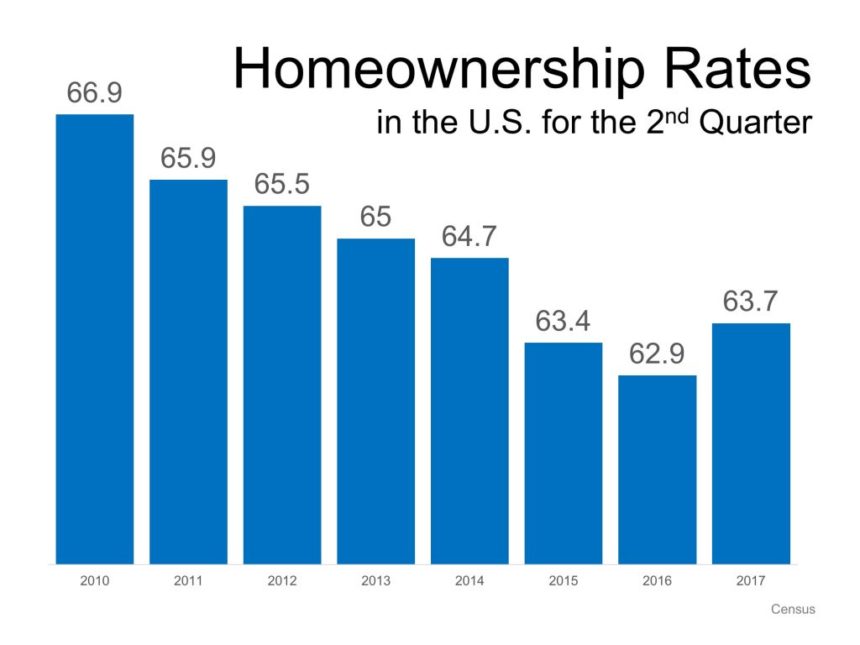

More good news from the housing market. For the first time in several years, the homeownership rate has increased.

According to the US Census, in the second quarter of 2017 the homeownership rate increased to 63.7%, the highest level in 3 years. In the past several years that number had been in decline:

So what factors have led to this turnaround?

Home Sales Continue To Increase

The obvious factor in the increase in the homeownership rate has been strong home sales over the last couple years.

Although home sales actually declined in July for the second consecutive month, July’s sales pace was 2.1% higher than July of last year. Nevertheless, July’s sales pace was the lowest of 2017.

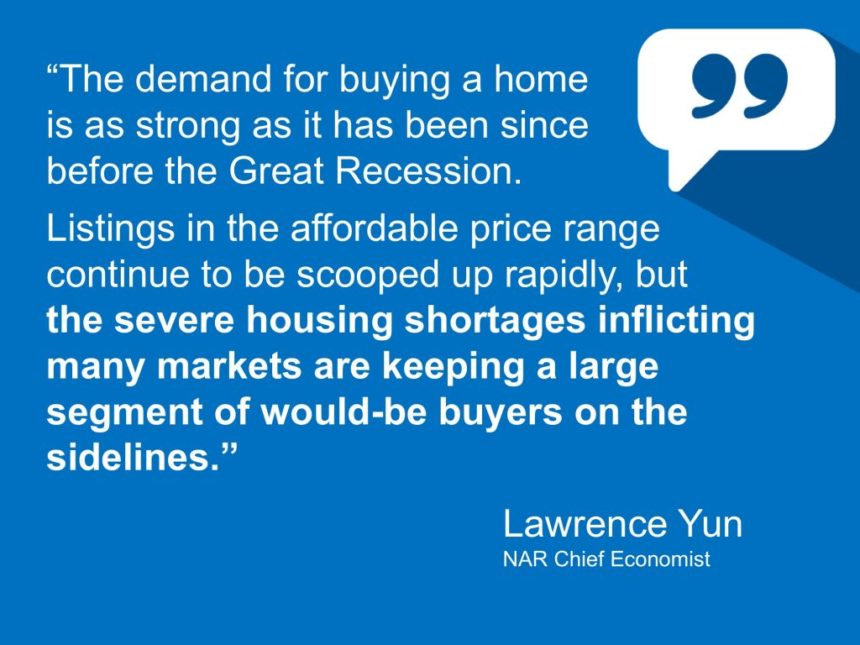

NAR Chief Economist Lawrence Yun says home sales aren’t slowing down due to declining demand. Rather, it is due to low inventory:

“Buyer interest in most of the country has held up strongly this summer and homes are selling fast, but the negative effect of not enough inventory to choose from and its pressure on overall affordability put the brakes on what should’ve been a higher sales pace,” Yun said.

