Are Rising Rates And Values Making Houses In Charleston SC Less Affordable?

With home values accelerating so far in 2017, there are articles all over the net questioning if the dream of home ownership in America is taking a hit. How will this impact people looking to buy houses in Charleston SC?

Are home values increasing too rapidly, causing people to be priced out of the market?

As usual, if you read the headlines then you are not getting the full story. So, let’s take a look at the latest reports.

The Housing Affordability Index Report

First, let’s take a look at the latest Housing Affordability Index Report from the National Association Of Realtors (NAR).

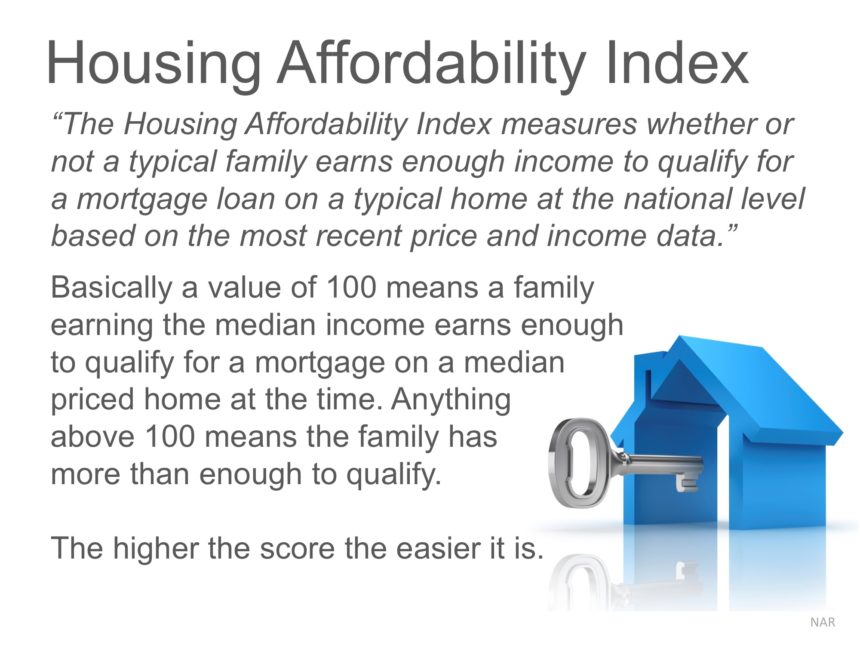

The Housing Affordability Index “measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent monthly price and income data.”

Basically, a value of 100 means a family earns enough to qualify for a mortgage on a medium priced home.

Anything above a 100 means the earn more than enough. Simply put, the higher the score the better.

