Homes For Sale Charleston SC: Are Rising Rates Impacting Housing?

If you are shopping homes for sale Charleston SC, then you are probably paying close attention to mortgage interest rates.

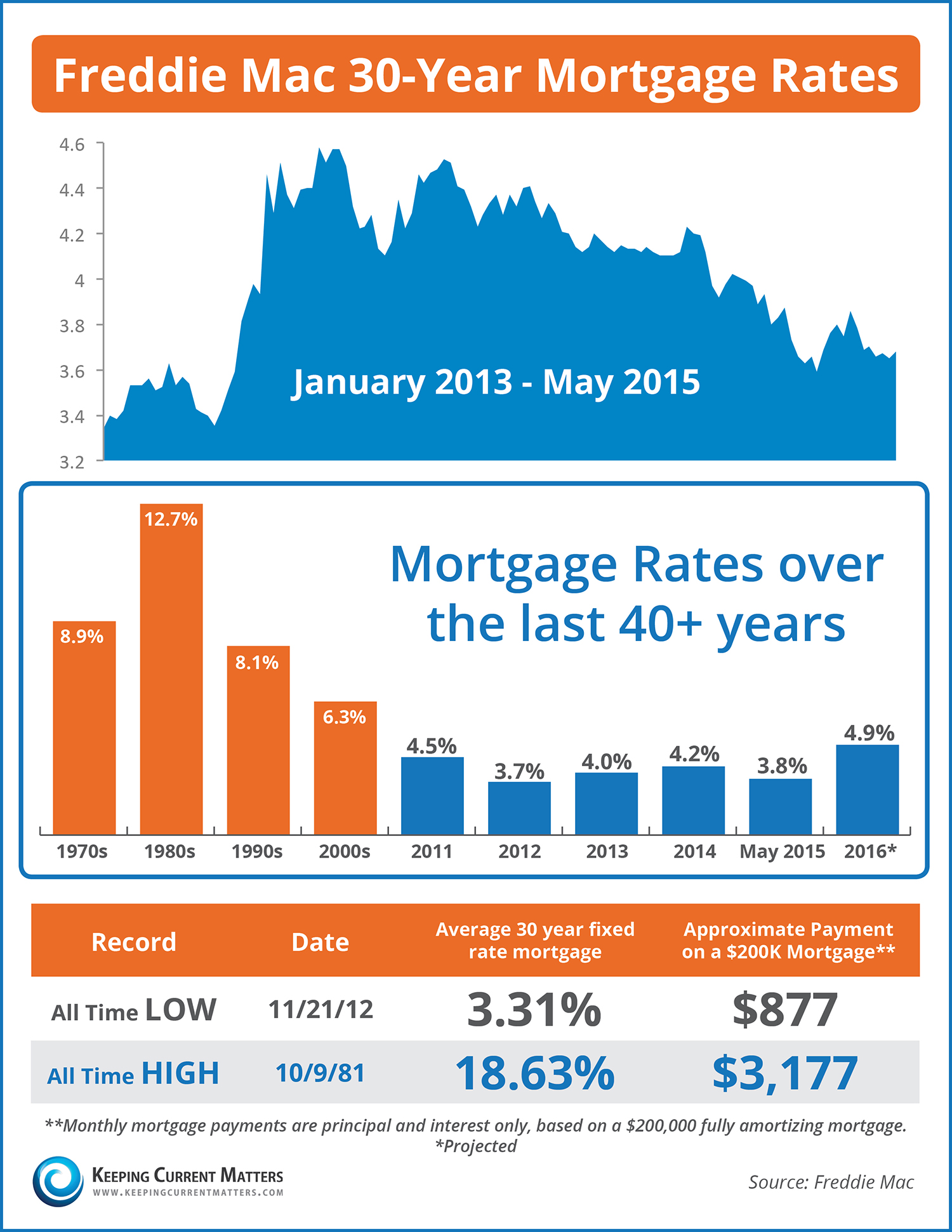

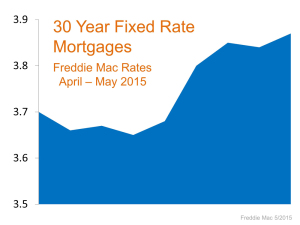

Interest rates have crept up the last 2 months, hovering just below 4%.

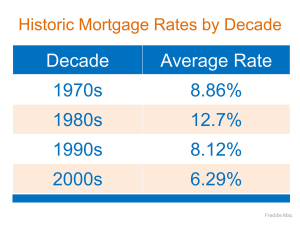

From a historical perspective, rates remain close to their all time lows.