“Contract activity has mostly trended downward since February and ultimately put a large dent on closings last month.”

According to NAR:

“Total housing inventory dropped 1 percentage point month-over-month to 1.92 million homes for sale. Year-over-year inventory declined 9 percentage points and is in its 26th consecutive month of year-over-year declines. Unsold inventory is at a 4.2-month supply, a 0.6 percent year-over-year decline.”

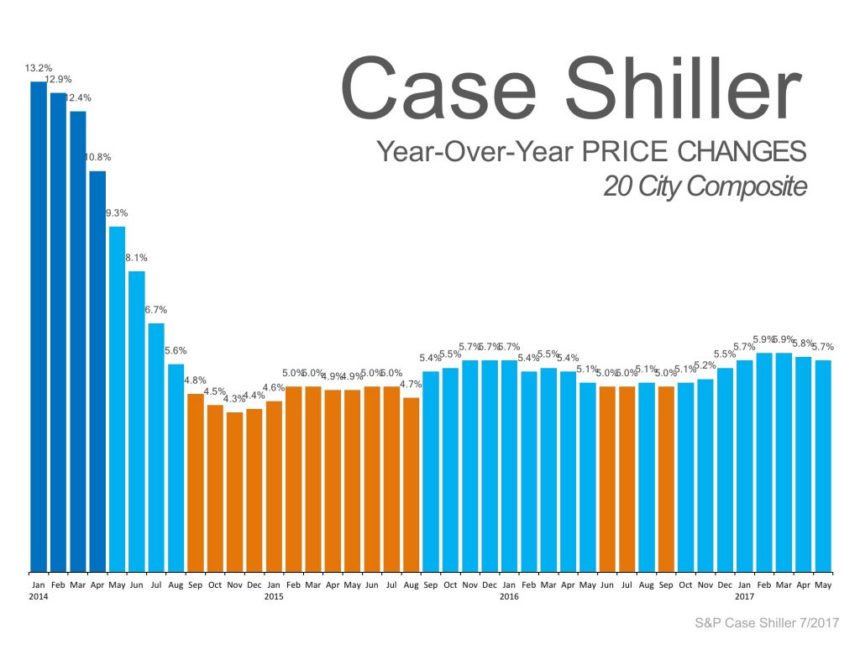

Because demand remains strong and inventory is in short supply, prices continue to increase. The median existing-home price for all housing types in July rose 6.2 percentage points to $258,300, which marks the 65th consecutive month of year-over-year gains.

Despite increasing prices and limited inventory, home sales remain strong.

“In the first half of the year, the housing market was able to keep its head above water, despite high prices and low inventory, because buyer demand was so strong,” said Redfin chief economist Nela Richardson.

“Multiple months of inventory declines took a toll on sales as buyers took a breather in July to wait for more listings. Despite last month’s sluggishness, the number of homes sold in the first seven months of the year was up 4 percent compared with the same period last year.”

Consumer Confidence Soaring

There are many indicators that show consumer confidence in the economy is strong, and growing.

A recent MarketWatch poll showed that consumer confidence rose to the second highest level in 16 years in July:

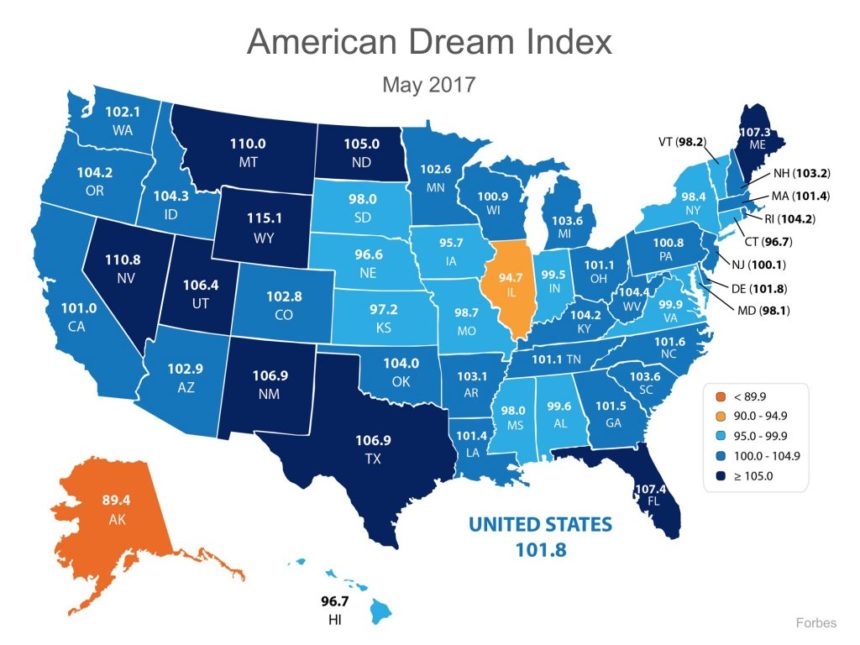

The most recent Forbes American Dream Index saw that index increase for the fourth straight month:

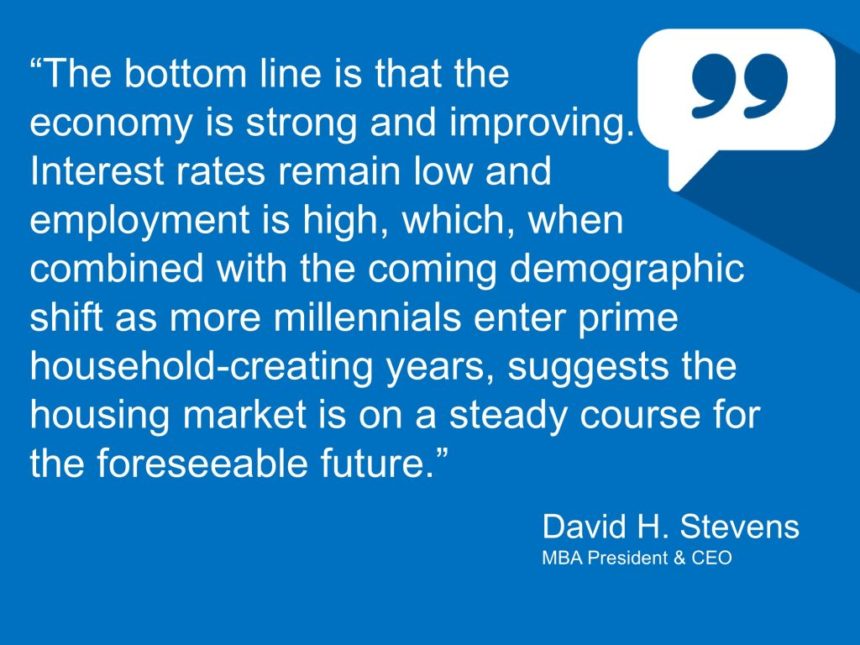

The Economy

Consumer confidence is not the only thing increasing. The economy continues to grow, and with it are new jobs and increasing wages.

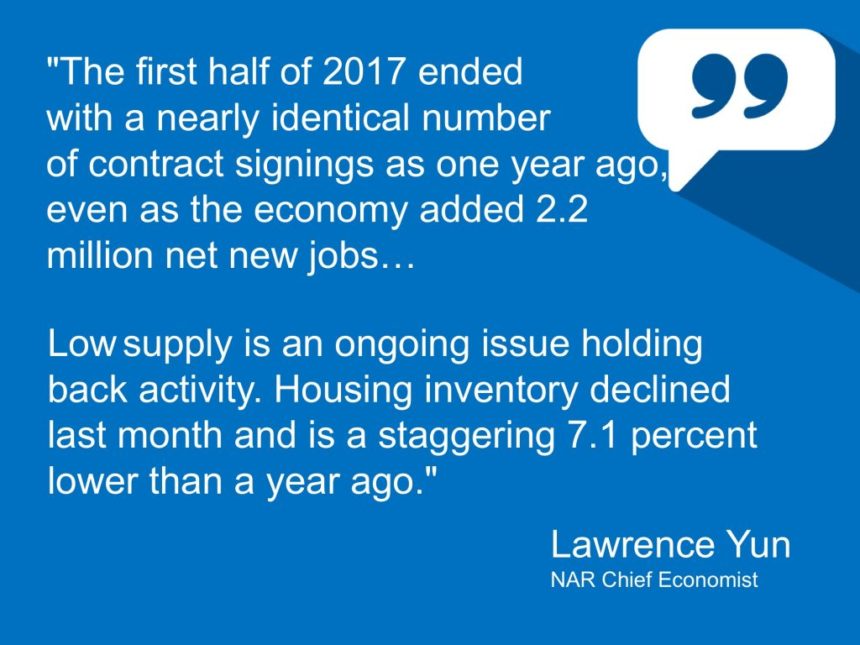

This is helping to fuel the demand for housing. However, inventory again is holding back the housing market:

Yun further explained

“Home prices are still rising above incomes, and way too fast in many markets,” Yun added. “Realtors continue to say prospective buyers are frustrated by how quickly prices are rising for the minimal selection of homes that fit buyers’ budget and wish list.”

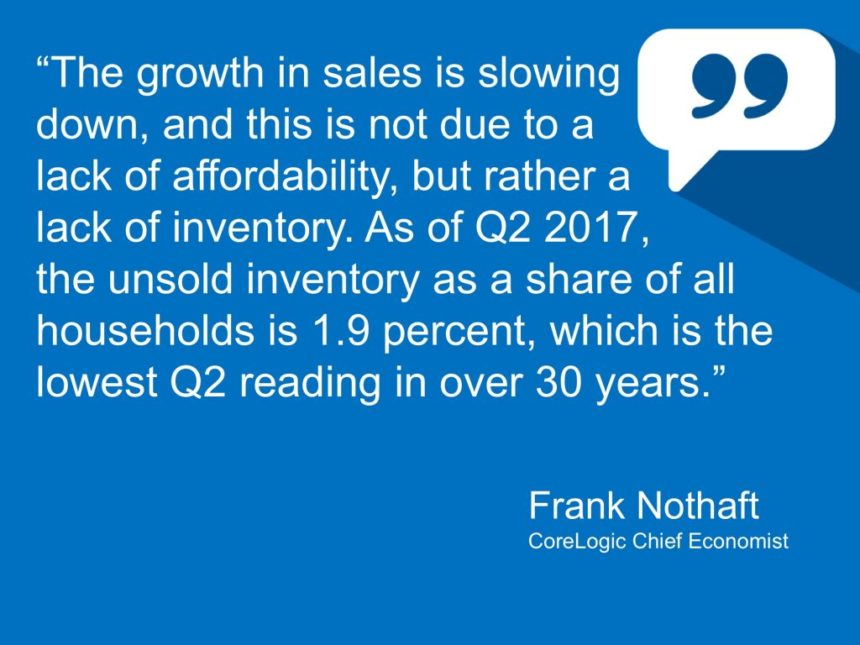

Despite rapidly increasing prices, home affordability is not yet an issue. Inventory levels are at historical lows:

Negative Impacts Of Low Inventory

Inventory has been a challenge for the real estate market for the better part of the recovery. Otherwise, the market has been doing well.

However, at some point increasing prices (as well as an increase in interest rates) could cool off the demand.

The current inventory shortage is making for a market that is not only challenging for prospective buyers, but can be frustrating as well.

The low inventory could also be scaring away potential buyers:

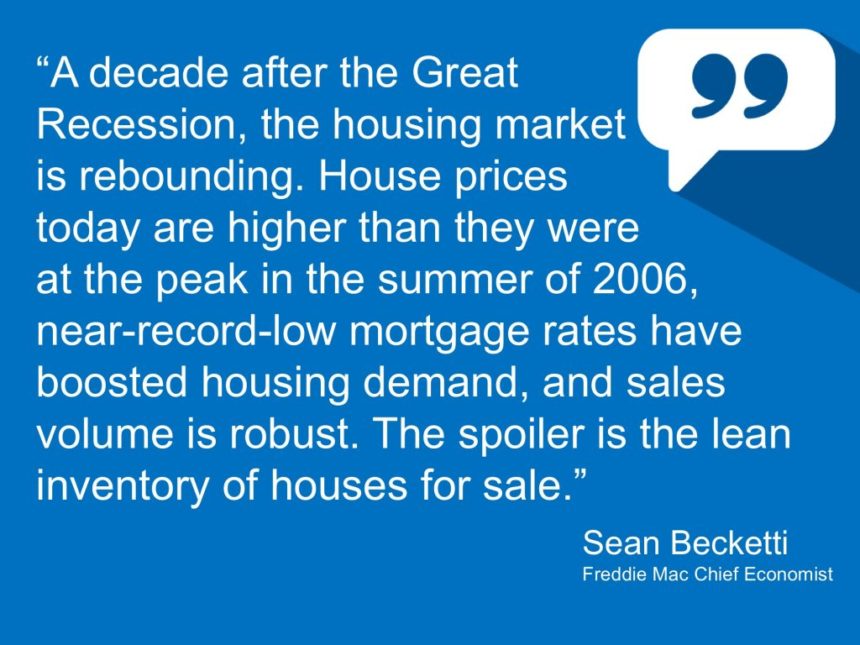

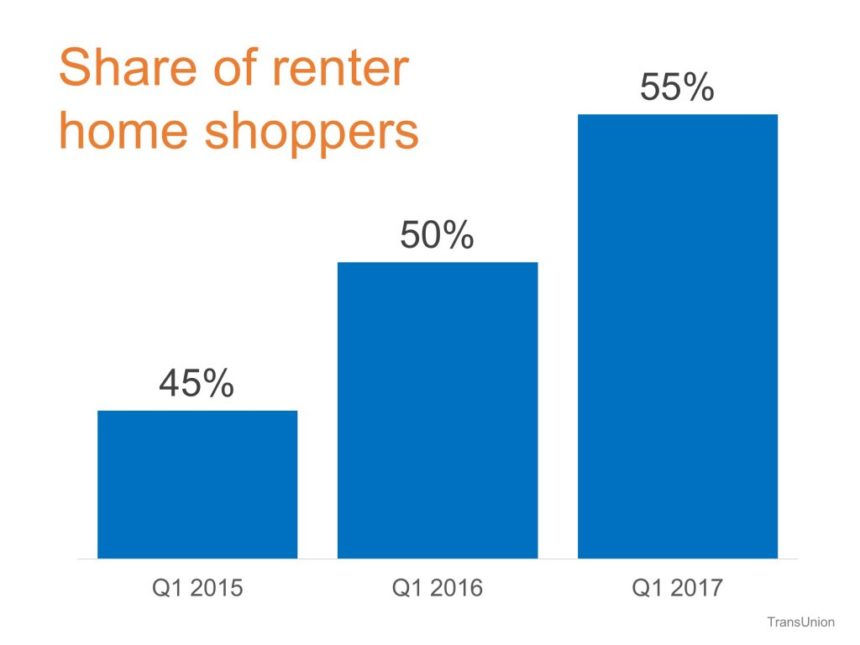

Despite this challenge, the outlook for the housing market remains strong:

Look for the homeownership rate to continue it’s increase, which means it will hit the highest level in 3 years:

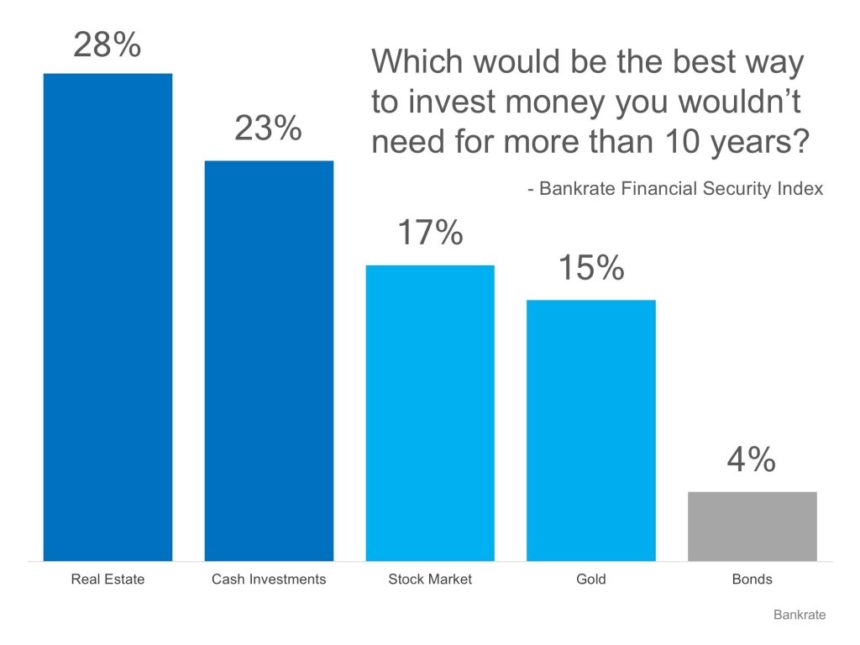

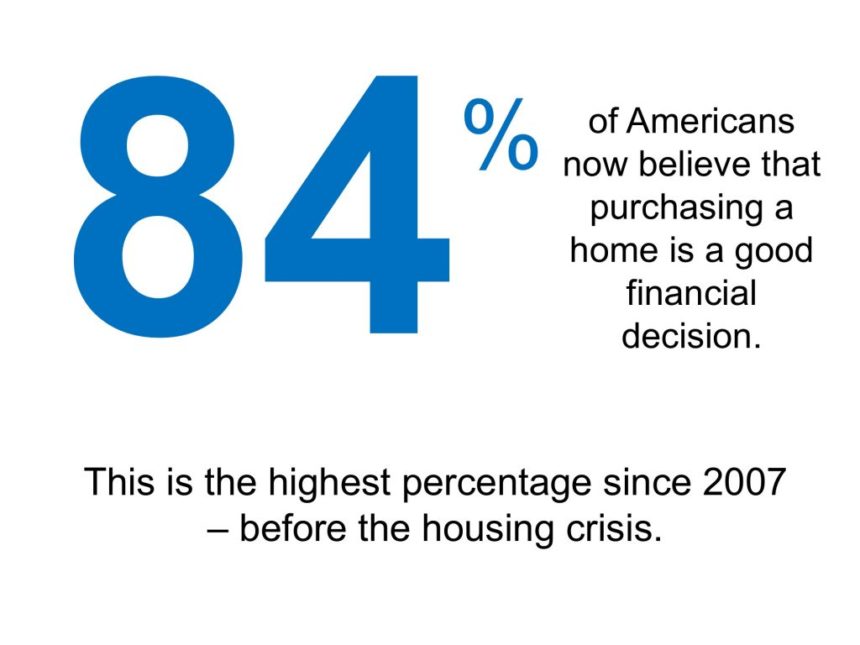

Real Estate Is Still Seen As A Great Investment

The strong economy and home values that are continuing to increase have helped refuel consumers confidence in real estate as an investment.

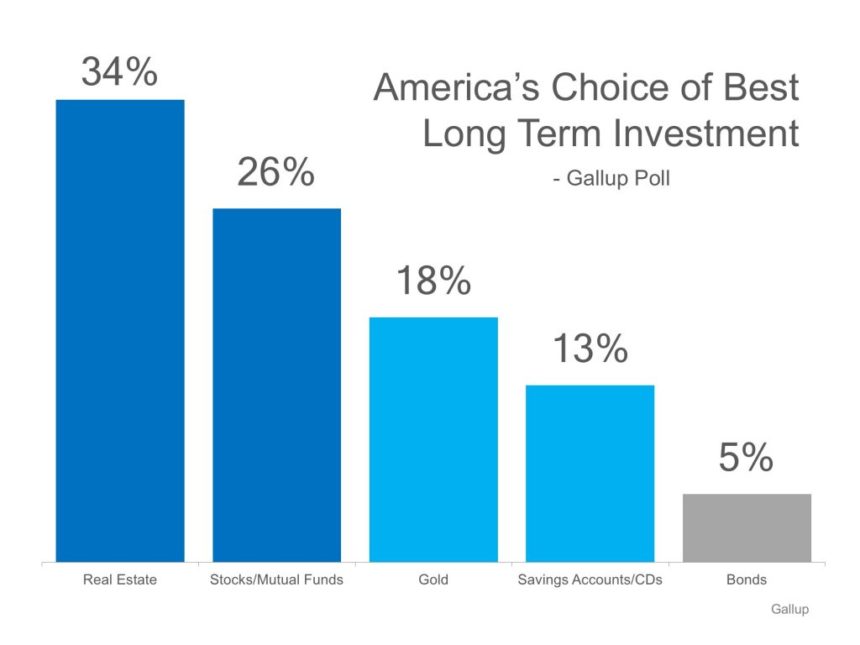

The most recent Gallup Poll shows that American’s view real estate as the best long term investment, even better than stocks:

Leave a Reply