Homes For Sale Charleston SC: Just How Much Do I Need For A Down Payment?

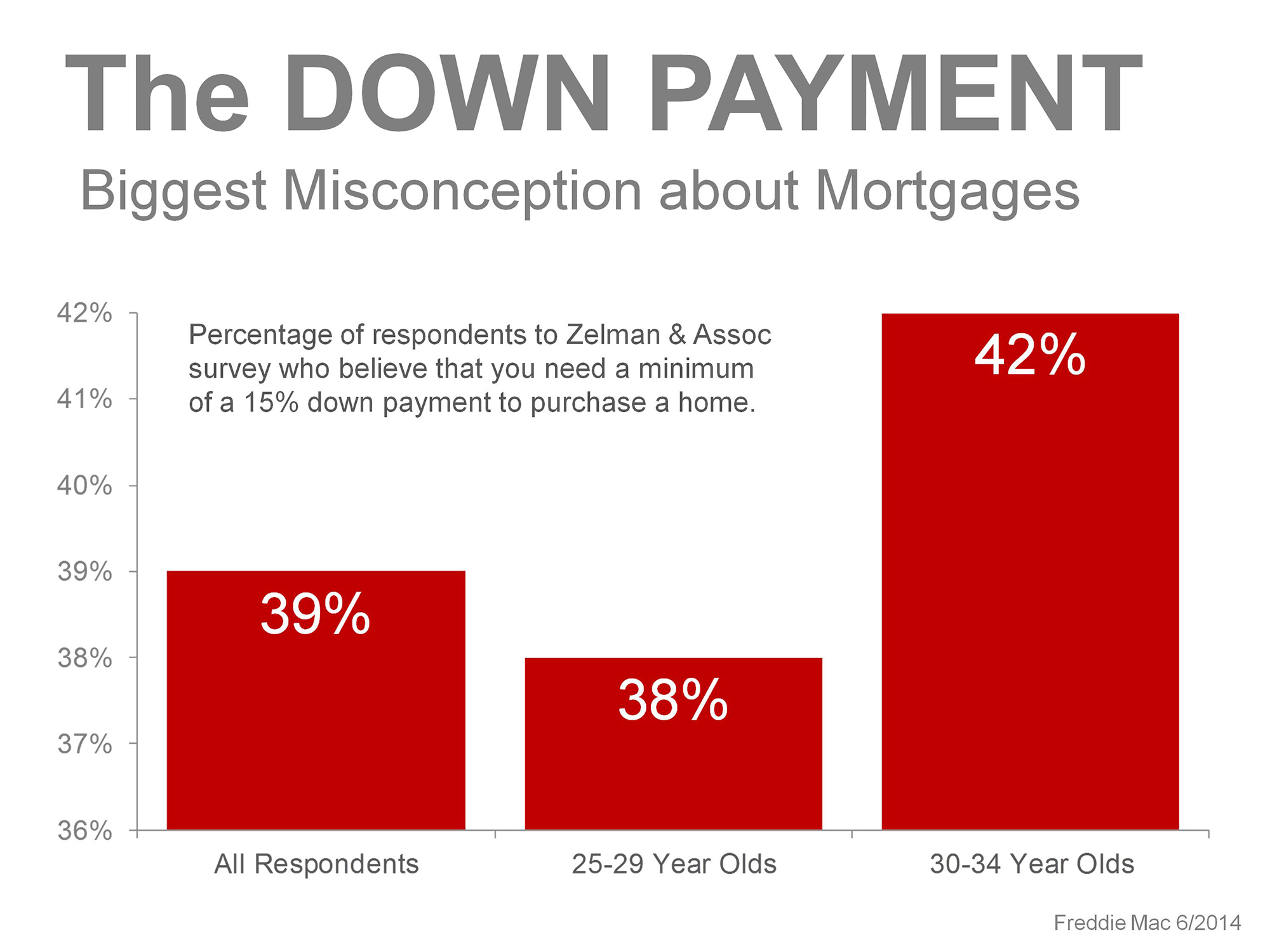

According to a recent report issued by Freddie Mac there are misconceptions among would be home buyers about just how much money is needed for a down payment. It seems many people believe that you need at least 15% for a down payment.

Many years ago 10% or even 20% was the rule of thumb. When the real estate market soared in the early 2000s, no money down loans were easy to come by. That helped lead to the real estate market bubble burst and mortgage meltdown, and no money down loans disappeared. Today, there are still two types of loans that you can get for no money down: VA loans and USDA rural loans. But those are only available to a small percentage of borrowers, so what about everyone else?

In today’s market, many people mistakenly believe that you still need 10% to 20% for a down payment, and that is actually not true. For many home buyers, especially first time buyers, the FHA loan is the best option. You can get an FHA loan for as little as 3.5% down. You can also have a family member “gift” you the down payment if you don’t have the money yourself. For better qualified borrowers there are Conventional loans, which can require as little as 5% down.

The Freddie Mac report was based on a survey of 25-34 year olds, prime candidates for first time home buyers. It is important to get the word out to the younger generation and dispel the myths-not only for them, but for the housing industry as well.

A very important part of the process of buying homes for sale Charleston SC is getting a mortgage pre approval. In fact, this should be the first step. It is also important for anyone thinking of buying a house to talk to a mortgage loan officer so they can realize that you do not need 10% to 20% for a down payment. The pre approval process doesn’t cost anything, and only takes a little bit of time–you can usually know whether you qualify or not right away. You can get fully pre approved in a matter of days.

Another advantage of talking to a mortgage loan officer is that you can know how much home you qualify for, what your monthly payment will be, and how much money you need to bring to the table for down payment and closing costs. If there are credit issues that will keep you from qualifying, the mortgage loan officer can identify them and show you how you can quickly fix them. They can also advise you how to improve your credit so you can qualify for a better mortgage–lower down payment, lower monthly payment and lower overall cost.

This step is an important first step. You can’t buy a house without pre approval. Realtors don’t want to show houses to people if they aren’t qualified to buy a house, and no seller will consider an offer without pre approval–in fact, sellers usually require a recent pre approval letter to accompany any offer before they will even consider it.

While the process of pre approval and searching for homes for sale Charleston SC can be a little daunting to first time home buyers, it doesn’t have to be. By connecting with the right Realtor and mortgage professional you can eliminate a lot of stress. First time buyers have a lot of questions, and not all Realtors have the patience to educate them about the process and answer their questions. Don’t get stuck with an agent that won’t answer your calls or emails, or makes you feel like you are burden.

To get the process of buying homes for sale Charleston SC and to ensure an easier stress free experience, check out my website.

Leave a Reply