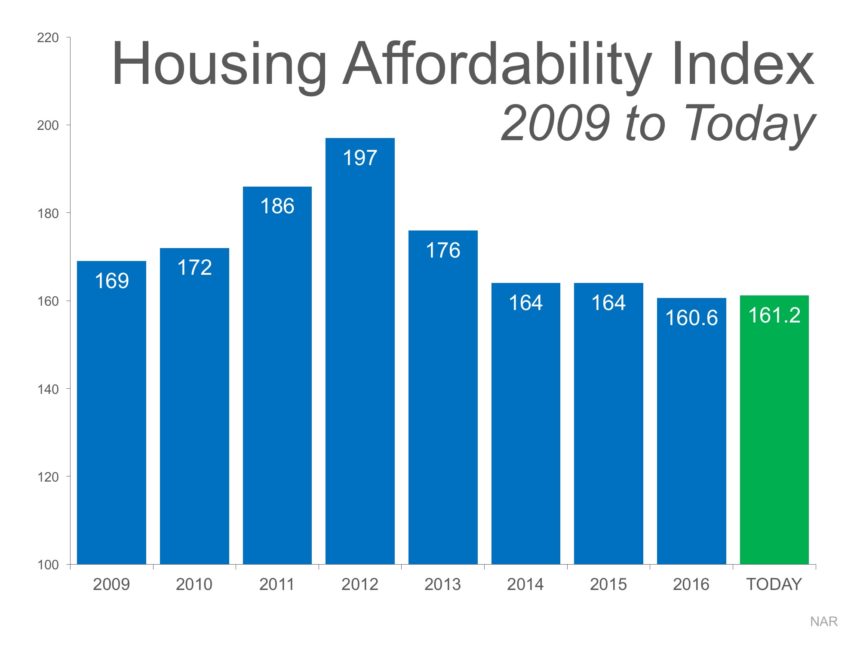

2016 saw the Index at the lowest it has been in 9 years.

2016 saw the Index at the lowest it has been in 9 years.

The first quarter of 2017 saw a slight increase in the index, but it still remains at it’s lowest point in 9 years.

But you can’t just rely on the headlines in this click bait day and age–they don’t provide the full facts.

Digging Deeper For Proper Perspective

While it is true that the Housing Affordability Index is the lowest it’s been in 9 years, you have to dig a little deeper.

First you have to look back over the last 9 years and take into consideration what happened in the real estate market. Interest rates dropped to near historical lows.

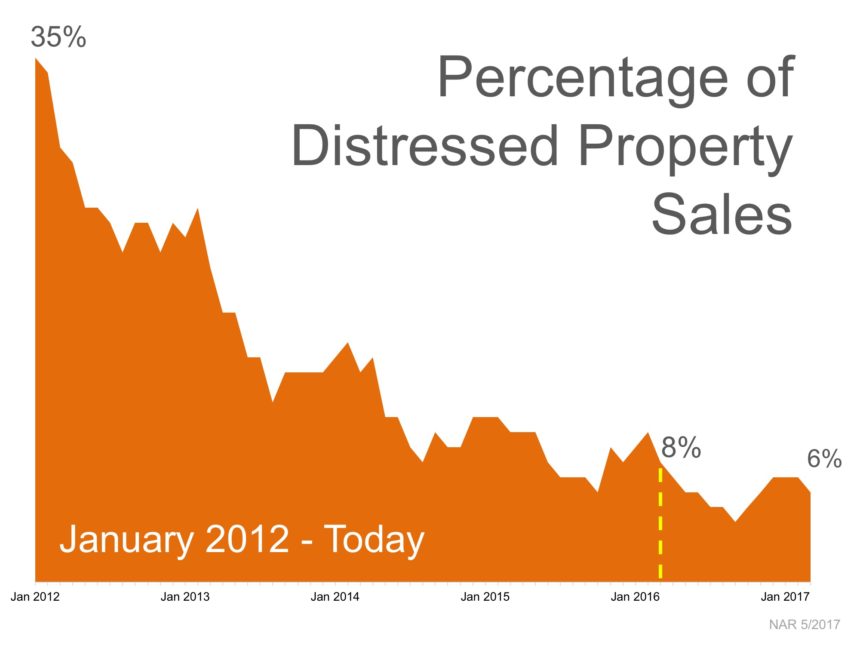

More importantly was the real estate crash in 2007-2008. As a result, a flood of distressed properties hit the market. Because of all of the short sales and foreclosures, homes were selling for deep discounts. This made homes more affordable.

The distressed properties had another affect–they brought down the values on the surrounding homes that were not distressed. So homes that sold during this time period were sold at a discounted price. This caused the Home Affordability Index to skyrocket.

This is why the Index is at the lowest point in 9 years–remember, anything above 100 is good. But if you just look at the above infographic without any context it is easy to understand why people would mistakenly believe that affordability isn’t where it should be.

