The most recent reports indicate home sales and home values continue to increase. Buyer demand remains strong, but a historically low inventory of homes for sale keep driving home values upward.

Home Sales 2017

Here is the latest look at overall home sales, compared to last year:

So far in the first quarter of 2017 home sales are just above home sales numbers in 2016, save for April. More on that in a minute.

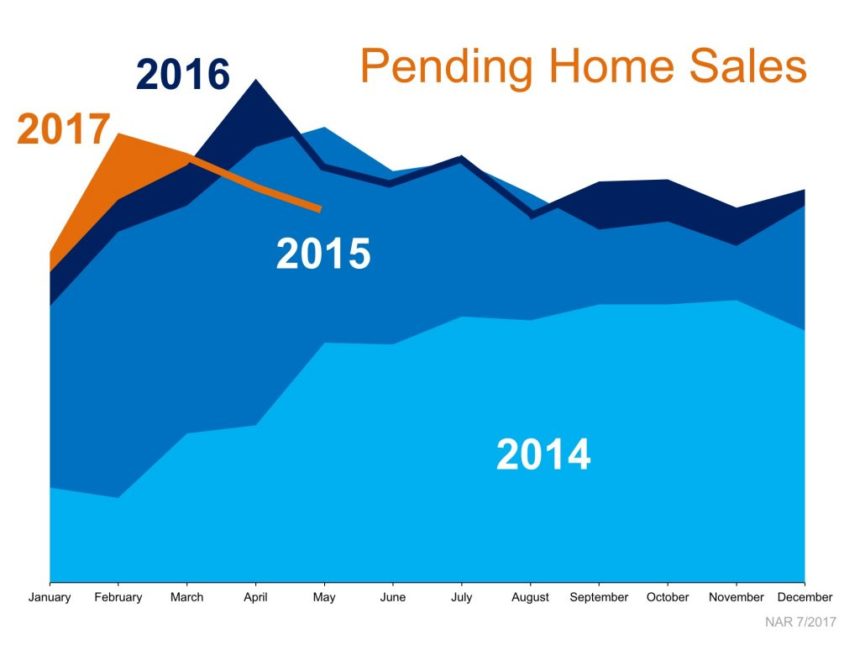

Here is a look at Pending Sales numbers, comparing them over the last few years:

You will notice that Pending Sales numbers have been trending upward the last few years.

However, in 2016, and now in 2017, we have seen Pending Sales dip below the numbers going back to 2015.

So, is this a troubling sign for the housing market? The short answer is no.

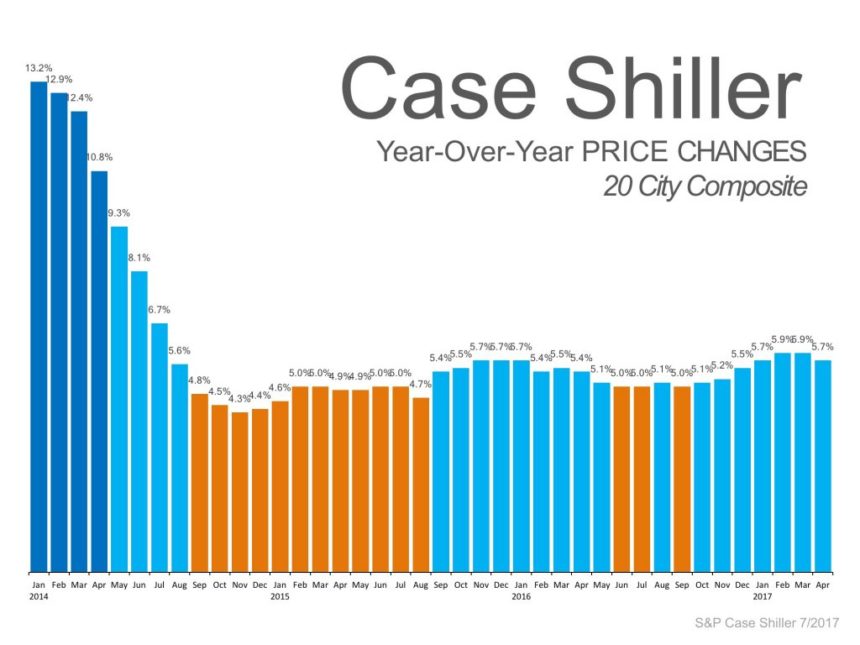

Home values have continued to appreciate at higher than projected levels:

Why Aren’t Home Sales Outpacing Year-Over-Year Numbers?

