In yesterday’s post I referenced a recent article by Deborah Kerns about NerdWallet.com’s recent “Home Buyer Reality Report 2017”.

There is a lot of great information and statistics in this report, so today I want to look into the results a little deeper.

The study looked into the home buying and mortgage process and broke it down by generation: Millenials, Generation X, and Baby Boomers.

If you have followed my blog, then you know one thing I preach is that anyone looking to buy a home, especially first time home buyers, should do the proper due diligence and research the process of buying a home.

An educated buyer is a smart, confident buyer.

It seems as though that is one big takeaway from this report:

“NerdWallet’s first Home Buyer Reality Report looks at the journey to home ownership, from starting the loan process to why even successful homeowners wish they’d done things differently.

We found that proper preparation is key, because what you don’t know about mortgages can hurt you.”

According to the survey, 49% of home owners would do things differently if they were to go through the process all over again.

Broken down by generation, 57% of Millennial and 61% of Generation X home owners had regrets about the home buying process, while only 38% of Baby Boomers did.

The Mortgage Process

A key component of home buying is the mortgage itself. In fact, it should be the first step of the process.

However, this is an area of a lot of confusion and stress for most home buyers, first time or otherwise.

According to the survey:

“Forty percent of mortgage applicants said their mortgage process was manageable, but 31% said it was stressful.”

Views on the mortgage process varied across generation lines.

“Gen X mortgage applicants were less likely to report having a positive experience (26%) with the mortgage process than millennial applicants (39%), but even though there was a difference in experience, Gen Xers were just as likely to have been approved for a home loan (91%) as millennials (89%).”

29% of Baby Boomers reported a positive experience, and 89% were approved for a mortgage.

Despite this fact, many potential buyers do not feel they qualify for a mortgage. According to the survey, this is especially true amongst the Millenials:

“In fact, 65% of millennials in our survey reported that they’ve never applied for a mortgage.”

Potential Buyers Disqualifying Themselves

Many would be buyers don’t even take the first step because they (mistakenly) believe they must wait to apply because they do not have sufficient credit and/or sufficient down payment–something I have covered before.

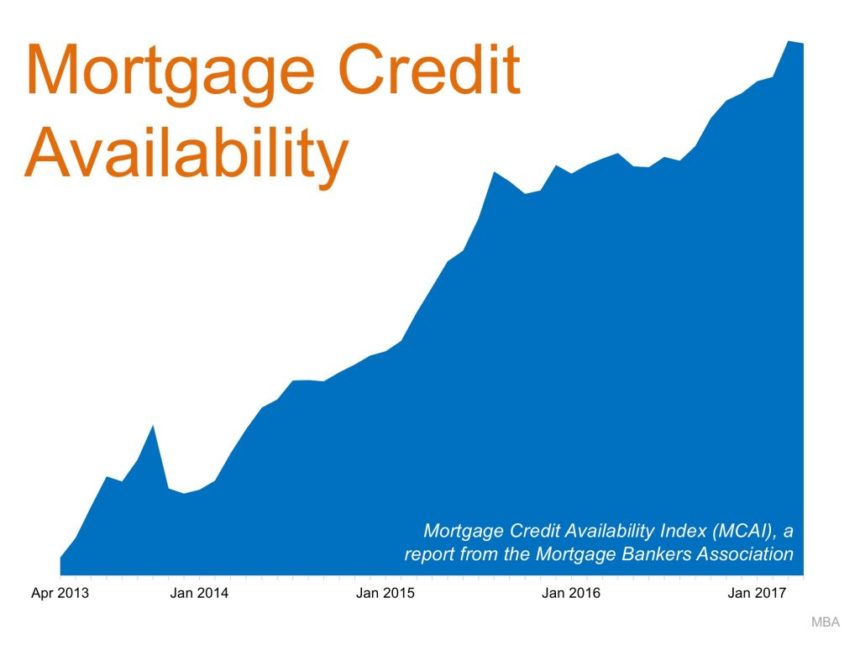

However, mortgage credit remains easier to qualify for in today’s market than it has in years previous:

These mortgage approval numbers prove that it is much easier to qualify for a loan in today’s market than it has been since the crash.

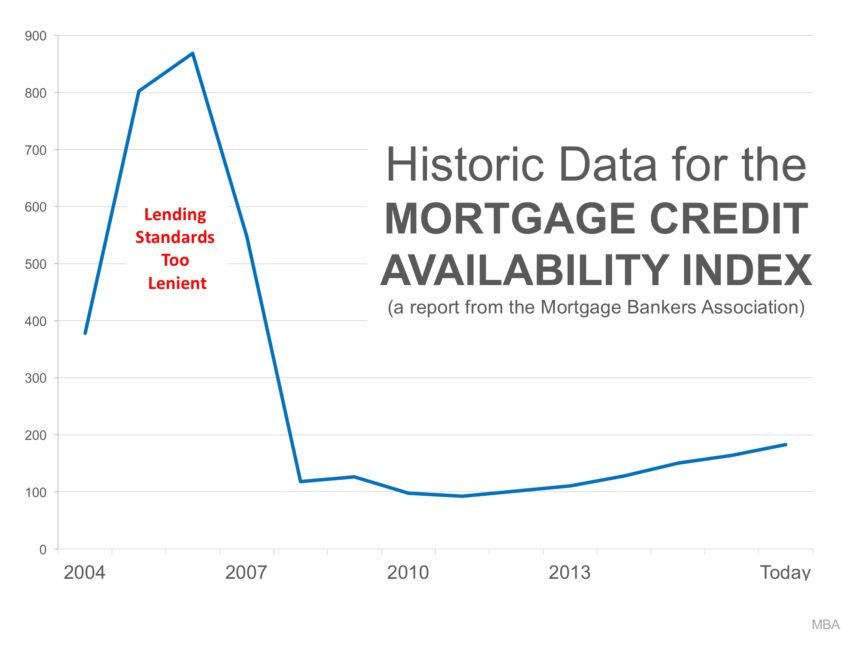

However, it is still nowhere near as easy as it was prior to the crash:

In this online age, nearly half (49%) of the respondents preferred to submit a mortgage application online as opposed to in person.