Interest rates have remained lower than expected so far in 2015.

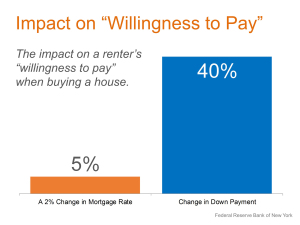

Studies have shown that the bigger issue for potential home buyers is down payment, not interest rate.

Especially for Millennial home buyers. Credit, or the belief that their credit isn’t good enough, is also an issue for Millenials.

One study I have referenced before was done by the Federal Bank of New York.

This study showed that an increase in the interest rate by 2 points had less an affect on buyers willingness to buy than a decrease in the required down payment.

That said, the Mortgage Bankers Association (MBA) announced that applications for mortgages actually dropped for the week ending May 29th.

The numbers were seasonally adjusted and also took into account the Memorial Day Weekend.

Applications to refinance took the biggest hit, but applications for mortgages to purchase were also down 3% from the previous week.

These such applications are still up 14% over the same period last year.

So, what does this mean for the market and for people looking at homes for sale Charleston SC?

Time will tell, and it really depends on what happens to interest rates going forward. For now, it is a bump in the road.

If interest rates rise, will that slow down home sales? Pending Home Sales have increased each month in 2015, and hit their highest level in 9 years.

Existing Home Sales actually dropped in April, but experts attribute that to the severe lack of inventory.

Despite the monthly drop, year-over-year sales numbers were still up by 6.1%.

Many industry experts do not feel a slight rise in interest rates will slow down the housing market.

Here is a quote from Freddie Mac’s US Economic & Housing Market Outlook from back in November, forecasting the potential of rising rates on the housing market in 2015:

“While higher interest rates generally detract from housing activity, when they occur with strong job and income growth the net result can be increases in household formations, construction, and home sales.

Our view for 2015 is exactly that, namely, income and job growth offset the negative effect of higher interest rates and translate into gains for the nation’s housing market.”

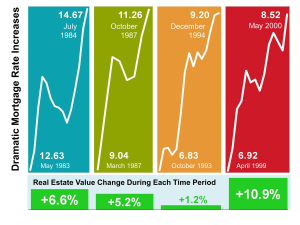

History also shows that just because interest rates increase dramatically, there isn’t an automatic hit to the housing market.

In fact, the last 4 times we saw an increase in interest rates (by more than 1 full point within a year), home values still increased.

With demand exceeding supply, home values should remain on the increase.

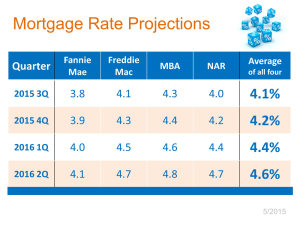

Interest rates are expected to rise throughout this year and into next year. By how much is anyone’s guess, but the Fed is expected to raise the base rate sometime after Summer.

Here are the latest projections for interest rates from Freddie Mac, Fannie Mae, the MBA and the National Association of Realtors:

The numbers out there clearly show a strong demand from buyers.

Home sales remain strong, Pending Home Sales are at a 9 year high, and Foot Traffic remains strong.

The big issue remains tight inventories.

On Friday the monthly Employment Report will be released. This, along with news from European Interest Rates will have an impact on interest rates here in the States.

NAR will release their next Existing Home Sales Report on June 22, and this will give us the latest numbers from May.

That report will show how much the rising rates have impacted housing. However, based on the most recent ones, it doesn’t look like it is impacting housing so far.

Is now a good time to buy?

If you are thinking about buying homes for sale Charleston SC, is now the time to pull the trigger?

Interest rates have already crept up some so far this year.

However, they are not as high as they were projected to be.

Plus, they remain close to their historical lows.

Buyers have been very fortunate that interest rates remain so low.

They have also benefited from Fannie Mae and Freddie Mac dropping their minimum required down payment from 3% to 3.5%, making it even easier to buy a home.

It simply boils down to your own situation. If you are ready to buy a house, then it is a good time to buy because there are so many factors working in your favor.

The wrong thing to do is get caught up in the timing of the market. Don’t feel that you missed out on the best interest rates and put off plans to buy.

Also, do not try to wait for the “perfect time” in the market for interest rates or home values. Do what makes sense for you.

The best advice comes from Doug Duncan, Fannie Mae Chief Economist:

“The rule for when is it time to buy is always the same: given your household budget and where current interest rates are, if it makes good financial sense to take out a home loan today, then today is the day to do it.”

If you are looking for homes for sale Charleston SC then bee sure to visit my Pam Marshall Realtor website.

Leave a Reply