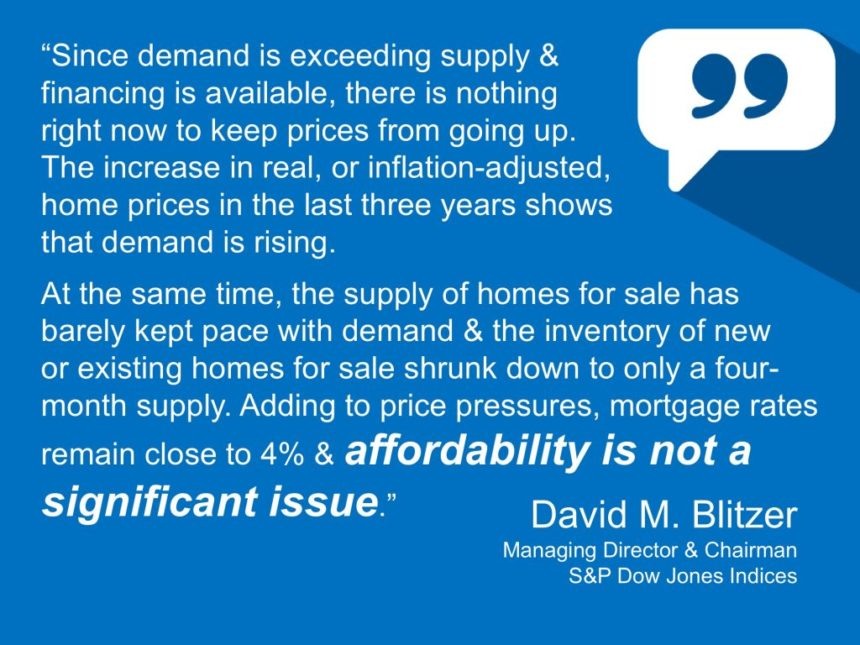

The big issue with the real estate market hasn’t been a lack of demand.

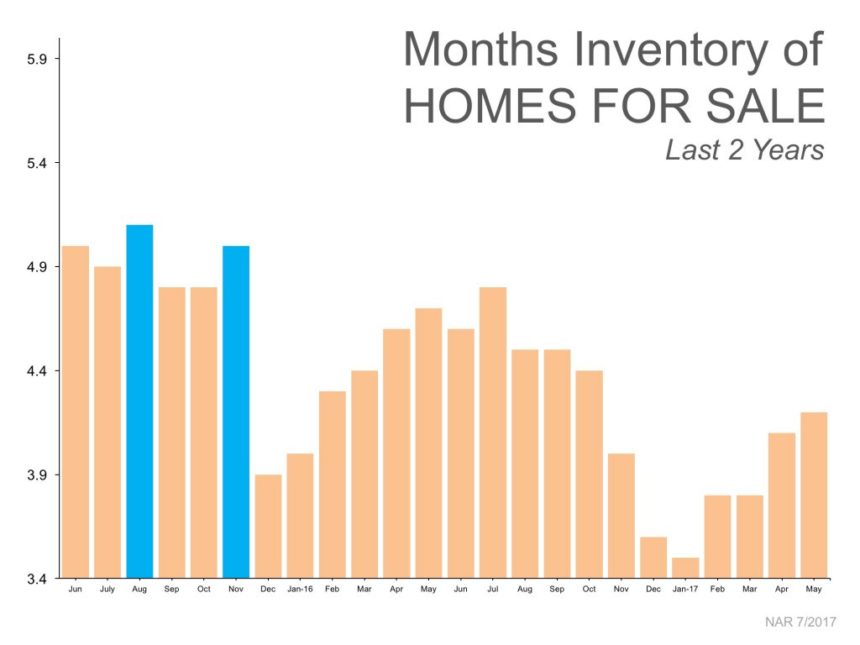

The problem that has existed for the market for the last few years has been a lack of inventory.

Simply put, the supply has not kept up with the demand.

