Mortgage Terms In English

A home mortgage involves a language of its own, so today I am going to explain some common mortgage terms and the importance of getting pre approval.

If you are thinking about buying a home, then you will want to start by applying for a mortgage first.

If you are thinking about buying a home, then you will want to start by applying for a mortgage first.

This is a great time to buy a house, but first things first: in order to buy a home, you will likely need a mortgage.

Before I get into some of the mortgage terms, here are the reasons and advantages of why getting a mortgage pre approval first is your best step:

1) You Will Have Time To Shop Around For The Best Mortgage

Shopping around isn’t a bad idea, but you have to be careful.

Shopping around isn’t a bad idea, but you have to be careful.

No one lender has the magic lowest interest rate–they all basically have access to the same interest rates.

Do not base your decision solely on which lender offers the lowest interest rate.

Sometimes they will promise a lower rate to get your business, even if they can’t actually get that rate for you.

Plus, interest rates fluctuate daily, so a rate you can get today may not be available tomorrow.

You also have to consider what is being compared.

You can’t simply compare interest rates–you have to also factor in what type of loan is being offered.

Make sure to ask for a Good Faith Estimate from each lender so that you are actually comparing apples to apples.

Keep in mind that a lowers interest rate on the wrong loan can be worse than a slightly higher rate on the right loan.

2) You Will Know If There Are Any Credit Issues That Will Prevent You From Qualifying

A problem for many would be buyers is that they don’t feel like their credit is good enough to qualify.

Unless you know you have serious credit issues, then you can’t be too sure.

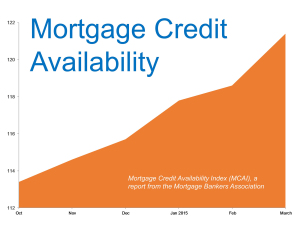

Good news is Credit Availability has increased in the last year.

Good news is Credit Availability has increased in the last year.

This means lenders have relaxed their guidelines, making it easier to qualify for a mortgage.

An advantage of speaking with a mortgage loan officer is that if you do have some credit issues, they can give you a checklist of which items to target and how to take care of them.

Improving your credit can lead to a lower interest rate, and save you money on your monthly payment.

If you do not qualify for a mortgage, then the mortgage loan officer can give you an action plan to improve your credit in the fastest, cheapest, and least difficult way.

3) You Will Know How Much Home You Can Afford

Your mortgage loan officer can help you find out what monthly payment will roughly be.

They can let you know just how much home you can qualify for and what you can afford.

It is not uncommon to qualify for more house than you are comfortable with, so your loan officer can help you determine what your ideal price range is to stay within your budget and comfort zone.

4) When You Make An Offer On A Home, The Seller Will Want To See That You Are Pre Approved

Sellers require pre approval letters to accompany offers. If you do not have this they will not seriously consider your offer.

The way homes are disappearing from the market so quickly, if you wait to get your pre approval until after you want to make an offer then chances are that house will be snapped up by another buyer.

Applying for a mortgage pre approval is fast and easy. Plus, it is free.

You can usually get pre approval in a matter of days.

Once you have this, you can shop for a home worry free–all you have to worry about is finding the right house.

Mortgage Terms Defined

I found a great article that defines many common mortgage terms from Ellen Chang at MainSt.com titled “10 Mortgage Terms Demystified”.

However, there are some other mortgage terms not on this list, so I decided to add some more.

Principle & Interest/PITI

You will see estimated monthly mortgage payments as either Principle & Interest or PITI.

You will see estimated monthly mortgage payments as either Principle & Interest or PITI.

Principle & Interest is your base payment.

It is common for lenders to automatically pay your annual insurance and tax bills on your behalf.

In exchange for this convenience, they break down each payment into 12 monthly payments and add that to your Principle & Interest payment.

Therefore, all of this rolled into your monthly payment becomes your PITI payment–Principle, Interest, Taxes, and Insurance.

Good Faith Estimate

This is a detailed estimate a lender gives you. It will include your interest rate, as well as loan amount and loan type.

This is important to have because if you do shop loans, the other lenders will be able to compare apples to apples. Here is a more detailed explanation of a Good Faith Estimate.

FHA, VA, Conventional

These are the different types of loans.

The Federal Housing Authority, Veterans Affairs, and Conventional loans are not the lenders themselves.

FHA and VA loans are backed by the Federal Government. Here is a full breakdown and comparison of the different types of loans.

Pre Qualify vs Pre Approval

A pre qualification can be done over the phone in minutes. Basically, a loan officer asks you some questions, and based on that information determines of you qualify for a mortgage.

A pre approval involves more steps along with verifying your information by pulling credit reports and submitting verification documents such as pay stubs.

A pre qualification is basically worthless.

FICO Score, Middle Score, Credit Score

You actually have three credit scores from three different credit bureaus: Equifax, Experian, and Trans Union.

You actually have three credit scores from three different credit bureaus: Equifax, Experian, and Trans Union.

Mortgage lenders will pull all three reports.

Likely, there will be three different scores.

Mortgage lenders throw out the highest and lowest of the three, and use your Middle Score.

FICO score is simply a term used within the credit industry. For a full explanation, you can read more about FICO and Credit Scores.

Mortgage Broker Vs Mortgage Banker

A mortgage broker will search many different lenders to try and find the best loan for you.

A mortgage banker works for one specific lender.

The advantages/disadvantages of using one over the other can really be argued either way.

DTI

This stands for Debt To Income Ratio. This is the amount of debt you have compared to the amount of monthly income you receive, expressed as a percentage.

This is based off of your gross monthly income, before taxes. You need to have this number below 36% to qualify for a mortgage.

The lender will also factor in what percentage of your gross monthly income your new mortgage consume. They do not want that percentage to be more than 28%.

Down Payment

This is the amount required to secure the loan.

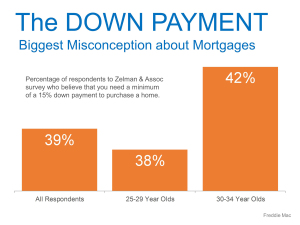

There have been misconceptions that at least 10% or more is needed, but that is not true.

Military personnel (active, reservist, or veteran) qualify for VA Loans, which require 0% down.

FHA loans only require 3% down. Conventional loans may only require 5% down.

Reserves

This is money due at closing that sets up your reserve, or escrow, account.

As mentioned earlier, your lender pays your annual tax and insurance payments.

This is a convenience to you because you don’t have to worry about 2 big payments each year.

Your lender breaks the payments down into 12 month installments and adds that to your monthly mortgage payment.

But first, they must establish escrow accounts to withdraw the money from when those payments come due each year.

Every month they deposit the portion of your mortgage payment specifically for your taxes and insurance into these escrow accounts.

Every month they deposit the portion of your mortgage payment specifically for your taxes and insurance into these escrow accounts.

However, from the start they need money to get the accounts set up.

You will usually need about the equivalent to 2 months of tax and insurance payments due at closing to establish these accounts.

This is part of your closing costs, and you will know in advance how much you will need. It is also possible to have the seller pay these for you.

Hopefully, these explanations will help clarify some of the mortgage terms you will be hearing as you get ready to buy a home.

To help make the process smoother and less stressful, you need to hire the right agent to help you in your home search.

Visit my Pam Marshall Realtor website for more helpful homebuying information.

I will help explain the process of buying a home, and help you understand mortgage terms, or any other term involved with buying a home.

Leave a Reply