Soaring Home Values ≠ Housing Bubble

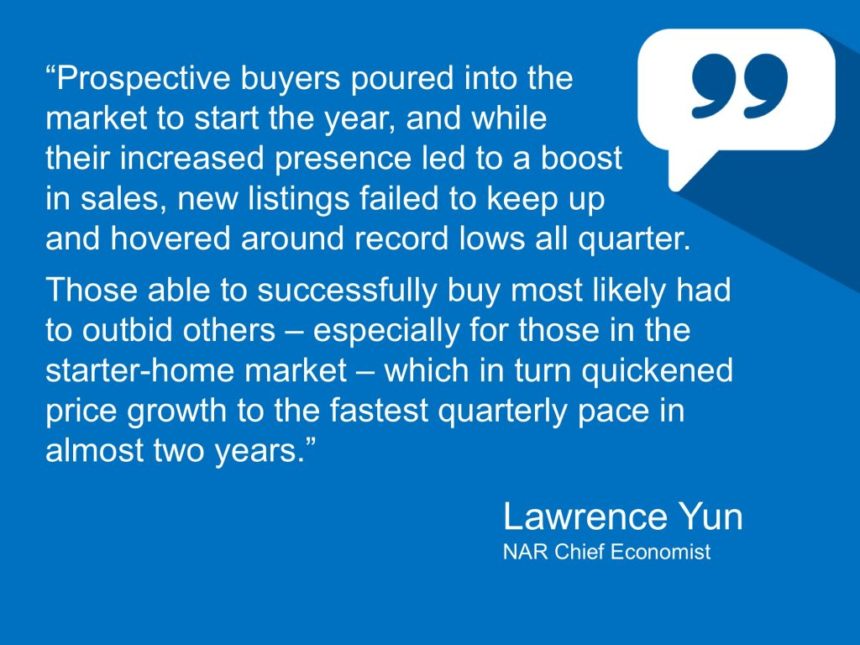

Home values are rising much faster than what was projected, and are at their fastest pace we have seen in two years.

As a result, many fear that we are in another housing bubble, similar to what we saw in 2006, just before the big real estate crash.

Zillow recently reported that:

“National home values have surpassed the peak hit during the housing bubble and are at their highest value in more than a decade.”

Although there is truth in that statement, it is important to realize that while some areas of the country are seeing values at or near the prices of a decade ago, it does not mean we are in another housing bubble.

Clickbait Doesn’t Tell The Whole Story

Of course, in this day and age, the media typically is more about attention grabbing headlines and clickbait, rather than reporting the entire story.

But for the average person, they hear just enough information and immediately remember back about 10 years ago when home values were skyrocketing and remember the subsequent crash.

Because the headlines are all about soaring home values, people are assuming that we are heading to another crash; that another bubble is forming.

The prevailing attitude falls somewhere between “what goes up must come down” and Chicken Little’s “the sky is falling!”.

However, never let the facts get in the way of a good argument.

Simply put, home values increasing rapidly does not indicate a bubble forming. It takes more than that to make a housing bubble.

In order to explain why this current market is not a bubble, first we need to look at the factors that made the mid 2000’s housing market a bubble.

THE 4 FACTORS THAT LEAD TO THE CRASH

The market crash was a result of several factors, almost a “perfect storm” of contributing factors.

