Housing Market: There’s No Bubble Chicken Little! (Yet)

There is some good news about the housing market. If you have read some of my previous posts, you know that a big issue facing the housing market is the lack of inventory.

2015 is on pace to be the best year in the last 9 for real estate. However, the lack of inventory could potentially derail that.

Let’s first look a little deeper at how this issue could be a bigger problem.

Housing Market: Impact Of Low Inventory

Inventory has a big role in the current housing market.

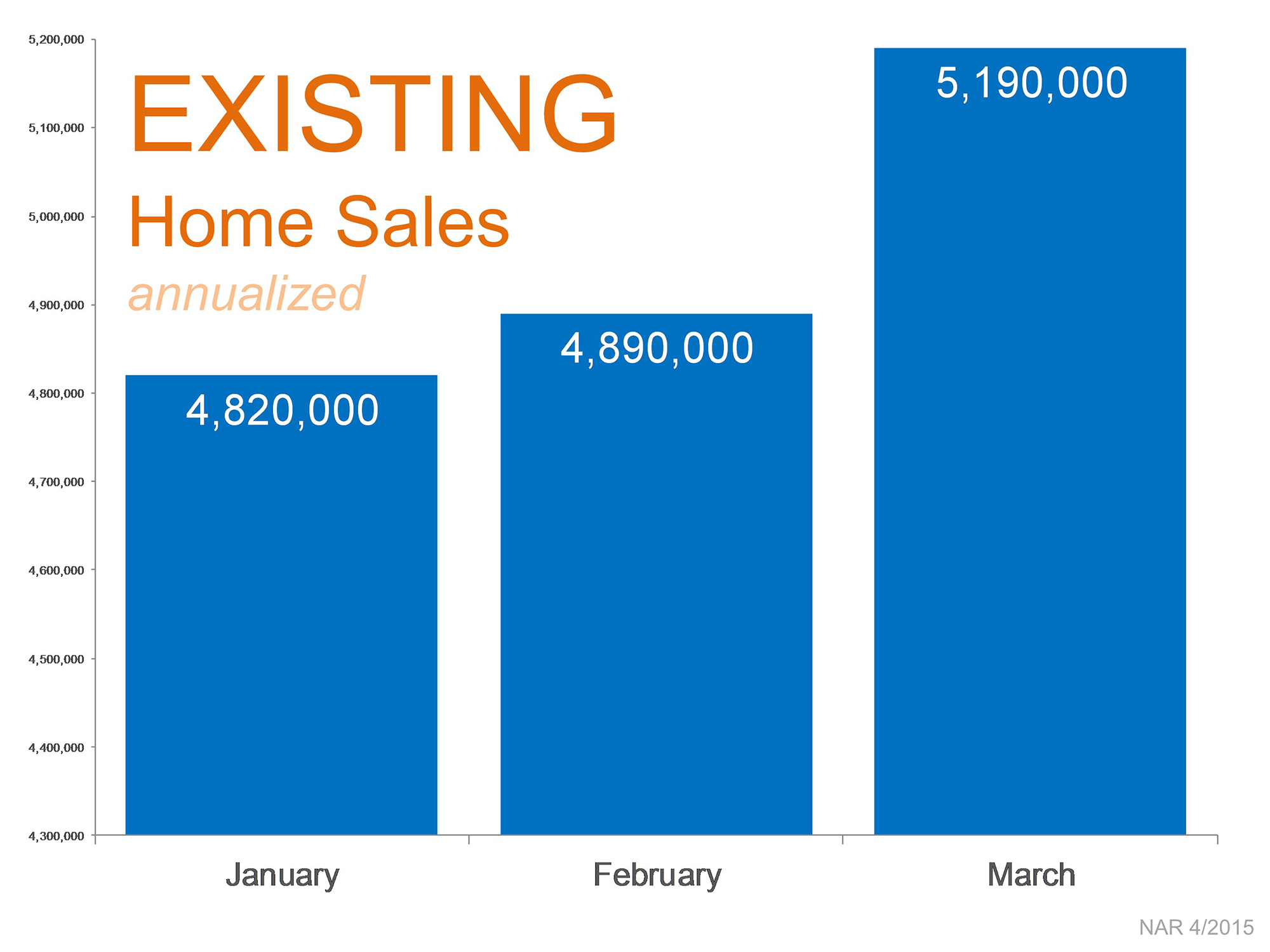

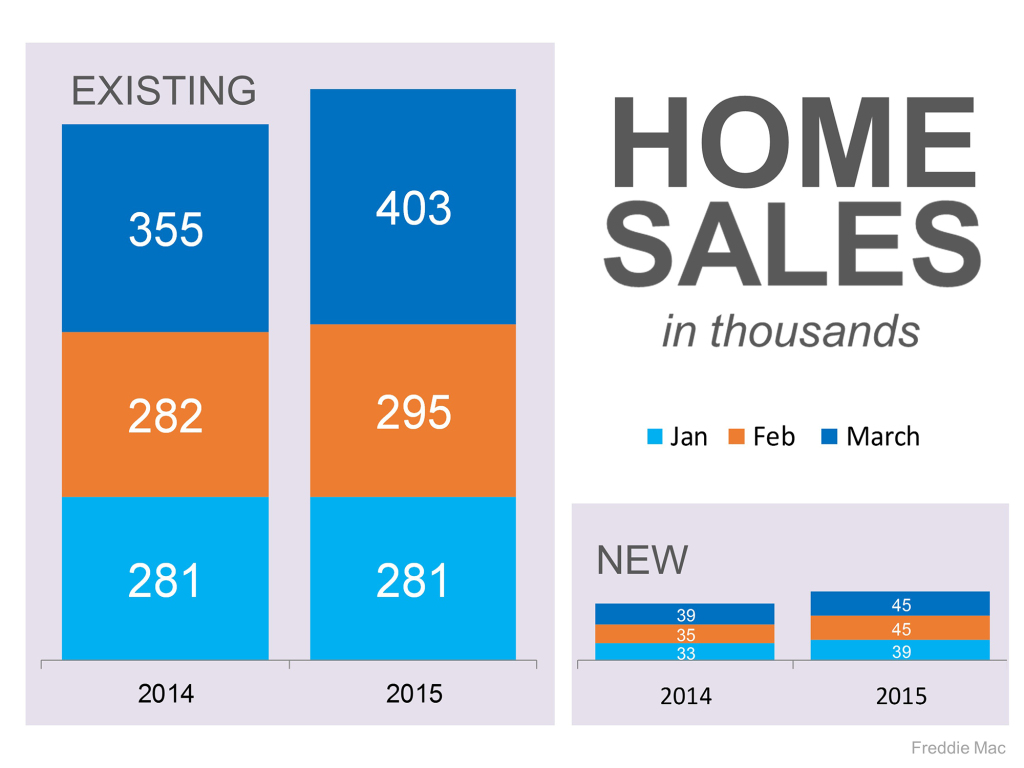

2015 has started off with strong buyer demand, and the buyers are out much earlier than they typically are. So far in 2015 we are well above 2014 sales numbers year over year.

Despite this strong surge of buyer demand, inventory is not keeping up.

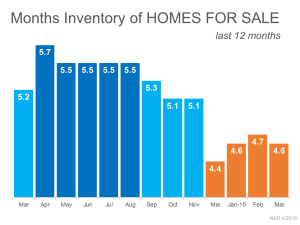

According to the most recent numbers, the national inventory has fallen to less than a 5 month supply.

A 6 month supply is considered normal. Right now, we are in a sellers market. That isn’t necessarily a bad thing.

However, if that were to continue, it could lead to bad things–more on that in a minute.

The lack of inventory boils down to basic economics.

The lack of inventory boils down to basic economics.

When demand exceeds supply, prices go up.

Increasing home values is not a bad thing–it certainly beats the alternative.

However, the real estate market works like any other market.

If things swing one way, they eventually have to swing back. The real estate bubble and crash we saw a few years back perfectly illustrates this.

Prices rose rapidly, and there really was no correction. That is, until the market crashed.

That was a big correction, and the pendulum had swung extremely in one direction (rapid increase in home values).

Without any corrections, that pendulum had to swing back just as extreme–and that’s when the bottom fell out.

