Homes For Sale Mt Pleasant SC: A Big Segment Of The Market Isn’t Even Aware That They Can Buy

So far in this series I have looked deeper into the Existing Home Sales Report numbers to help explain just how the real estate market is doing as a whole. While the numbers overall look good, they could certainly be better. Based on the Pending Sales Report, it looks like the sales numbers will be sharply increasing in the near future. But there is something else holding things back from where they could be.

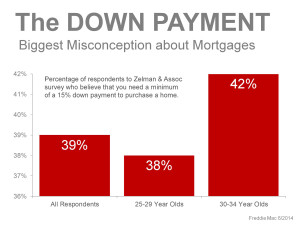

I touched on this a little a few posts ago about down payment misconceptions–here is that graph again.

One thing to note is that this graph breaks down the misconception that you need at least 15% for down payment. The respondents are broken down into two age groups: 25-29 year olds and 30-34 year olds. This is key–this is the next wave of first time home buyers, but also the next wave of move up buyers.

For many in the 30-34 age group, they took advantage of the First Time Home Buyer tax incentive offered some years ago to stimulate the housing market after the bubble burst. Many of these homeowners watched as they lost equity in their homes to the point that they were upside down.

For them, the idea of being able to sell was not an option a couple years ago. However, now that prices are on the upswing, they may be eligible to move up but don’t realize it. Especially if they mistakenly believe that they need at least 15% down payment. It is likely that many have started families and could use something a little bigger than a starter home.

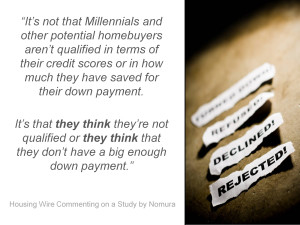

That is a lot of potential buyers out there that are standing on the sidelines not even aware that they could be moving up. And move up buyers are important to any housing market, local and n

ational. That is two large potential groups of home buyers that don’t even realize that they could buy homes for sale Mt Pleasant SC.

ational. That is two large potential groups of home buyers that don’t even realize that they could buy homes for sale Mt Pleasant SC.

It is important to get this message out to as many people as possible, especially the younger generations. Another reason to get this message out is because home ownership costs are going up.

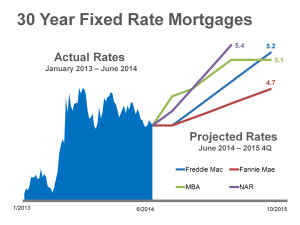

As shown in the Existing Sales Report, prices are heading up. But interest rates are also projected to go up as well. Most economists agree that the Government will tightly monitor interest rates, but this time next year rates should start rising.

Of course, how much varies depending on who you ask, but most estimates have interest rates close to a full point higher be 4th quarter 2015. To the right is a graph showing the projections from Freddie Mac, Fannie Mae, National Association of Realtors and the Mortgage Banker Association.

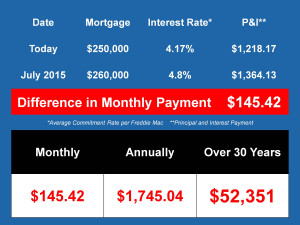

To better illustrate just what this means to home buyers nationally and those searching homes for sale Mt Pleasant SC that may be sitting on the fence, here is another graph clearly illustrating this in simple terms.

If you take a home priced at $250,000 right now, at today’s interest rate your monthly principal and interest payment would be $1,218.17. Take that same house next year, and using a conservative estimate of where interest rates might be, and that payment increases to $1,364.13 a month–an increase of $145.42 a month. That may not sound like a lot, but with a mortgage that cost multiplies over time, which the graph illustrates.

One thing to note–the home’s price for next year has increased to $260,000 to reflect the continuing rise in home values that is expected to continue. (More on that in another post). So, it is important to not only let a large potential segment of the home buying market be made aware of the fact that not only can they buy, but it might be best to look to do it sooner rather than later.

Stay tuned for more market updates. For more information about homes for sale Mt Pleasant SC, be sure to check out my website.

Leave a Reply