Housing Market: What’s Holding Us Back

When discussing the housing market, I have often criticized the media for either not telling the full story or for sensationalizing the headlines.

I found an article that explains what is happening in the market very well. It touches on many things I have discussed, and summed up the market very well.

There is a lot of reason to be optimistic about the housing market, but there are still some obstacles keeping us from seeing a fully healthy, prosperous market.

If we can overcome some of these obstacles we could see a very strong market.

In her article entitled “Why You Still Can’t Afford To Buy A House“, Anita Hamilton lays the housing market out very efficiently.

Despite many good numbers reported from the housing market, some things just aren’t adding up.

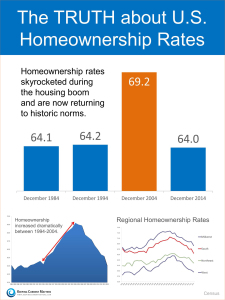

The rate of home ownership continued to drop, despite the increasing number of home sales and homes under contract.

The seasonally adjusted rate for home ownership dropped in the first quarter of 2015 to 63.8%, the lowest since 1989.

That is also down from the peak of over 69% from just over 10 years ago.

This happened during the last real estate boom, and it appeared that home ownership rates were returning to historic norms.

However, if that rate continues to drop, that is a troubling sign.

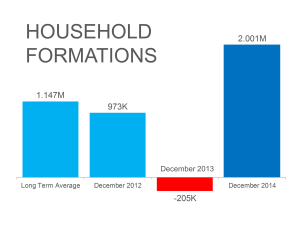

To make this even more confusing, the number of new households formed continues to increase. In fact, that number is nearly double the historical average rate.

In the fourth quarter of 2014 new households increased by 1.7 million, and increased in the first quarter of 2015 by another 1.5 million.

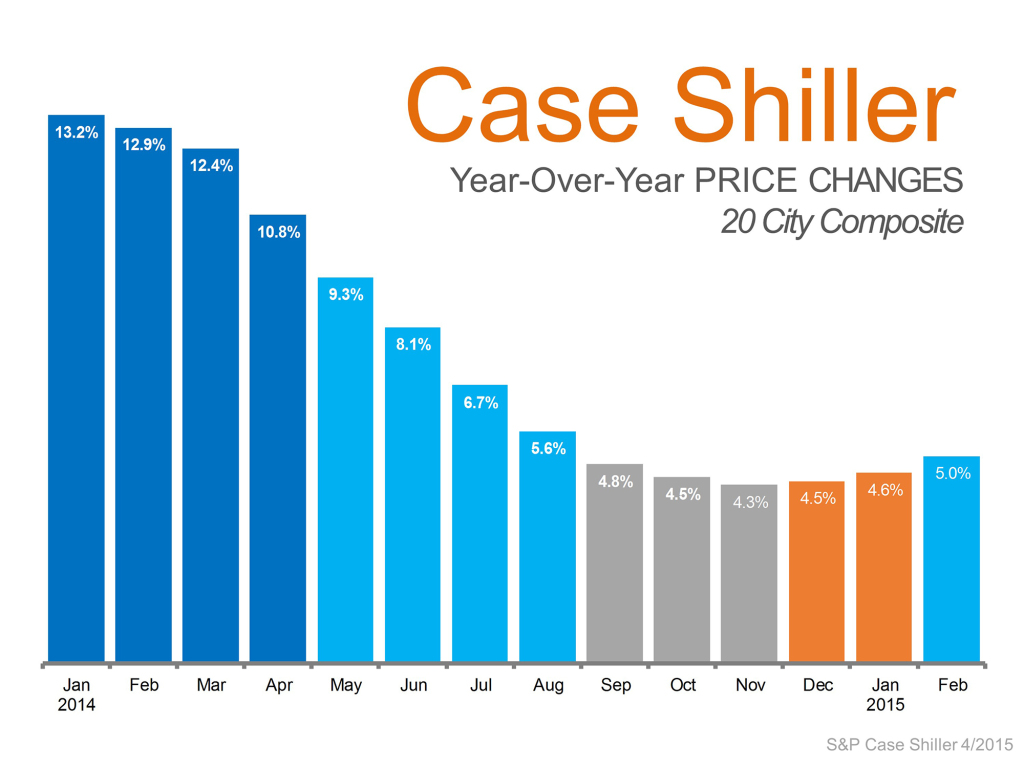

Home values continue to rise.

The latest numbers show that home values increased in February by 5% over last February.