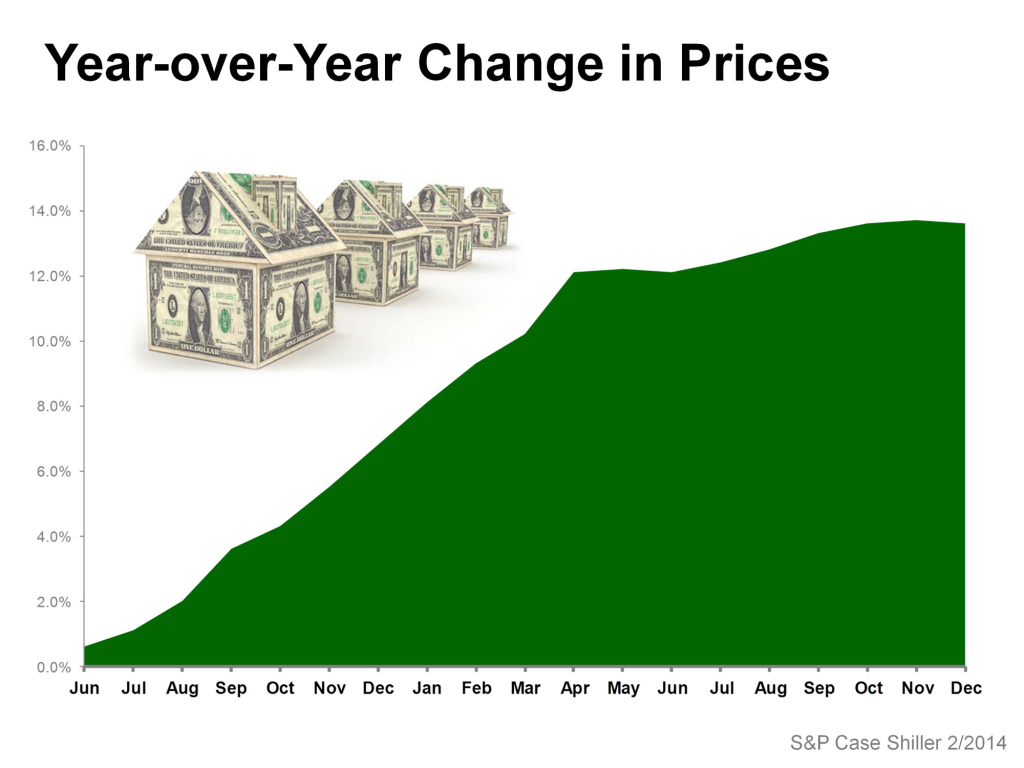

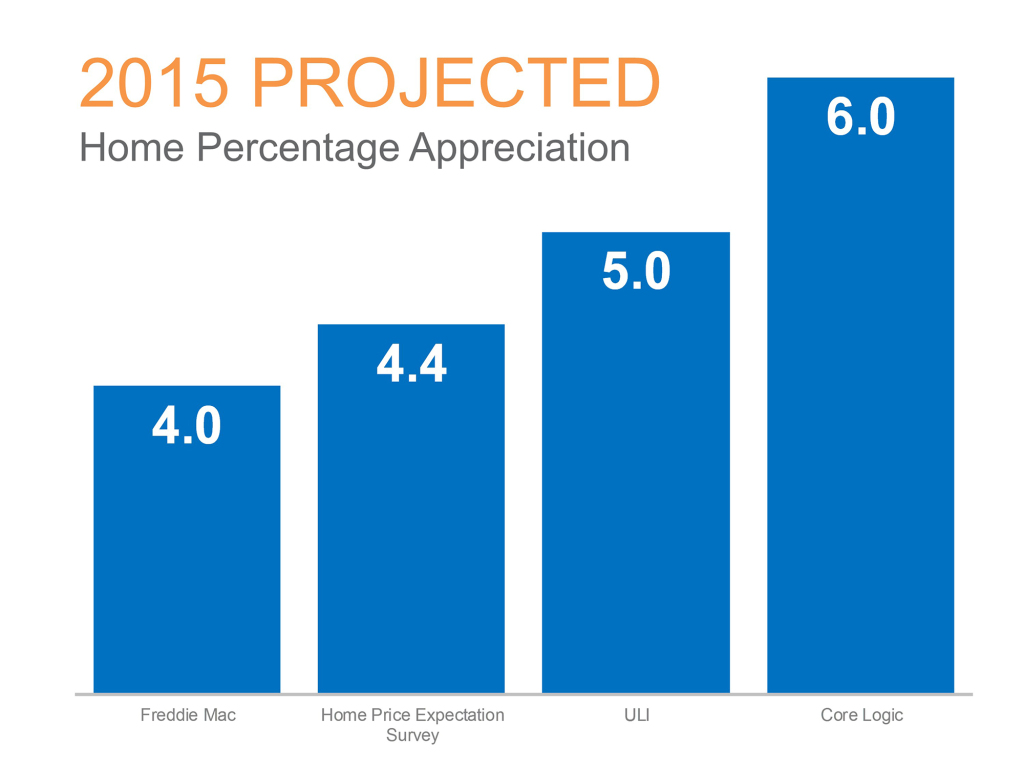

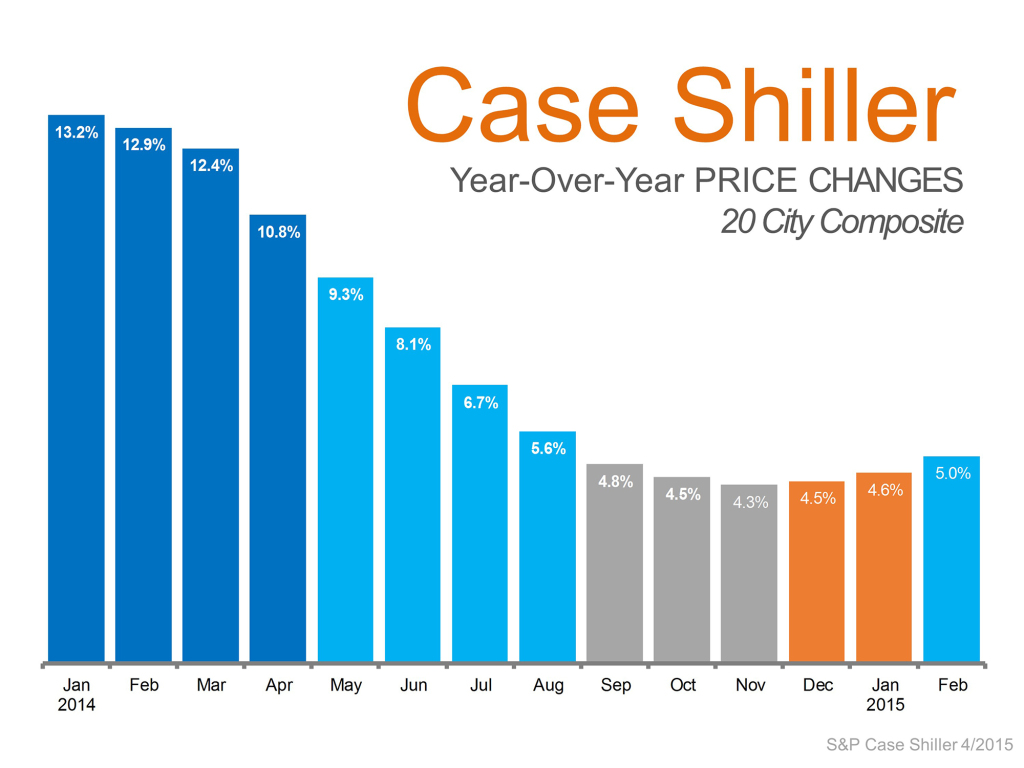

If you look at the appreciation rates in 2013 and 2014, you can see the explosion in the appreciation rates–we managed to make a very good recovery and enjoy some prosperity as well.

If you look at the appreciation rates in 2013 and 2014, you can see the explosion in the appreciation rates–we managed to make a very good recovery and enjoy some prosperity as well.

Traditionally in real estate, homes appreciate at an average rate of 3% to 4%.

We didn’t see appreciation more than 4% until October of 2013. Then things took off.

We actually saw double digit appreciation rates through the last half of 2013 and into 2014.

However, then the market began to correct itself. As you can see in the above graph showing appreciation rates broken down by each month of 2014, we got under double digit appreciation.

It is important to note that homes were still appreciating, just at a lower rate.

By the end of 2014 we were closer to the traditional rate of 4%. This was good news and showed the market stabilizing and easing into a healthy, sustainable rate of appreciation.

And this brings us back to the issue of inventory.

And this brings us back to the issue of inventory.

