Real Estate Market Prime Opportunity For Sellers

So far in 2017 home values have been increasing at a rapid rate. This is partly because buyer demand is so strong right now.

According to the latest quarterly Metropolitan Median Area Prices and Affordability and Housing Affordability Index from The National Association of Realtors (NAR), home sales pace was the strongest in a decade.

Buyer demand fueled an increase in home values during the first quarter of 2017 by 6.9% above the first quarter of 2016.

That was the biggest year-over-year quarterly increase since the second quarter of 2015 (8.2%).

But a huge factor contributing to this is the low levels of inventory of homes available in the current real estate market. It is Economics 101: supply is not meeting the demand.

This is not new news, inventory levels have been too low for the last few years. However, in the current housing market inventory levels are the lowest they have been in years.

According to Lawrence Yun, Chief Economist for NAR (emphasis mine):

“Prospective buyers poured into the market to start the year, and while their increased presence led to a boost in sales, new listings failed to keep up and hovered around record lows all quarter,” he said.

“Those able to successfully buy most likely had to outbid others – especially for those in the starter-home market – which in turn quickened price growth to the fastest quarterly pace in almost two years.”

According to the most recent Home Price Expectations Survey, the latest numbers regarding inventory show just how far behind inventory is and has been.

Here is a look at the year-over-year inventory levels for the last year:

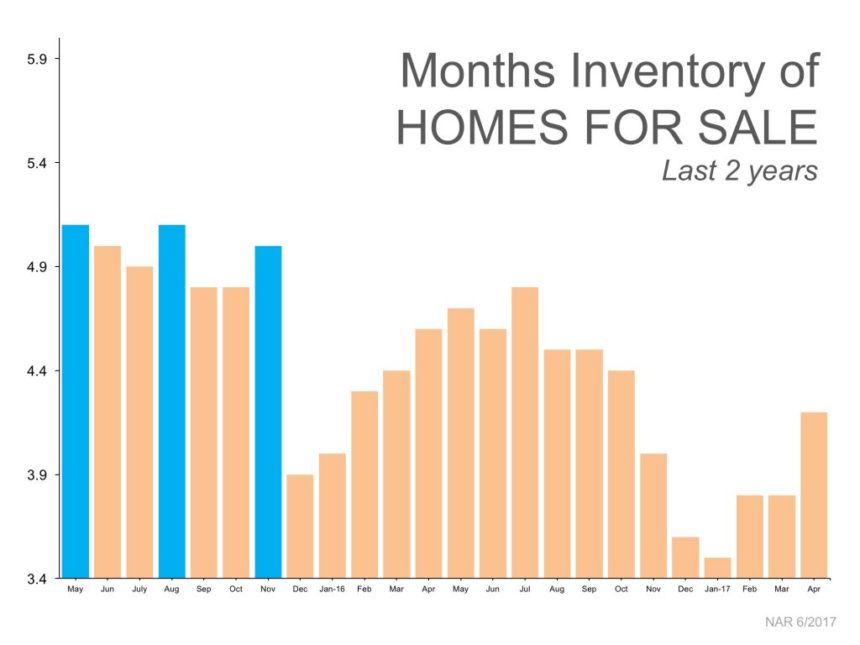

For perspective, here are the numbers over the last two years:

Only 3 months in the last two years have we seen inventory levels at 5 months (the blue bars). A normal real estate market has 6 months inventory.

This is not a new issue for the real estate market, and the next graph shows the trend going back to 2011:

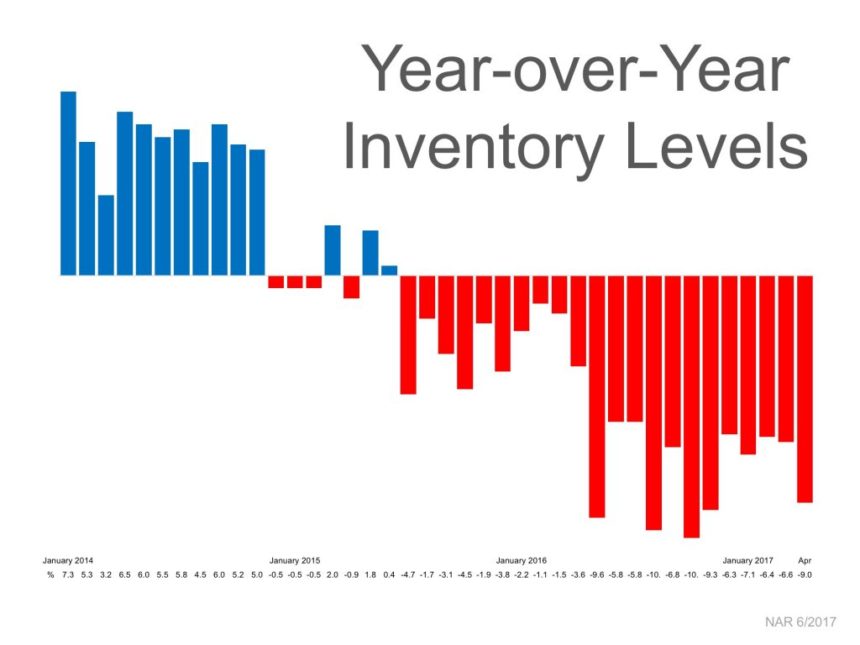

To further illustrate that lack of inventory is not a new issue, here are the year-over-year numbers going back to 2014:

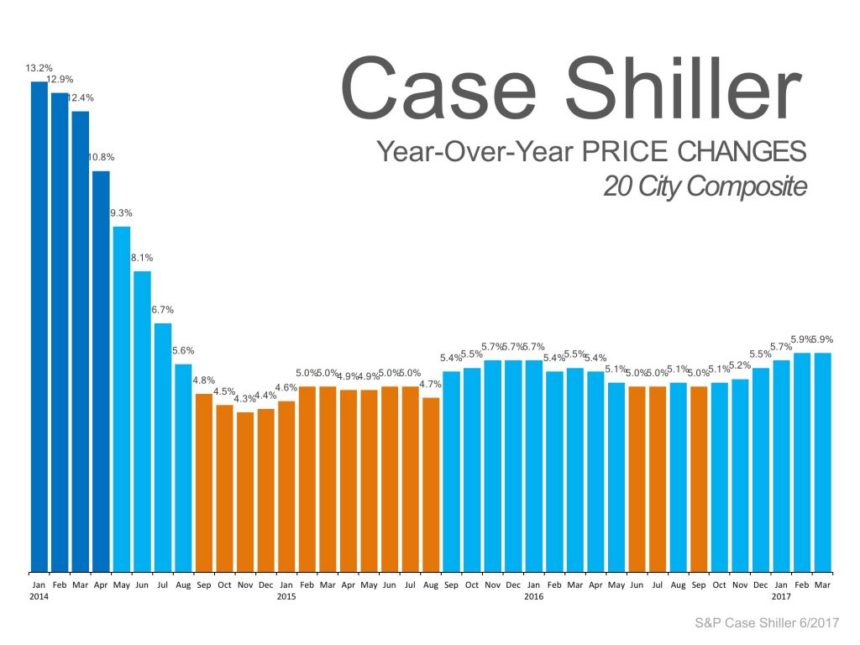

Despite the declining numbers (or actually because of them), home values have been on the rise over the same period:

Despite the lack of inventory, homes are still selling, and fast. Here is a look at home sales so far in 2017 (compared to 2016):

Opportunity Lost

This is a great time to be a home owner. Equity is building up rapidly, and the housing market presents a great selling opportunity.

Homes are being snapped up quickly, and it is not unusual for sellers to have a bidding war for their home. Especially at the lower end of the real estate market spectrum: starter homes.

According to CNBC’s Diana Olick, this is the “strongest seller’s market ever”, especially at the entry level:

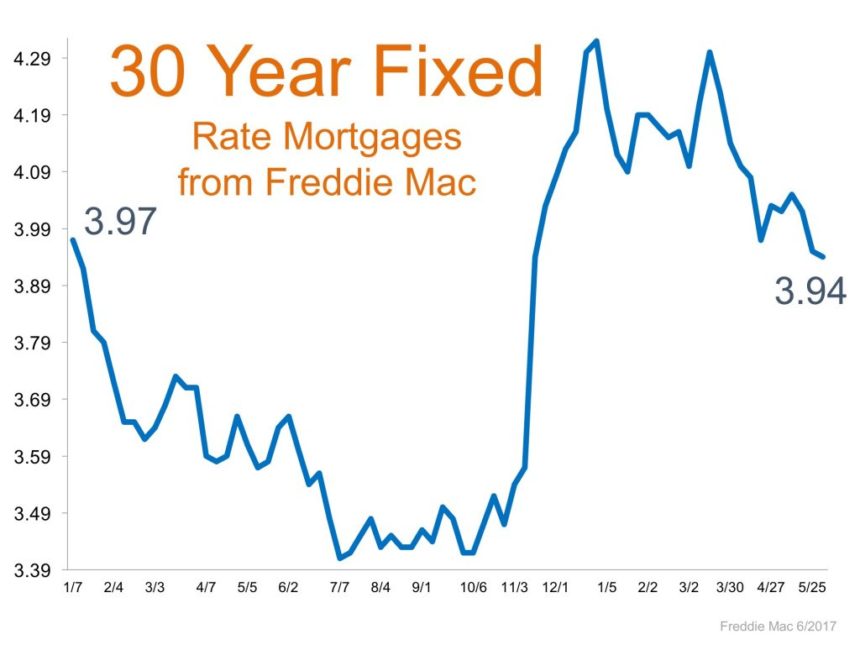

The lack of inventory is a factor working against prospective buyers. But one thing that is working in their favor is the fact that interest rates remain near historic lows.