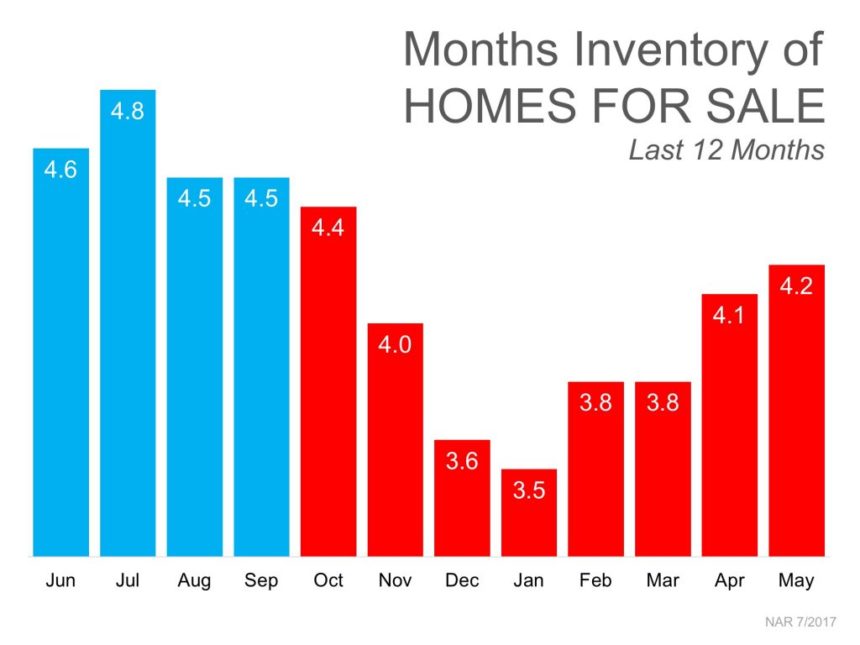

The next couple of infographics clearly show this to be the issue:

Keep in mind that it takes 6 months of inventory to be considered a balanced, normal market.

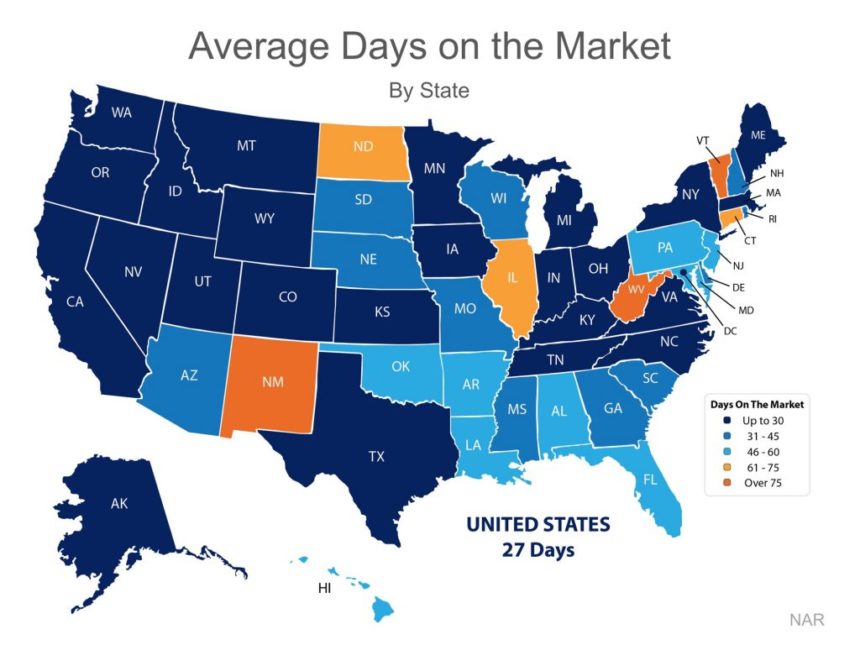

This latest statistic also shows how inventory isn’t anywhere near where we need it to be:

The Average Days On The Market across the country is 27 days. It takes less than a month to get a home sold right now.