With the strong buyer demand, there simply wasn’t enough inventory to meet it.

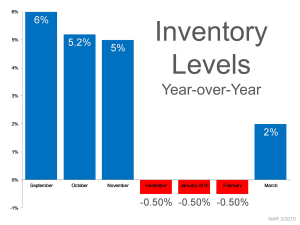

In fact, for the first few months of 2015, inventory levels actually declined year-over-year.

As a result, prices were pushed up faster, and the appreciation rate increased.

So, there are already many people, especially the media, starting to shout that we are heading for another bubble.

But, so far, that is not true.

Here is what needs to happen for a bubble to form (and subsequently to burst).

Let’s say inventory remains low. This will continue to drive prices up.

At some point, potential buyers will simply not be able to afford the house they want.

This will dry up some of the demand and cool things off a little.

First, appreciation rates would drop. Eventually, they would also dry up. Now that doesn’t mean the market will simply crash.

Chances are prices would stagnate, and then drop a little. All of this could happen over the course of a year, 6 months, or just a few months.

However, if price appreciation slows down or stagnates, wouldn’t it be reasonable to assume that would stir up some buyer interest?

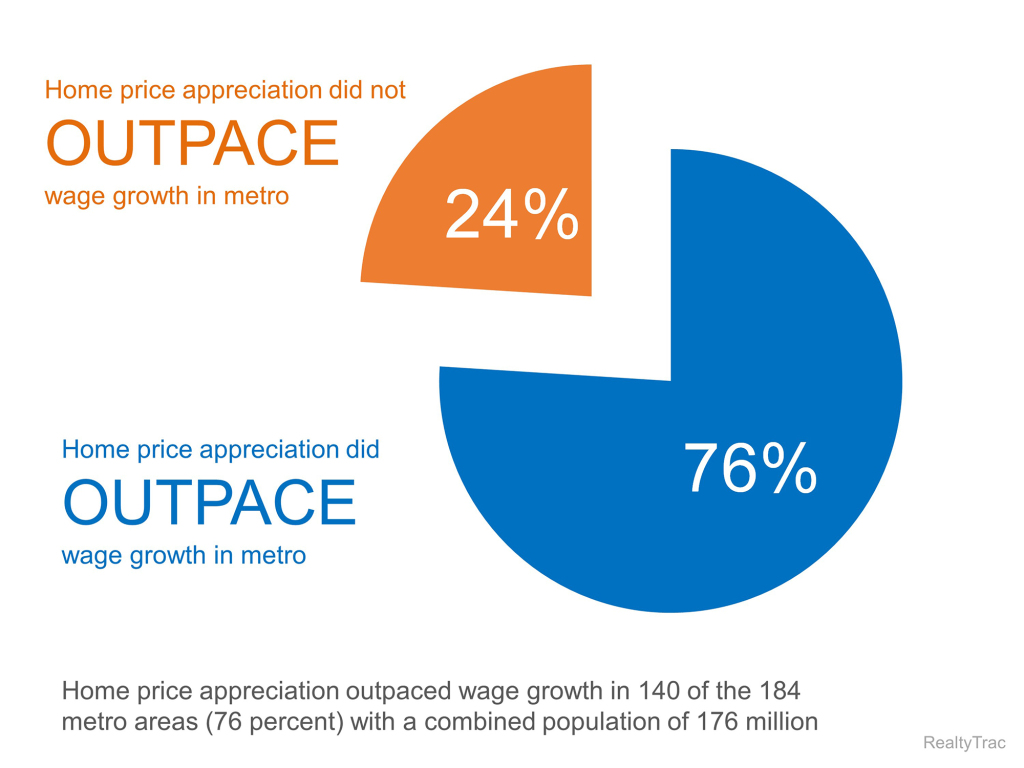

There is another big factor that has to be taken under consideration: wage increases.

Simply put, wage increases have not kept up with home appreciation increases.

Simply put, wage increases have not kept up with home appreciation increases.

This is putting a squeeze on potential buyers and making homes less affordable. However, continuing to rent is not an attractive alternative simply because of the current market.