This also works in the favor of home owners who are thinking about selling in two ways.

First, they can take advantage of the low rates when purchasing their next house.

Second, they likely will not see an increase in their interest rate (or not very much of one) with their new mortgage compared to their current mortgage.

Opportunity exists for home sellers to gain even more equity than they have over the last few years simply because they will more than likely be purchasing a more expensive home this time.

Even if they aren’t moving up, home values for an equal home will be higher than they were just a few years ago.

Real Estate Market: Easy Way To Increase Net Worth

It’s no secret that home ownership is a means to build wealth.

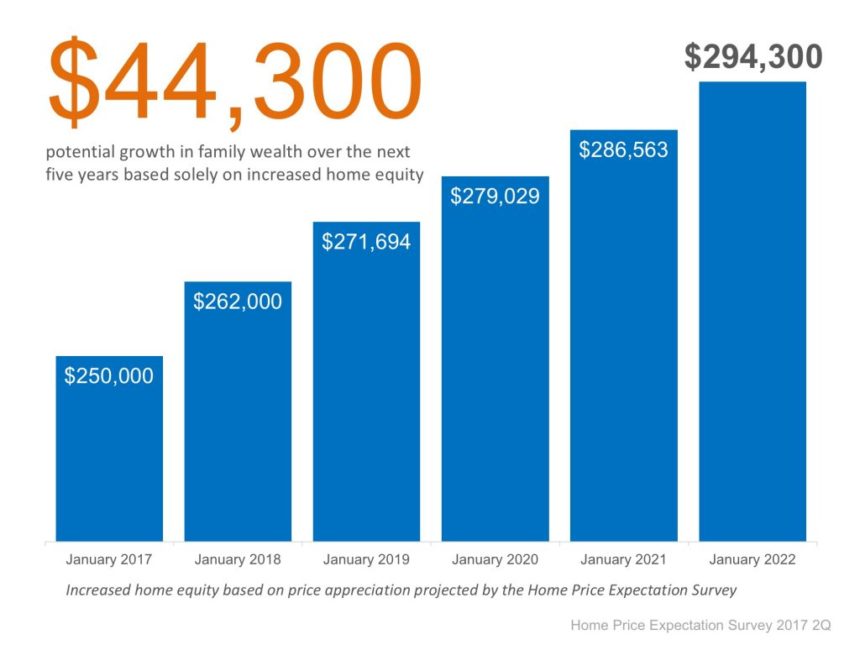

Based on the most recent appreciation projections from the Home Price Expectations Report, someone who bought a home at the beginning of this year could see the following wealth build up over the next few years:

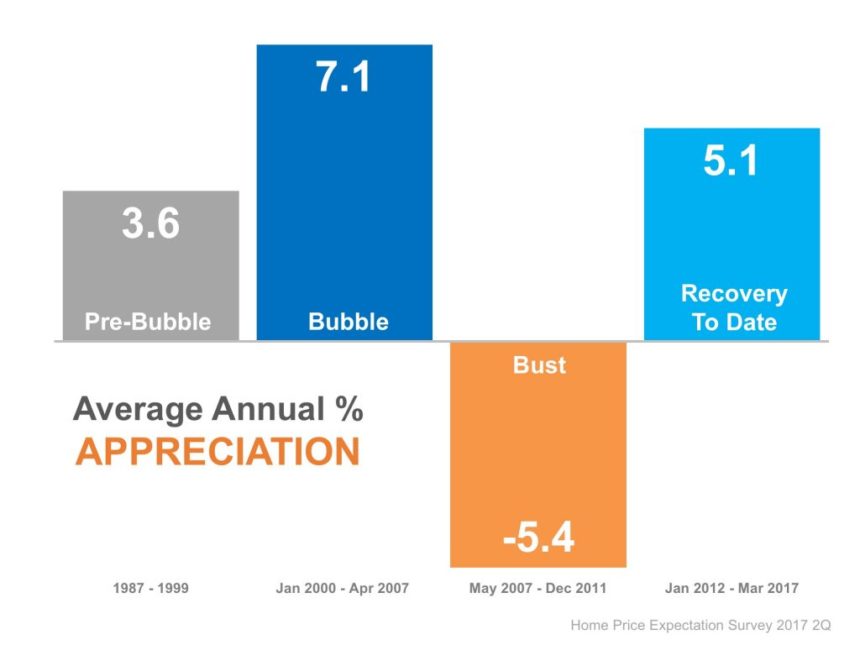

We can’t predict the future, but history can give you an idea of what is possible. Here is a look at the Average Annual Appreciation Rate has been since January 2012:

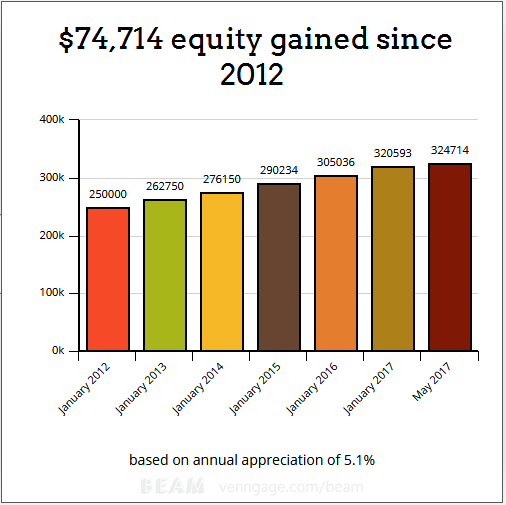

So, if a home owner purchased a $250,000 home in January 2012, then here is what their equity (and net worth gain) looks like today (based on the average annual appreciation of 5.1% and 6.9% appreciation through the first quarter of 2017):

So, theoretically a current home owner could sell right now and realize a nearly $75,000 in gain, purchase another $250,000 home and end up with another nearly $45,000 in gain over the next 5 years.

Of course, that home owner would likely spend more than $250,000 on the next home, so their gain would be that much greater.

But imagine knowing what was to happen in the market 15 years ago.

By buying and selling multiple homes you could see significant gains in equity and wealth simply by moving up into more expensive homes. Higher priced homes gain more in equity, all other factors equal.

This is just for simple illustrative purposes.

Before someone says “Yeah, but about that crash. No matter the big gains, they would have been wiped out by the crash!”, let me remind you that if you knew what was coming, then you would have avoided that part.

What if you sold your last house around 2007 and then rented for a few years? (There, happy ending!)

Plus, this real estate market is very different than the one from ten years ago. This time, we are not in another bubble.

Take away the investment angle and one fact remains: current home owners have an opportunity to move into their dream home.

The home they are in now is either the starter home or the move up home. Demand is strong for these homes, yet supply remains scarce.

If The Real Estate Market Is The “Strongest Seller’s Market Ever”, Why Is Inventory Still Low?

So, if now is a great time to sell, why aren’t more home owners taking advantage of this market?

It’s hard to pinpoint exactly why this is the case, but there are some indicators.

Many home owners are former first time home buyers from a few years ago.

So, they have never been in this position and may not fully understand that the market is once again in their favor–only this time they are in a position to sell a home before buying one.

