Mt Pleasant SC Real Estate: Buyer Misconceptions

The Mt Pleasant SC real estate market continues to do well in 2018, reflecting the trends of the national real estate market.

However, despite the strong buyer demand that exists, there are some misconceptions holding back many would be buyers.

These misconceptions continue to exist despite evidence to the contrary. These misconceptions not only exist for potential first time home buyers, but also for current home owners that may be thinking about moving up.

A recent article from a reputable source was titled “2 Major Myths Holding Back Home Buyers” and detailed these misconceptions.

Myth #1: “I Need a 20% Down Payment”

According to the article, the Urban Institute recently released a report entitled, “Barriers to Accessing Homeownership”. The report revealed that:

“eighty percent of consumers either are unaware of how much lenders require for a down payment or believe all lenders require a down payment above 5 percent.”

The report also revealed that:

“Consumers are often unaware of the option to take out low-down-payment mortgages. Only 19% of consumers believe lenders would make loans with a down payment of 5% or less… While 15% believe lenders require a 20% down payment, and 30% believe lenders expect a 20% down payment.”

39% of non home-owners believed that buying a home required at least a 20% down payment, while 30% of current home-owners believed that a 20% down payment was required.

Despite that misconception, the fact remains that you can purchase Mt Pleasant SC real estate with as little down as 3%. Military personnel and veterans can take advantage of their VA benefits and purchase a home for 0% down.

For anyone looking into the Mt Pleasant SC real estate market, it may be possible to purchase outside of Mt Pleasant using a USDA loan, which also does not require a down payment.

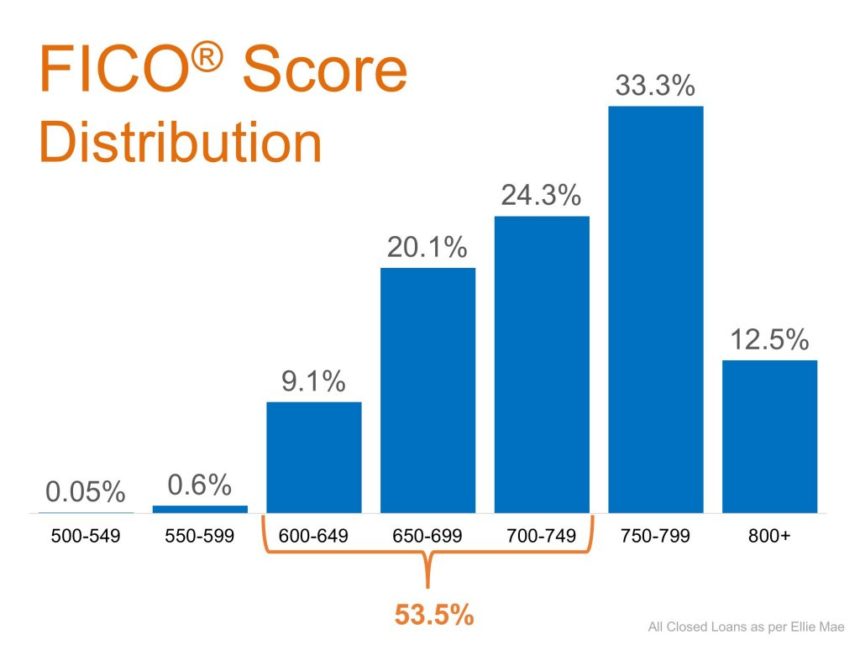

Myth #2: “I Need A 780 FICO Score Or Higher To Buy”

Many American’s consider a 780 or greater FICO score to be what is the standard for “good credit”.

However, according to Elli Mae’s most recent “Origination Insight Report”, which focuses on recently closed (approved) loans, it is not necessary to have a 780 FICO or better:

Over 50% of the most recently closed home loans had a FICO score between 600-749.

Mt Pleasant SC Real Estate: Don’t Disqualify Yourself!

These misconceptions have been holding back a segment of the market.

Many would be first time buyers have already disqualified themselves based on these misconceptions and haven’t even tried to get mortgage pre-approval.

Many believe they need near perfect credit or need time to save up a sufficient down payment when they are able to qualify right now.

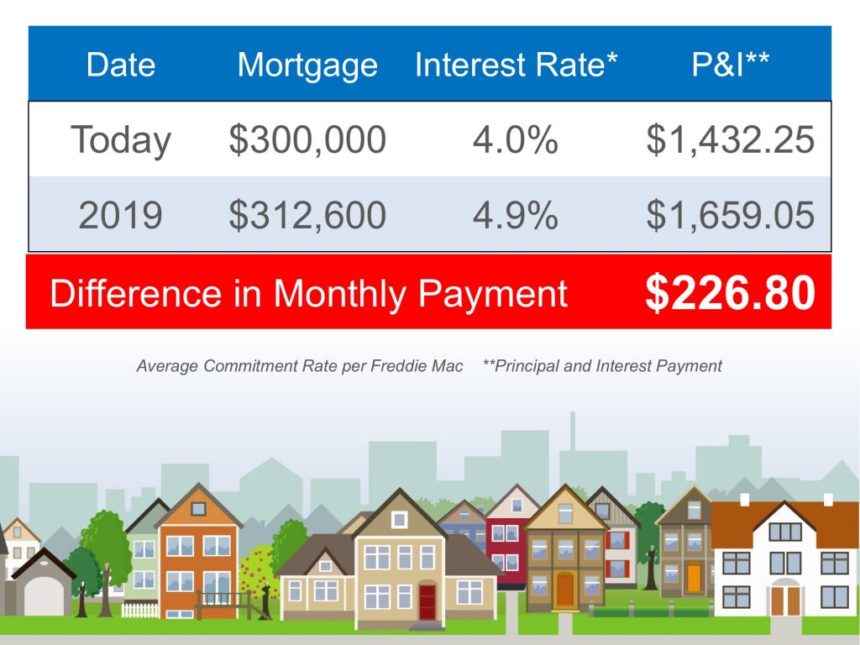

Making a larger down payment certainly has it’s financial benefits, but waiting longer to buy may not be the smartest move.

Home prices continue to rise, and so are interest rates. The home you want today may not be affordable by waiting.

The graph below illustrates how rising home prices and rising interest rates can impact buyers who wait:

Bottom Line

The best advice? If you are thinking about buying a home, it is best to know all of your options. Don’t disqualify yourself based on false assumptions.

Talking to a Mt Pleasant SC realtor and mortgage loan officer is an easy process that takes just a little bit of time. The cost is free and there is no obligation.

Call me today to get started and you will know exactly what it takes to make 2018 the year to buy a home in the Mt Pleasant SC real estate market.

Article Source: Pam Marshall’s Simplifying The Market Blog

Searching for Mt Pleasant SC homes for sale? Then sign up for a free list of available homes here.

Thinking about selling? Then be sure to check out my seller’s page.

You can read more about real estate on my local blog and my national blog.

Leave a Reply