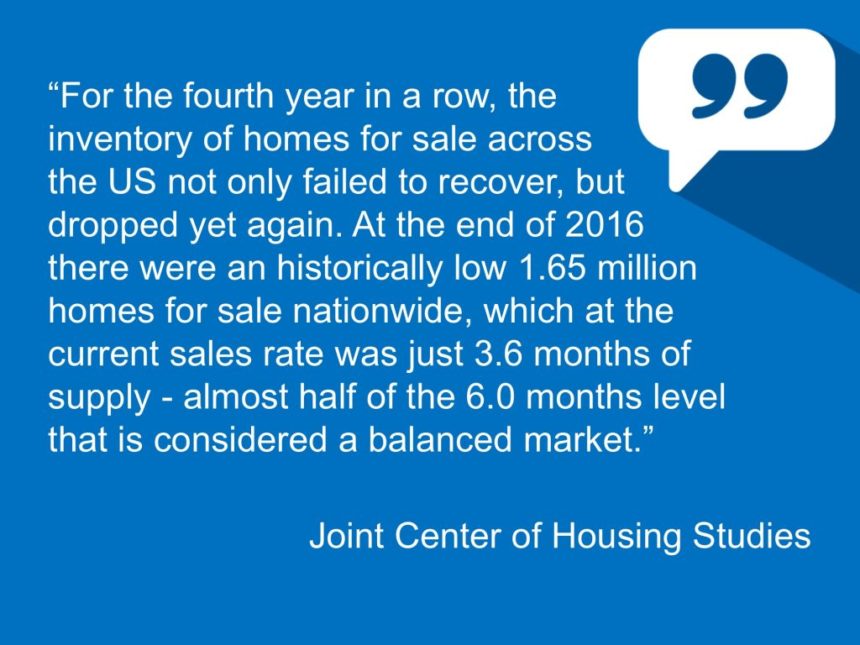

A recent report from the Joint Center For Housing Studies of Harvard University emphasized how much of an issue the lack of inventory is for the market:

Lack Of Inventory Keeping Home Sales Down

If you look at the home sales and Pending Sales infographics, you will see that both numbers are just keeping up or are below where they have been in the previous couple of years.

This might lead some to believe that the fact that these numbers are down indicates trouble ahead.

But once again, it is important to keep things in the proper perspective.

After seeing both home sales and pending sales numbers increase their year-over-year numbers for the last few years, why are they appearing to slow down?

The answer is not a lack of demand. There has been pent up buying demand that we are seeing unleashed. The answer is simply that there are not enough homes to meet the demand.

If there was a better supply of inventory, then those numbers would continue to be increasing over the previous years.

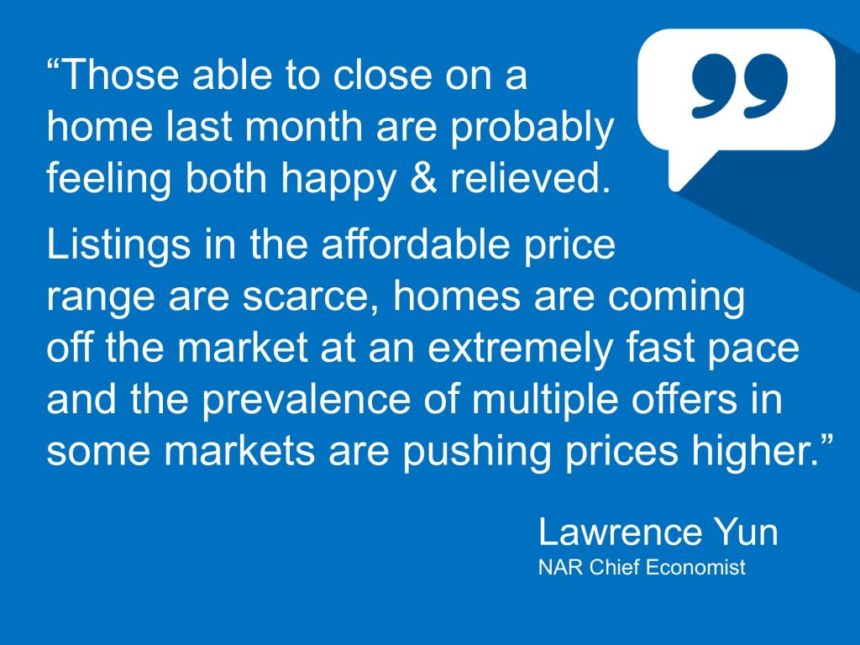

The current market is tough for buyers.

Multiple offers are commonplace, and many buyers lose out on a house or multiple homes before they finally succeed:

Are We Heading For Another Bubble?