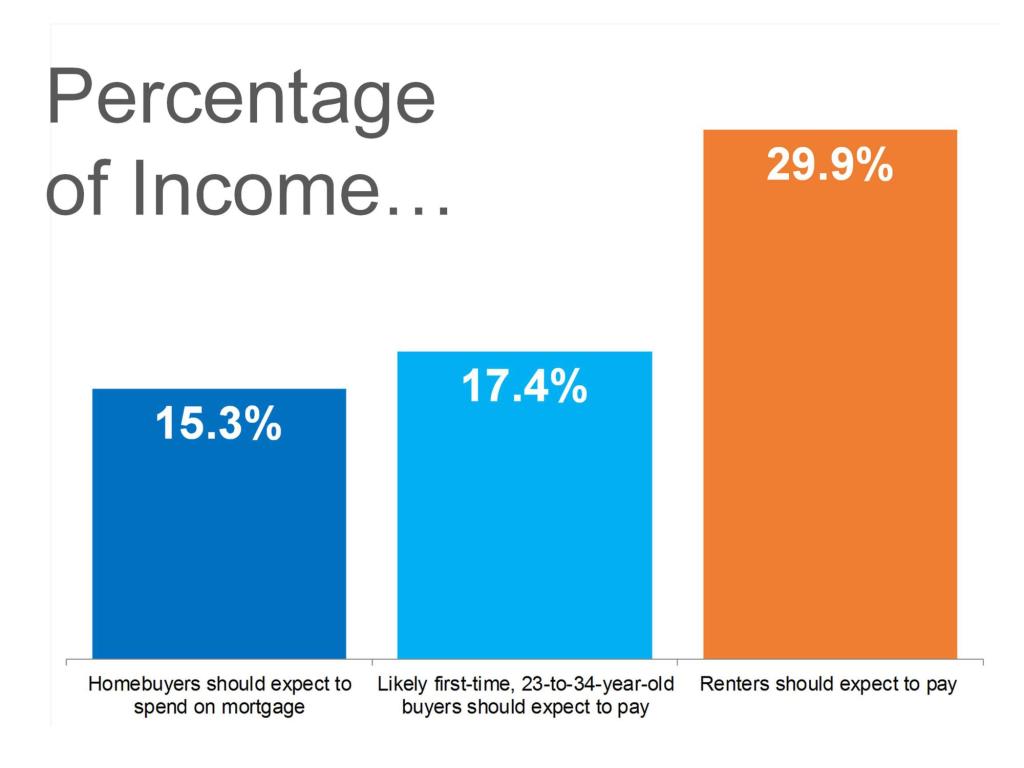

First, for most renters it is actually cheaper to pay a mortgage than it is to rent.

The rental housing market saw the lowest levels of vacancy at the end of 2014 in 21 years.

You can pretty much count on rents increasing over time–they always do. But the rental market resembles the real estate market–demand exceeds supply. So, rents are being driven up even further.

So, potential buyers are feeling the squeeze from both sides.

Renting is the less attractive option, yet if home prices continue to rise, it may become their only option.

Ironic considering that owning a home is much cheaper in the current climate.

The percentage of income spent on monthly housing expenses is traditionally less for a mortgage than rent.

That discrepancy is even larger in today’s market.

Interest rates are also expected to rise this year, and that will contribute to homes being less affordable to buyers.