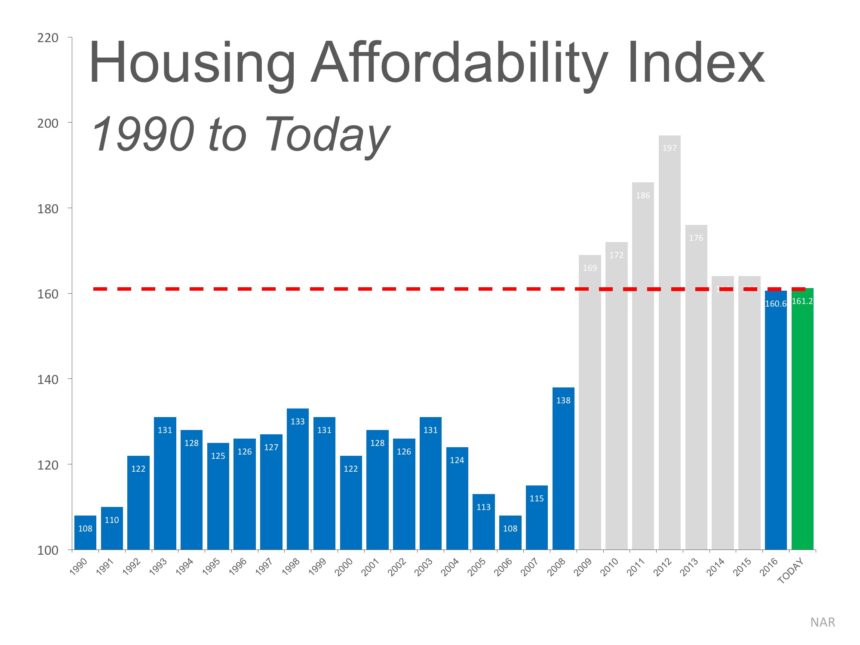

To put this in the proper perspective, let’s stretch the timeline further out. That is, let’s look at Home Affordability over a longer period of time.

This infographic looks back to 1990, with the distressed years grayed out.

As you can see, today compared to the years prior to the crash, is much stronger than it has been in nearly 30 years.

As you can see, today compared to the years prior to the crash, is much stronger than it has been in nearly 30 years.

The previous 9 years is a bit of an aberration because you can’t buy a home for a discount like you could in the post-crash years.

In fact, here is another quick infographic showing how much of the market was made up of distressed sales–that number was very high in 2012 but has plummeted since

The Housing Opportunity Index

Another, separate, report confirms this.

According to the National Association of Home Builders (NAHB) and Wells Fargo Housing Opportunity Index (HOI), Home Affordability rose slightly in the first quarter of 2017.

According to the report:

“Some 60.3 percent of new and existing homes that sold in the quarter were affordable to families with an median income of $68,000, which was up from 59.9 percent in the fourth quarter.”

Despite home values accelerating and rising interest rates, Home Affordability is being supported by job growth and wage growth. Job growth is fueling the demand for housing, and the wage growth is helping to offset the increases in home values and interest rates.

In fact, wage growth is outpacing the increase in home values.

According to the NAR report, wage growth is outpacing home values in more than half of the markets for the first time since the first quarter of 2012, when median home prices were still falling.

If this trend continues, then that will offset the erosion of the home affordability trend.

That is exactly what we are seeing with the index over the last year–it has leveled off.

Good Economic Indicators For Real Estate

Housing Affordability should continue to remain steady and see increases simply because of the economy. According to the most recent First American Real Estate Sentiment Index:

Should rising interest rates have us concerned? Real Estate professionals from the First American Report feel that buyer demand will remain strong despite rising rates, until interest rates hit 5%.

But it is not just real estate professionals that feel we don’t have to worry about rising interest rates–just yet.

The most recent Home Price Expectation Survey–which is a quarterly industry report from a panel of over 100 industry experts, analysts and economists–basically said the same thing:

“Most experts believe there won’t be a significant slowdown in appreciation until rates reach 5.5 percent, which isn’t likely to happen this year. Zillow expects the conventional 30-year fixed mortgage rate to be closer to 4.75 percent by the end of 2017.”