It has been recently reported that home values in many parts of the country have reached or exceeded their peak levels from before the market crash.

With home values continuing to soar (due to lack of supply), many people are bringing the “B” word into the conversation: Bubble.

But, this market is completely different than what we saw in the early to mid 2000’s.

For one, the strong demand was artificially created. Mortgage lending standards were much, much looser then.

In fact, they were way too lenient.

Just about anyone that wanted a mortgage was able to be qualified.

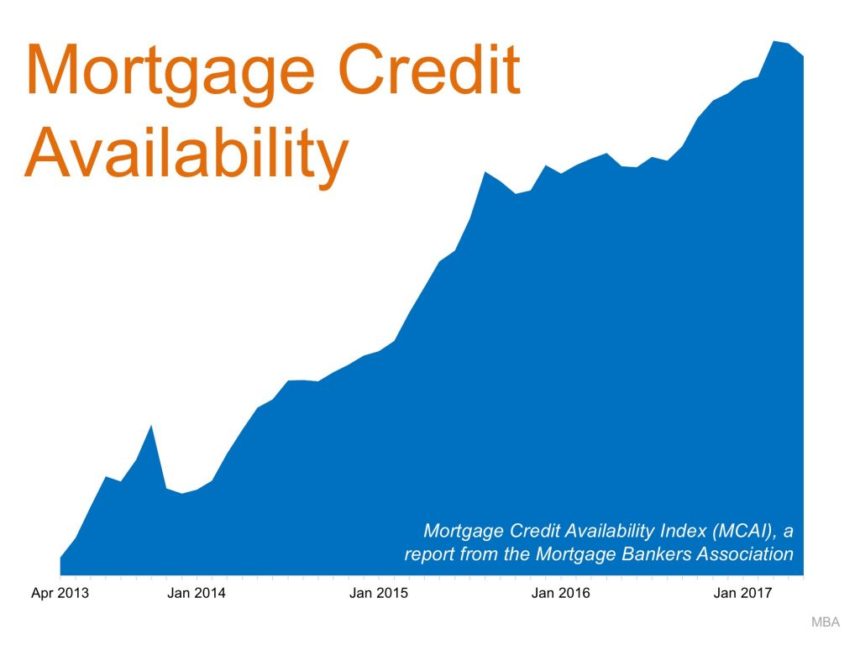

Today, lending standards have relaxed a little since after the mortgage meltdown.

In the aftermath of the market crash, banks tightened up their lending guidelines to an extreme.

The polar opposite of what we saw during the “Wild West” days of lending.

Here is a look at Mortgage Credit Availability from the Mortgage Bankers Association, which shows how much easier it has been to get a mortgage over the last few years:

Remember, at the beginning of that graph it was virtually impossible to get a mortgage unless you had nearly perfect credit.

These lending standards were too strict, and were an extreme correction to the extremely relaxed standards that helped us get into the real estate mess we found ourselves in 10 years ago.

The stricter standards hurt the industry when what we needed was some help to get the recovery going.

Fortunately the banks realized this and started to use common sense in their lending guidelines (yes, the fact that they would be associated with common sense can be argued, but that is for another day).