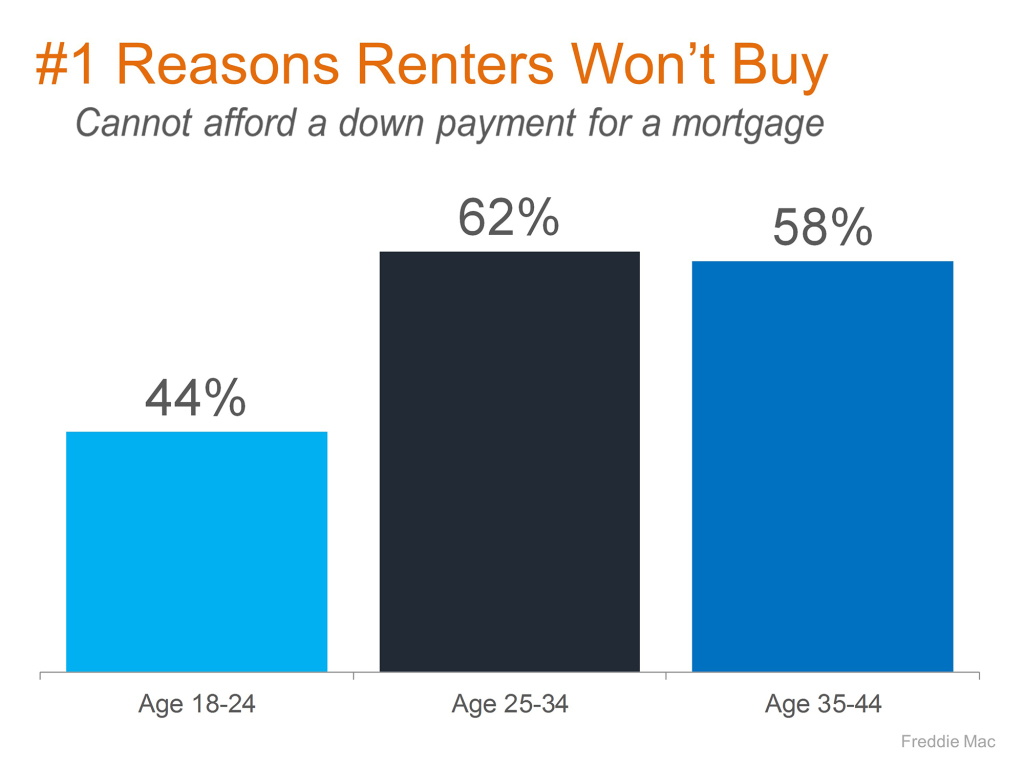

However, recent studies have shown that higher interest rates won’t have a strong affect on buyer demand. The bigger issue for buyers is the down payment.

There has been a misconception amongst buyers that at least a 10% or 15% down payment is needed to buy a house.

Both Fannie Mae and Freddie Mac have recently lowered their minimum required down payment from 3.5% to 3%.

They have also reduced the rates of Mortgage Insurance, helping to reduce borrowers monthly mortgage payment.

Now, for the good news as promised. Although it is possible for things to go bad and head towards another bubble, here is what will keep that from happening.

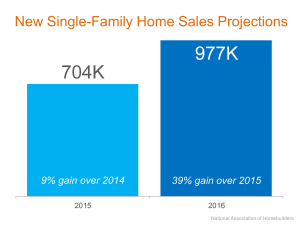

First, builders understand that demand is strong and they have reacted.

New homes sales have increased and are expected to continue to go up.

This is helping to increase inventory and meet the demand.

Also, March saw national inventory levels increase year-over-year for the first time in 2015.

We are just now going into the “traditional” selling season of Spring and Summer. This is when most people list their homes for sale, and when the most sales occur.

Even though 2015 hasn’t been a traditional year for the buyers, it appears that perhaps many sellers are still thinking traditionally.

Even though 2015 hasn’t been a traditional year for the buyers, it appears that perhaps many sellers are still thinking traditionally.

That’s ok, better late than never.

The inventory is expected to rise, and increasing home values should play a part on that.

Industry experts feel that the increasing home values will motivate many sellers that are on the fence to come off and jump into the market.

Another positive way the increasing home values are impacting the market is that there are fewer home owners that are under water.

Those numbers have dropped dramatically. According to CoreLogic, a leading real estate analytics provider, 1.2 million home owners regained equity in 2014.

According to their most recent data, 5.1 million homes remain underwater.

For many of these home owners, selling hasn’t been an option. Either they had no equity, or not enough.

But thanks to rising prices, selling is now an option. This means more potential home sellers that could be hitting the market in the coming months.

Despite the lack of inventory, most industry experts are still predicting 2015 to one of the best years for real estate in recent memory.

Despite the lack of inventory, most industry experts are still predicting 2015 to one of the best years for real estate in recent memory.

There are a couple things we need to keep an eye on, such as inventory and wages.

However, home sales are still hitting high numbers, Pending Sales are hitting highs, and home values continue to increase.

Anyone that sees nothing but a bubble on the horizon is simply a chicken little at this point.

The recent acceleration of home values is a result of high buyer demand and an inventory slow to respond. The next few months will see if inventory can narrow the gap.

There are many good signs in the housing market, you just have to look around at the big picture.

If you are thinking about buying or selling in the Charleston SC housing market, then visit my Pam Marshall Realtor website for help.

Leave a Reply