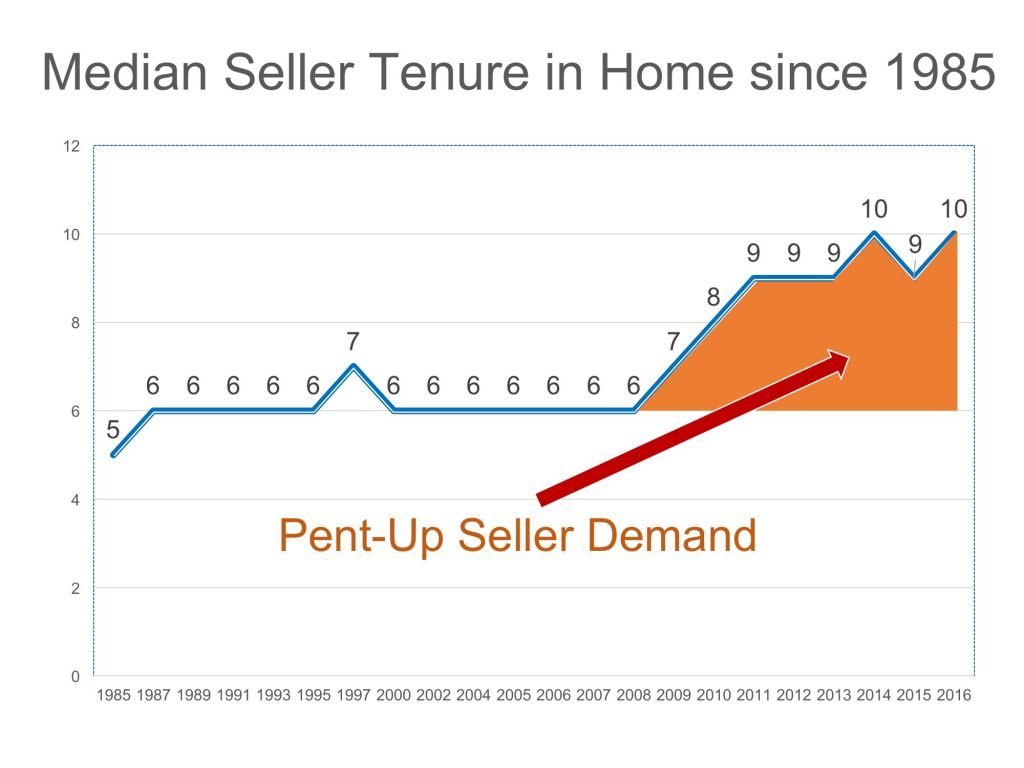

Also the average time people remain in the same home has increased over the last decade.

Previous to the crash, people tended to stay in the same home for 6 years. In the last decade, that average is up to 9 or 10 years.

A big factor in this change was the result of the housing market crash. People saw the value of their homes drop to the point that they had very little equity or were completely upside down.

Selling was not an option unless you chose to do a short sale.

So, basically people became trapped in their home.

Equity Gains Much Higher Than Perception

It seems that many people are not aware of the recovery and gains made in the real estate market.

Most home owners that have owned their home for 4 years or more have gained significant equity in their homes, but they are probably not aware of just how much they have gained.

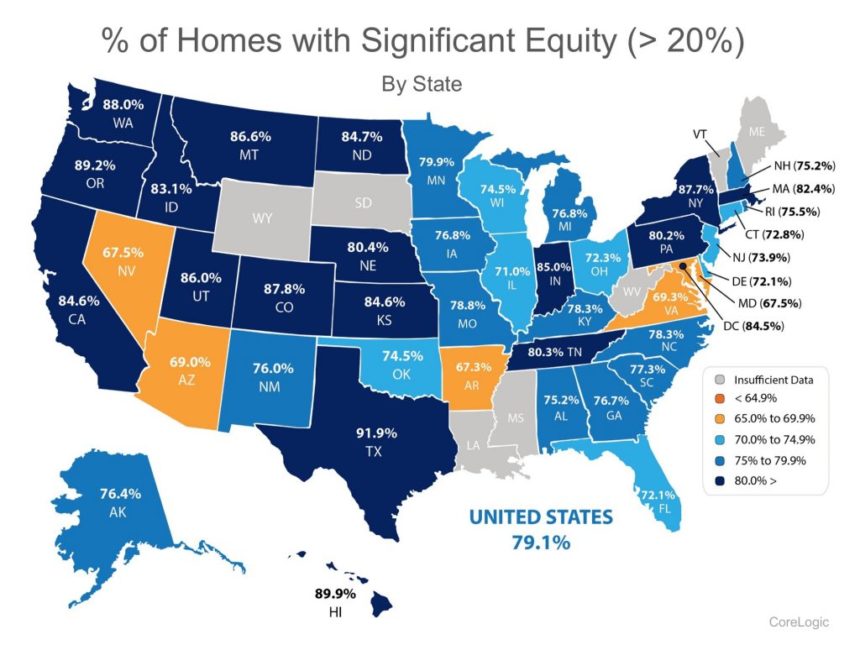

A study by CoreLogic at the beginning of the year showed the percentage of homes in the US that had significant equity (equity greater than 20%):

Not included on that infographic are the nearly one third of homes across the country that are owned free and clear.

So nearly 80% of homes with a mortgage have 20% or greater equity.

In fact, according to the most recent CoreLogic Equity Report, 78.8% of homeowners have significant equity (more than 20%) in their homes today.