Consumer Confidence In The Economy

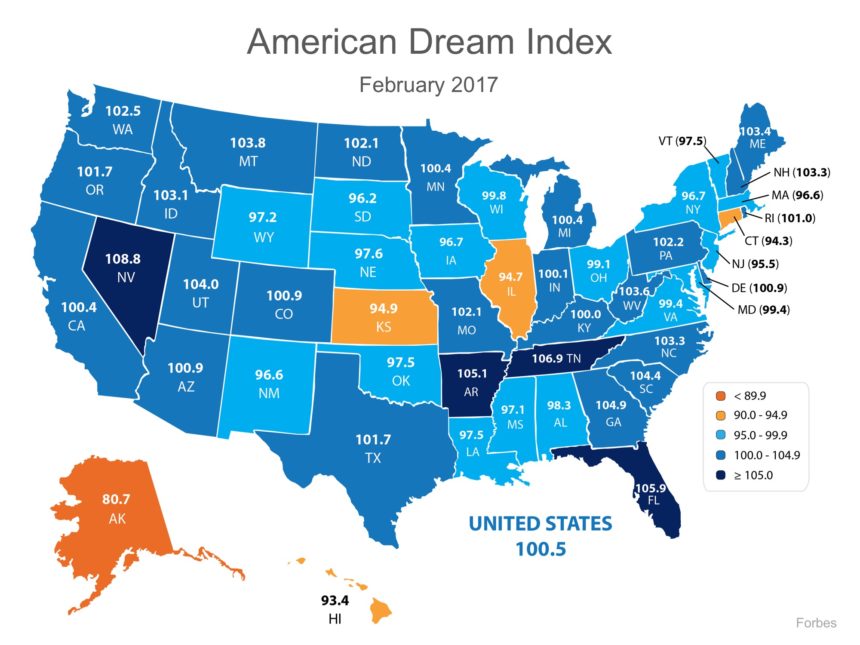

Forbes recently released their annual American Dream Index Survey that measures American’s confidence in the economy for the upcoming year. The base point is 100, so anything above 100 is good.

Here are the results, and they show that Americans are very confident with the economy moving forward.

Consumer confidence remains high, and in fact hit a peak according to the most recent results from a Gallup poll.

Obviously, a strong economy bodes well for the real estate. History has shown that to be true:

From the NAHB and Wells Fargo report:

“Ongoing job growth continues to fuel demand for housing, while wage growth is helping to offset the effects of rising mortgage rates and keep home prices affordable,” said NAHB Chief Economist Robert Dietz. “NAHB anticipates that housing will continue on a gradual, upward path throughout the year.”

What About Interest Rates?

From the Home Price Expectation Survey:

“The quarterly survey, sponsored by Zillow and conducted by Pulsenomics LLC, asked more than 100 housing experts and economists what factors would have the greatest impact on U.S. housing this year. The most frequent answer was rising mortgage rates and their impact on mortgage affordability, with more than half of panelists selecting it”

Most experts agree that we do not need to be worried about the impact of interest rates until we see them get to and past 5%. So, when will that be?

