let your loan officer about any potential changes to your credit, as well as potential changes with your job. These can wipe out your pre-approval. If your loan officer recommends certain steps to help improve your credit, then these changes are ok.

It is also best to take the necessary steps as soon as you can, and also be sure to send your loan officer any requested paperwork and/or documents.

6) If You Haven’t Already, Get A Realtor!

This should be one of the first steps. Be careful who you choose. Not all Realtors have the patience to work with first time buyers.

If an agent isn’t good with returning calls or emails, or doesn’t have the patience to answer questions about the home buying process, then move on!!

Also, make sure you have an agent that represents YOU! The agent whose name is on the yard sign or is at the new builder’s office represents the sellers, and will look to protect their best interests.

You are entitled to have your own agent represent you, and best of all it doesn’t cost you anything!

7) Make The Home Search Easier!

The internet is a great resource for information about the home buying process. You can also find most homes that are for sale. However, there is a lot of homes that are not for sale any longer.

There are also websites that don’t have complete information about a home. This way, you have to call the agent/office to learn important details.

Instead, you can visit my buyers page and sign up to have listings that match your exact criteria sent directly to your inbox. Plus, you will receive updates and new listings so that you don’t miss the “perfect” house.

Bee sure to sign up for my “First Time Home Buyer’s Survival Guide“.

You can also download a copy of my “Fall 2014 Buyer’s Guide” by completing the form below.

Stay tuned for tomorrow to see Part 2 of my First Time Home Buyer Checklist Summerville SC.

We respect your email privacy

Powered by AWeber Email Newsletters

Leave a Reply