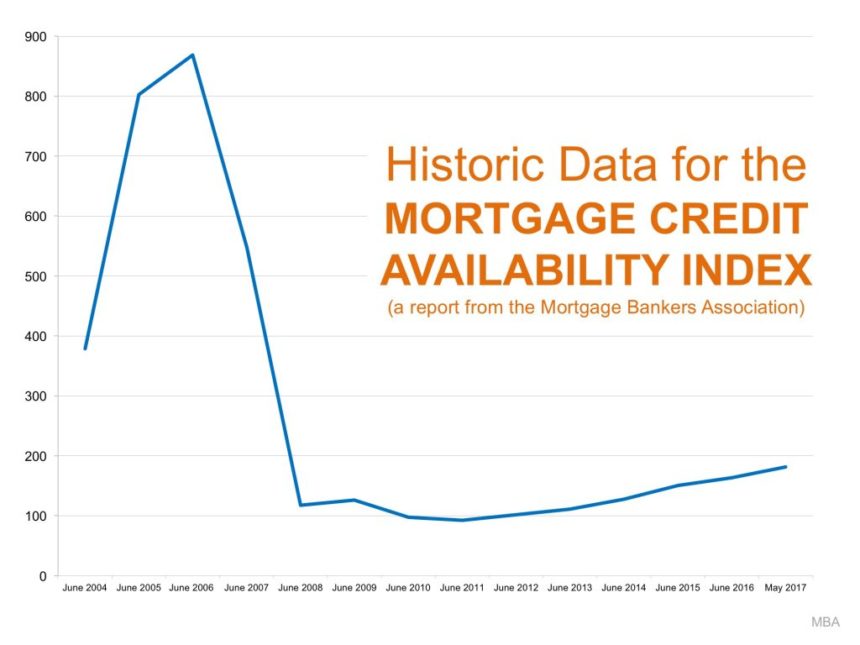

But have they relaxed their lending guidelines too much? That is not a case.

You can look at the next infographic that shows Mortgage Credit Availability going back to the crazy days and see we haven’t come close to the ridiculously loose standards that existed before the crash (and we likely will not see that ever again):

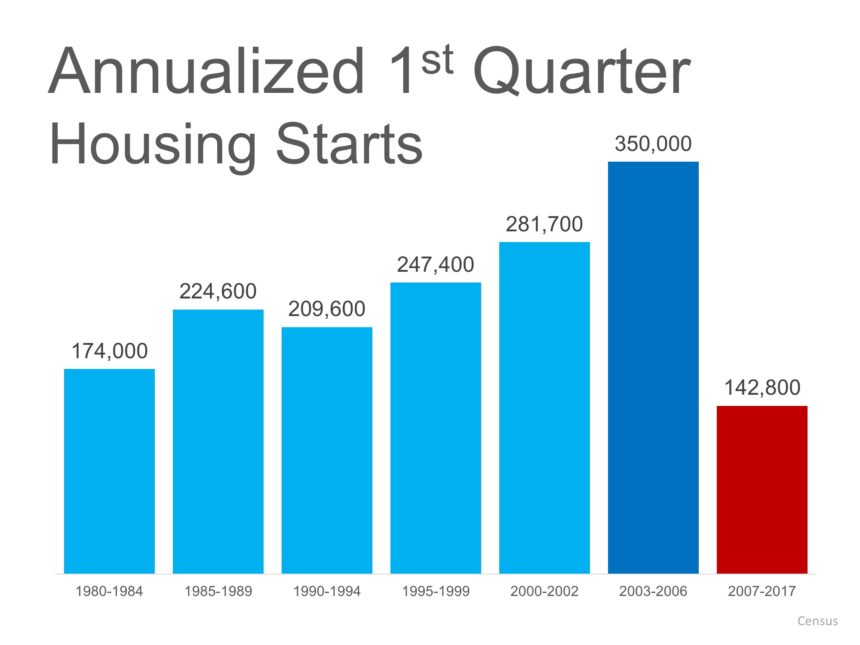

Overbuilding Of New Homes

Another factor that contributed to the market crash was the overbuilding of new construction homes.

The market was flooded with homes as builders rushed to meet the artificially created demand.

In the current market, new homes are actually needed to help increase inventory to meet this demand.