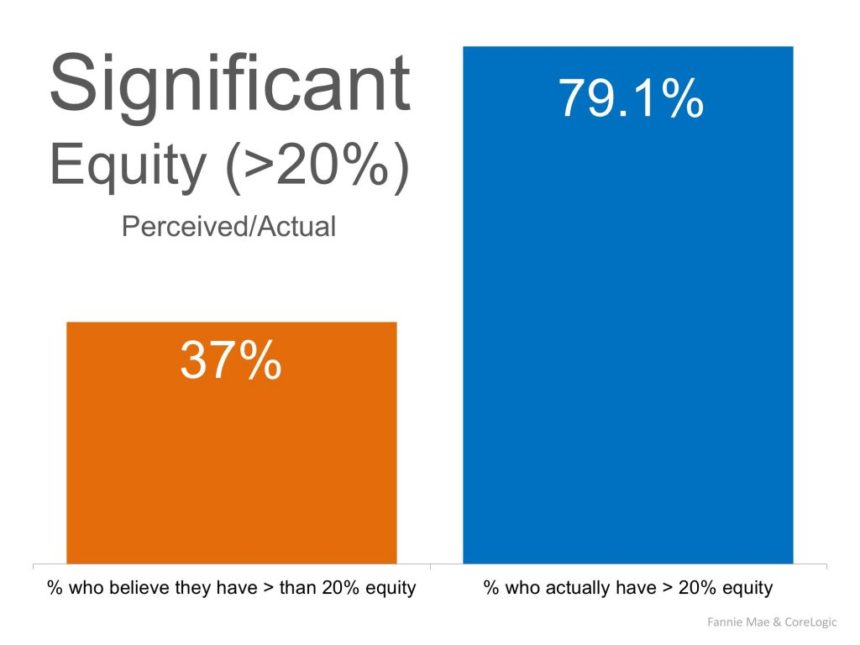

Despite that fact, perception does not match up with reality. Most home owners with significant equity simply are unaware of where they stand:

It is quite apparent that many home owners that would otherwise consider selling haven’t even thought about it simply because they do not feel they have enough equity to do so.

Mortgage Misconceptions Holding Sellers Back

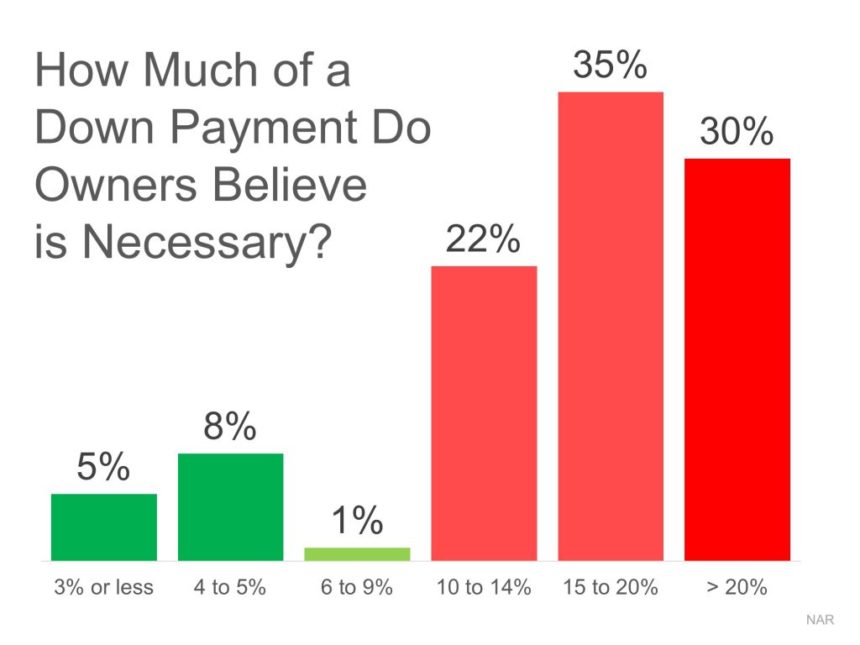

Another issue that could be holding back sellers is misconceptions.

Many would be first time buyers have already disqualified themselves because they mistakenly believe that they must have near perfect credit and at least 20% down payment in order to qualify to purchase a home.

Unfortunately, many home owners share these misconceptions:

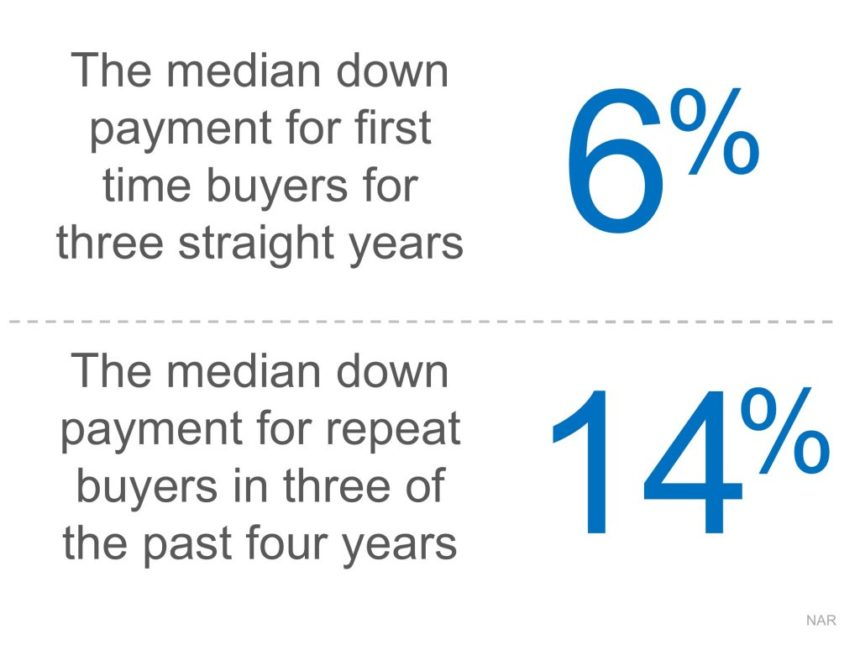

Having been through the process already you would think home owners would know that you do not need 10%, 15%, 20% or more for a down payment.

Perhaps they feel things changed as a result of the crash and mortgage meltdown, but that is simply not the case:

Many move up buyers will use some of their equity for a down payment, hence the larger down payment versus a first time buyer. However, you still only need 3% down in this current market.

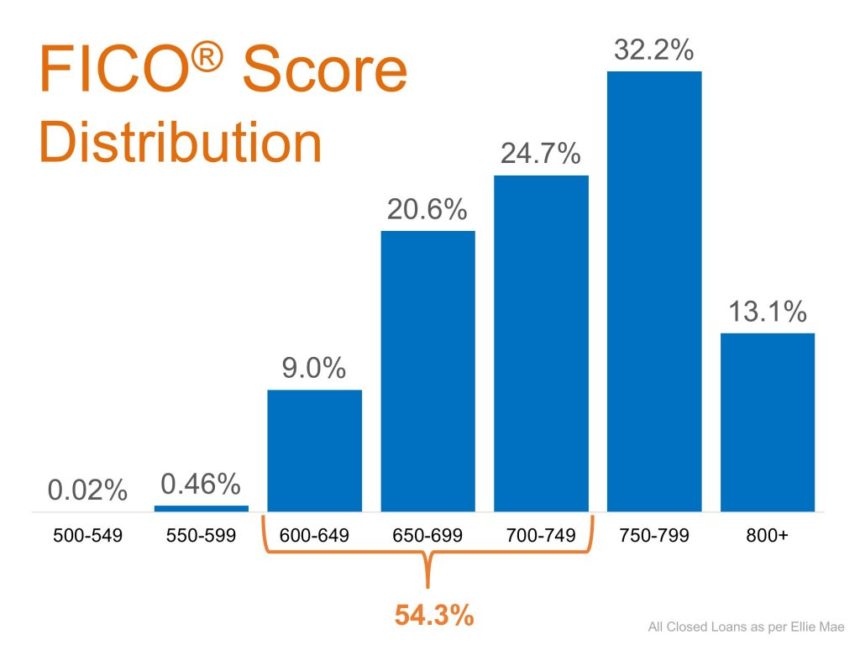

Perfect credit is not a requirement, either. Here is a look at the average FICO score for the most recently closed mortgages:

Confidence In Housing Market Still Catching Up

Perhaps the biggest obstacle holding back sellers is confidence in the real estate market. Although home values are rising rapidly, there are some that actually fear that the market is going to repeat itself from ten years ago.

However, just because home values have hit peak levels from before the crash does not mean they still can’t continue to increase, and it certainly does not mean we are in another bubble.