64% of Millenials and 63% of Generation X preferred to apply online, compared to only 34% of Baby Boomers.

As far as their experience, descriptions varied across both all respondents and generations.

Here is a breakdown of the respondents feelings regarding the mortgage process:

Home Buying Regrets

As mentioned before, 49% of the survey respondents expressed regrets about their experience.

“Twenty percent wished they had saved more money before buying a home, 13% said they would do more research on the mortgage-lending process, 14% said they would have shopped around more for a mortgage, and 13% would’ve researched the home-buying process more.”

Home Buying Regrets Of Millenials

“If they had to do it all over again, 57% of millennial homeowners would change their approach to the home-buying process.

At the top of the list: 28% said they’d save more money before buying, 15% would do more research on the home-buying process, 14% would better organize their paperwork from the start, and 12% would do more research on the mortgage-lending process.”

Home Buying Regrets of Generation X

“20% wished they purchased a bigger home. 27% said they would save more money before buying a home, 19% said they would do more research on the mortgage process, 18% said they would have shopped around more for a home loan, and 16% would do more research on the home-buying process.”

Home Buying Regrets Of Baby Boomers

It seems as though experience does count for something. 56% of baby boomer homeowners said they wouldn’t change anything about the process. Their regrets list pales compared to the other generations:

Mortgage Denial Not The End

Overall, of all respondents that had applied for a mortgage, only 6% were denied.

Over a third of those denied (35%) said that the denial encouraged them to improve their financial situation.

The most common reason for denial was a high debt to income ratio, affecting 52%. Credit history and score was second at 39%, and the third most common reason was insufficient income (25%).

The big positive from this is the fact that despite the denial, 33% stated that they weren’t going to give up.

By going through the application process, they now knew what steps they had to take in order to get approved to purchase a home.

Lessons To Be Learned

The internet can be a great source of information. If you are thinking about buying a home, even if you have done so before, it is still important to do your homework.

The market has changed over the last few years, so your previous experience of home buying could be very different than buying a home in today’s market.

This NerdWallet article is also a great resource because you can learn from people that have recently purchased a home.

It is apparent that many people experienced the same issues with the mortgage process. Many felt the process was confusing and stressful. Many people expressed frustrations about the home buying process as well.

The majority of those with buyer’s remorse were in the younger generations–the Millennials and Generation X.

Two regrets both age groups cited were not doing enough research about buying a home and not researching the mortgage process enough.

According to NerdWallet’s mortgage expert,Tim Manni:

“According to our research, borrowers who don’t understand the mortgage process or don’t know enough about their own credit history tend to hit obstacles or be rejected when applying for mortgages.

They also tend to feel regret after their deal is done, even if they succeeded in buying a home. That tells me borrowers aren’t doing enough research — on themselves or the mortgage process — before applying for a home loan.”

Other frustrations included how long the process took, not feeling like they were aware of all of their mortgage options, not feeling like a priority to their mortgage loan officer, to sticker shock from closing costs.

Set Yourself Up For Success: The Right Professionals

This is why it is so important that you choose the right team of professionals to work with.

Rather than being hung up on who has the lowest rates, buyers should be more concerned with who they feel will talk to them straight and explain all of their options.

It is important that your real estate agent will take the time to educate you about the home buying process and answer all of your questions.

If the lender of agent you talk to doesn’t make you feel like they will take the time to educate you about what you are about to jump into, then you need to find someone else.

It is also important that you start the process off right. Start saving money, and speak with a mortgage loan officer for pre-approval months before you intend to buy.

Qualifying for a mortgage is not impossible. But even of you don’t qualify today, at least you know what steps you need to take to get you there.

If a loan officer won’t explain to you why you were denied and what steps to take to get approved, then it is time to talk to someone else.

From NerdWallet’s Tim Manni:

“If you’re serious about buying a home, understand that the mortgage lending process will be a bit invasive, and it’s going to take a lot of time and back-and-forth communication.

That’s why you need to be proactive about cleaning up your finances and improving your credit. Educate yourself early about how to address the major issues that will prevent you from qualifying for the right loan or the best mortgage rates.

Taking these steps sooner rather than later will better position you in a lender’s eyes.”

Here are some great resources to help educate you about both the mortgage process and home buying process, from a great real estate team that will take the time to answer your questions and educate you about the process of buying a home.

You can download for free our “Demystifying The Mortgage Process Guide” as well as our “Millennial Home Buying Guide” here.

Stay tuned to the latest stats, news and real estate trends on this blog and this blog.

Be sure to also visit my Pam Marshall Realtor website for more helpful information about buying a home.

Leave a Reply