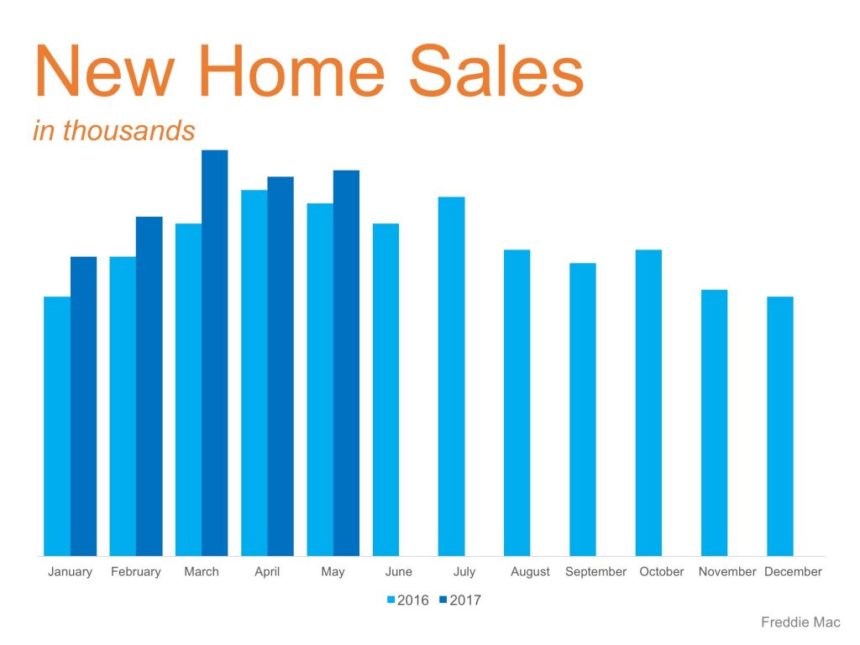

New home sales are also up, as builders are trying to close the gap between demand and supply:

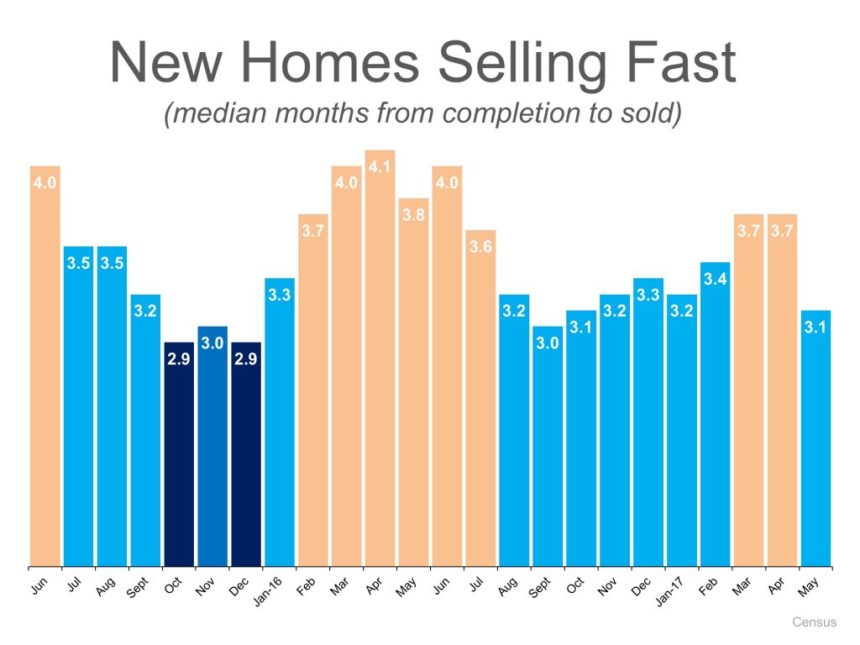

Even with new home sales increasing, they still aren’t keeping up with demand:

New home construction faces some challenges as builders are scrambling to catch up to the market, something I covered in greater detail.

But builders are nowhere near the record levels they saw prior to the market collapse.

In fact, new home starts are still at the lowest levels we have seen in decades:

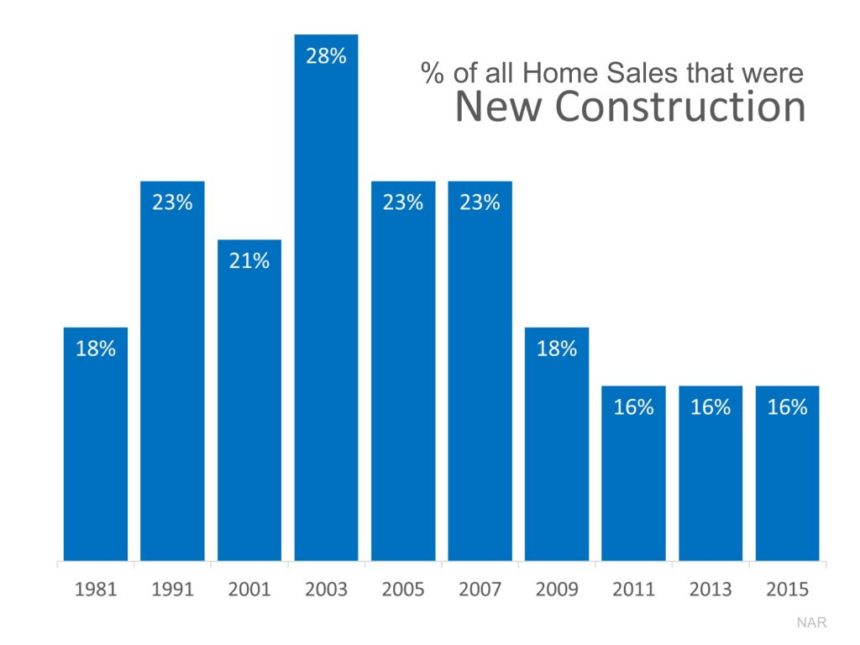

New Construction homes sales are also seeing their smallest market share in decades:

So, overbuilding is clearly not an issue. In fact, the issue really is that they can’t build them fast enough.

“The havoc during the last cycle was the result of building too many homes and of speculation fueled by loose credit. That’s the exact opposite of what we have today.”

Jonathan Smoke, Chief Economist of Realtor.com

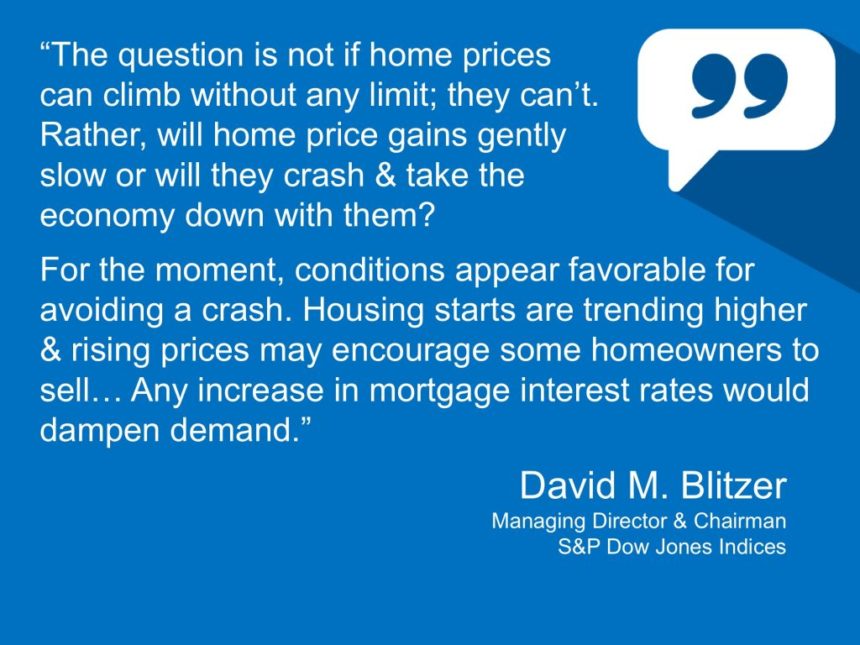

Home Values Are Soaring, And That Can’t Last Forever, Right?

That is true, after all, what goes up must come down. But is that a concern in today’s market?

According to the experts, not at all:

Will rising home values price potential buyers out of the market?

I previously discussed home affordability in greater detail here.

Bottom Line

Home values continue to increase, which is a good sign for the market. Home sales are slightly on the increase, and they are at least holding steady.

Those numbers would also be increasing more, but the lack of available homes is holding them back.

The current market is fairly healthy, other than the 900 pound gorilla in the room: lack of inventory.

Supply of homes for sale is the biggest issue facing the housing market.

Available homes for sale are at historic lows, and new construction homes are also at historic lows.

Buyer demand is at or near historic highs, but this demand was not created artificially by bogus mortgages.

Look for home values and home sales to continue trending upward.

Even if we see a flood of inventory, whether it comes from current home owners and/or new construction homes, keep in mind that it will help close the gap of demand vs. supply.

Remember, we need a 6 month inventory of homes for sale for a normal market.

We haven’t been close:

Home values will continue to increase, it is simple economics of supply and demand.

Home sales will be more affected by inventory levels, as interest rates remain near historic lows, keeping homes affordable.

And please, do not buy into the hype that it is 2006 all over again and that we are in another……

Keep Up With The Latest Real Estate News, Stats, And Trends!

Be sure to watch the latest at this blog and this blog.

Download one of my free real estate guides:

You can also check out my Pam Marshall Realtor website.

Leave a Reply