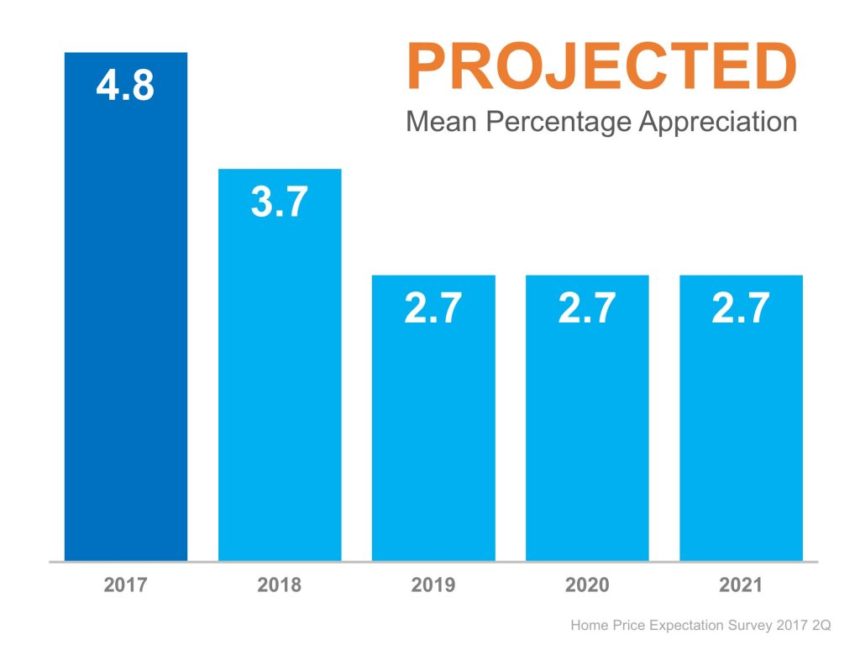

Projections from the latest Home Price Expectation Survey expect home values to continue to increase over the next few years. However, the rate of appreciation should slow down:

It is important to realize that the projections are still calling for continued appreciation over the next 5 years–there are no red bars on that graph.

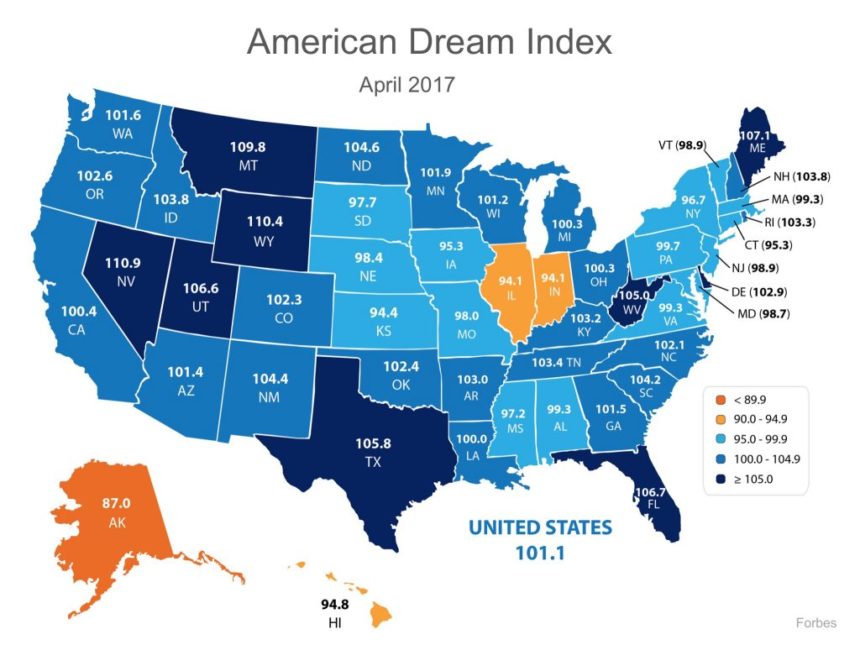

Plus, consumer confidence in the economy remains high.

Here is a look at the latest Forbes American Dream Index that measures peoples confidence in the economic outlook:

This confidence appears to have spread into the housing market as well.

According to the Fannie Mae’s Home Purchase Sentiment Index (HPSI),

“This is only the second time in the survey’s history that the net share of those saying it’s a good time to sell surpassed the net share of those saying it’s a good time to buy.”

However, that still has not translated to the real estate market, at least not just yet.

According to Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae:

“High home prices have led many consumers to give us the first clear indication we’ve seen in the National Housing Survey’s seven-year history that they think it’s now a seller’s market. However, we continue to see a lack of housing supply as many potential sellers are unwilling or unable to put their homes on the market…”

Bottom Line

The housing market is starving for inventory. Home owners have a variety of factors working in their favor.

They have gained a large chunk of equity on a just a few years, opening up the opportunity to sell their home and make their next move.

Interest rates remain low, so their next mortgage won’t have that much of a higher rate than their current mortgage.

It is a hot seller’s market where demand far exceeds supply, which can lead to a multiple offer situation and quick sale–the ideal situation to be in as a seller.

Plus, with home values projected to continue to rise for the next few years (and no, we are not heading for a crash!), the opportunity to continue to gain equity and build wealth remains.

Keep up with the latest real estate news by subscribing to this blog or this blog.

You can download free real estate guides for buying or selling here.

Check out my Pam Marshall Realtor website for information about Charleston SC real estate.

Leave a Reply