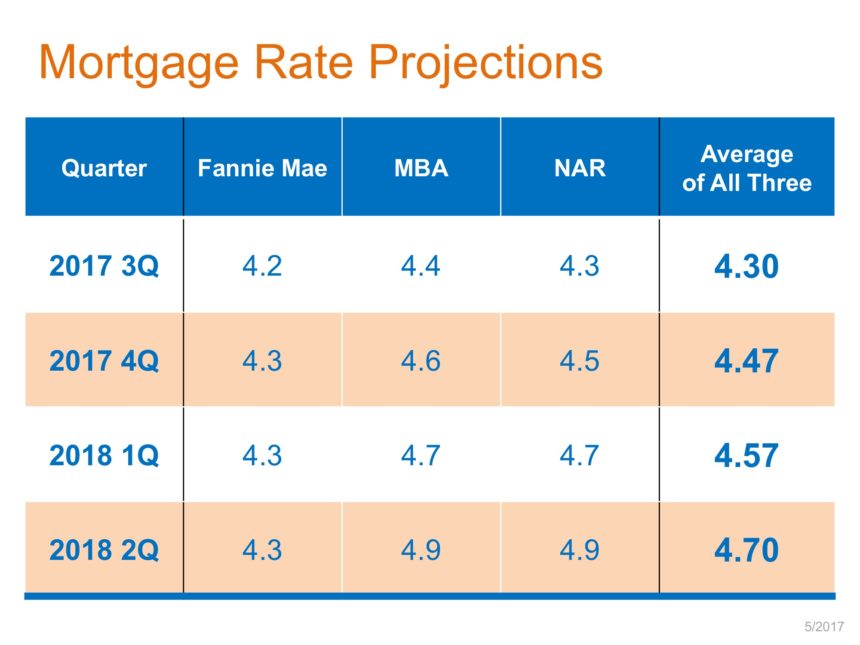

Here are the latest Mortgage Rate Projections from Fannie Mae, NAR, and the Mortgage Bankers Association (MBA):

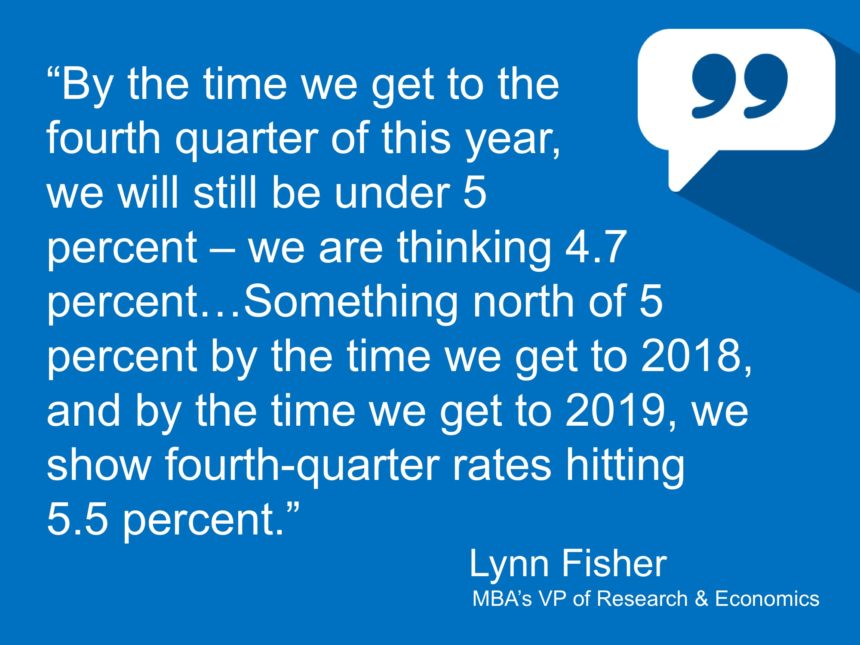

We likely do not have to worry about rates exceeding 5% this year. According to the MBA:

We likely won’t see a big impact on the real estate market from rising interest rates until sometime in 2019.

While these projections are not set in stone, the big takeaway is that we don’t have to worry about interest rates for right now.

Homes appreciating is a good thing for the real estate market. Strong buyer demand is as well. Lack of inventory and rising interest rates could have a detrimental impact on the market, but the economy is doing well enough to offset those concerns.

It also helps that Americans have confidence in the economic outlook for 2017. This is huge–because when it comes to America’s outlook on the economy, often perception is reality even when facts might indicate otherwise.

If you are looking to buy or sell houses in Charleston SC then be sure to visit my Pam Marshall Realtor website.

Leave a Reply