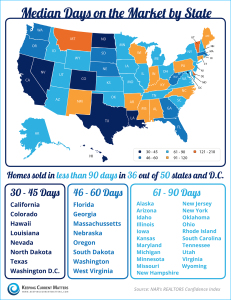

Inventory continues to be the big issue.

Demand for housing is strong, but there simply isn’t enough homes for sale to meet that demand.

As a result, the national of inventory of homes for sale has dropped to below a 5 month supply, when a normal supply of homes is 6 months.

As a result, 36 of the 50 states (including DC) are experiencing an Average Days On The Market (DOM) of under 90 days.

So, as Anita Hamilton asks in her article,

“So, the number of households is increasing, the housing supply is low, and prices are rising — yet the number of homeowners keeps decreasing. How does this add up?”

First off, new household formations does not just refer to new home owners.

This is people moving out on their own. Either they have graduated college, are moving out of their parent’s homes, or are leaving roommate situations to live on their own.

In other words, most of the new households are renters.

As a result, of the total households out there, more and more are rentals as opposed to owners. The article better explains:

“Since the overall number of households is increasing and the majority of these are renting, the number of homeowners relative to the total is shrinking.

It is not as though large numbers of people are losing their homes, as was the case during the housing crisis.”

It appears that many of these new households either cannot afford to buy a house, or simply are not buying houses. (More on this in a minute).

As a result, the rental market is way out of whack. Rental vacancies hit a 21 year low at the end of 2014, and that number has dropped.

As a result, rents are rising at a faster rate. As the article points out,

“millennials and those knocked down by the housing crisis have recovered to the point where they can enter the rental market, but not to the point where they can afford to buy a home even with the currently low fixed interest rates.”

The article also summarizes how this is impacting the housing market:

“There is a cascade effect going on in the housing market that will take some time to remedy.

Those who want to upgrade their homes are having difficulty gathering down payments and qualifying for loans, thanks to wages that are still stagnant and credit that is still relatively tight.

Thus, the supply of starter homes is low, making first-time ownership difficult for those who have recovered enough to qualify.

Some signs of wage pressures and loosening credit are present, but not enough to fuel a true recovery.”

The decline in home ownership rates is expected to stabilize at some point, and remain stable until the housing market can get into a better rhythm, hitting all cylinders.

“A combination of rising wages, job increases, government approaches to make credit more affordable to first-time homebuyers, and the general decline of underwater homes through home appreciation should lead to a housing upturn.

Of course, the question on everyone’s mind is: how long will it take to reach full recovery and convert renters into first-time homebuyers?”

While no one can say for sure when this will happen, the article does point out this inevitability:

“However, we can predict one thing with certainty.

If the housing outlook is still struggling at this time next year, politicians and policymakers up for re-election will panic and start to take action, most of which will probably be misguided.

Let’s hope the market intervenes before the politicians can act.”

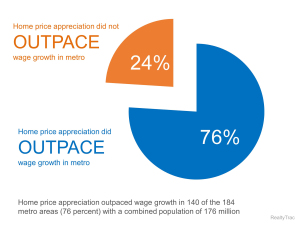

For most of the last year, the big issue for the housing market has been inventory.

However, it appears that wage increases is as big of an issue.

Home values have outpaced wage increases, and this is creating a strain on the housing market.

Sellers that want to buy their next home are feeling the squeeze, as are first time home buyers.

First time buyers are trying to save up for a down payment, but they spend more of their monthly income on rent than do home owners. This makes saving up for a down payment tougher.

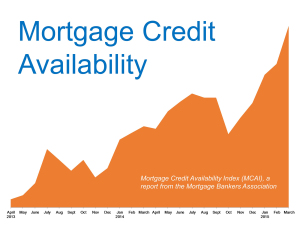

One thing mentioned in the article that I don’t fully agree with is the statement that credit is still relatively tight.

By all means, we will not see the banks tripping over themselves to lend money like we did 10 years ago, but in the last year they have loosened their guidelines.

So, it is true that credit is still relatively tight. However, that is loosening.

Also, both Fannie Mae and Freddie Mac decreased their minimum down payments from 3.5% to 3% making it easier for first time buyers to get a mortgage.

It also appears that many millennials are actually choosing to rent as opposed to buy, when the numbers indicate that buying is a better option right now.

There are plenty of good signs in the housing market, but we aren’t yet where we really want to be.

Hopefully, these obstacles can be cleared before politicians get involved.

If you are thinking about buying or selling in Charleston SC, then bee sure to visit my Pam Marshall Realtor website.

If you would like to keep up with the latest numbers for the Charleston SC housing market, then check out my Charleston SC Real Estate stats page.

Leave a Reply