1. The real estate boom was a result of huge buyer demand that was artificially created.

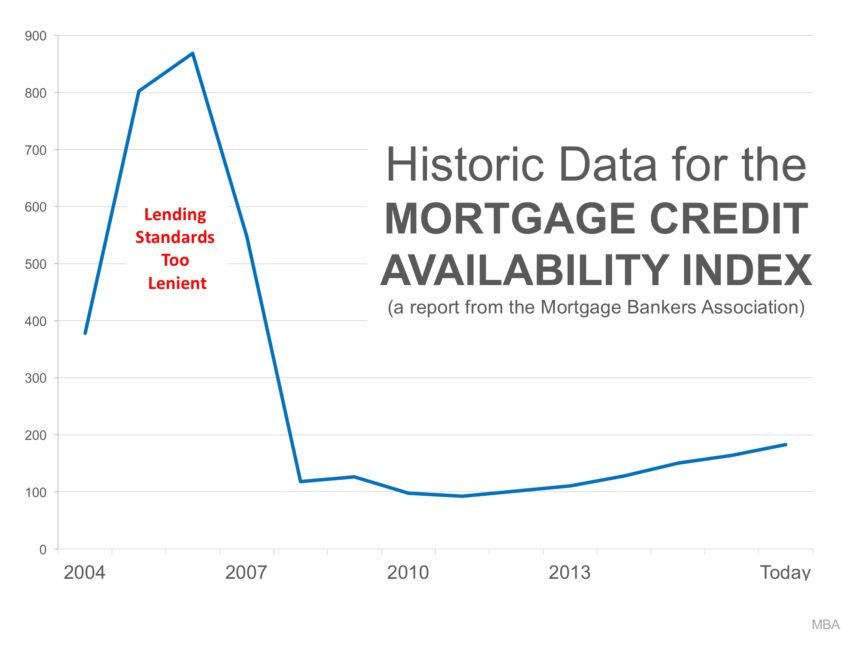

2. The primary factor that fueled the huge demand for housing and the subsequent crash was lending standards that were way too lenient.

Banks were bending over backwards to get people approved for a mortgage. People that were not qualified to purchase were able to obtain a mortgage anyway.

The running joke in the industry back then was “if you can fog a mirror, then you are approved”.

As a result, the housing market was flooded with a tidal wave of buyers. Prices began to skyrocket.

Because home values were rising so rapidly, many home owners refinanced their homes and cashed out their equity.

Many used this new found wealth to spend on frivolous things like vacations, jet skis, etc.

This, combined with the prevalence of zero down loans, left many home owners mortgaged to the hilt.

3. This increase in demand caused home builders in many markets to overbuild.

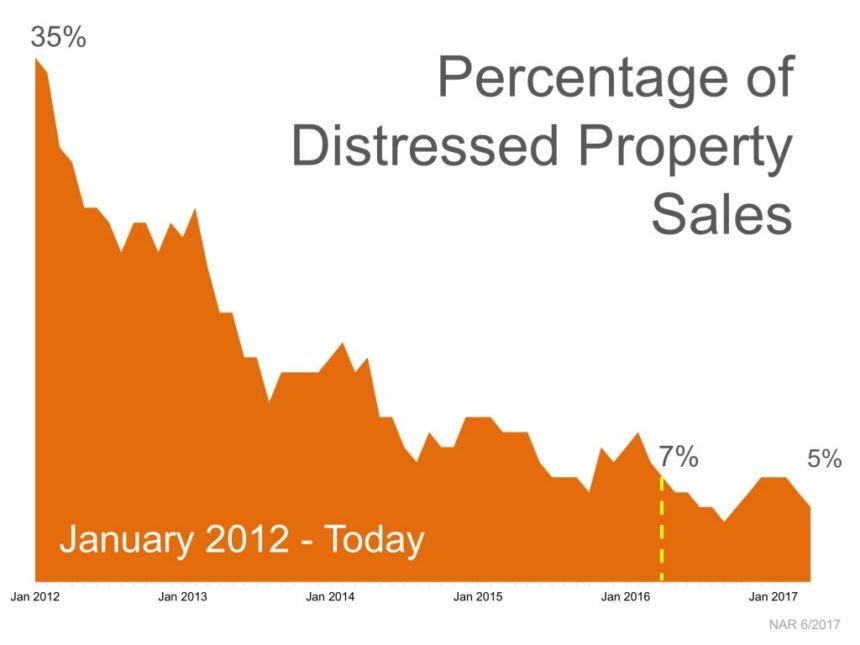

4. Then, the wave of foreclosures began, followed by short sales.

These distressed properties drove the market down. Surrounding homes saw their values plummet as a result, and the big crash was on.

So, Where Do We Stand Today, And Why Is It Different?

First, the current housing market climate can be explained by simple economics: supply and demand.

Right now, the number of buyers looking to purchase a home is greater than the supply of homes on the market.

This strong demand, however, is natural, and has not been artificially inflated.

Here Are Several Facts That Show Definitively That We Are Not In Another Housing Bubble, And We Are Not Heading For Another Crash

1. If we look at home prices, most homes haven’t even returned to prices seen a decade ago.

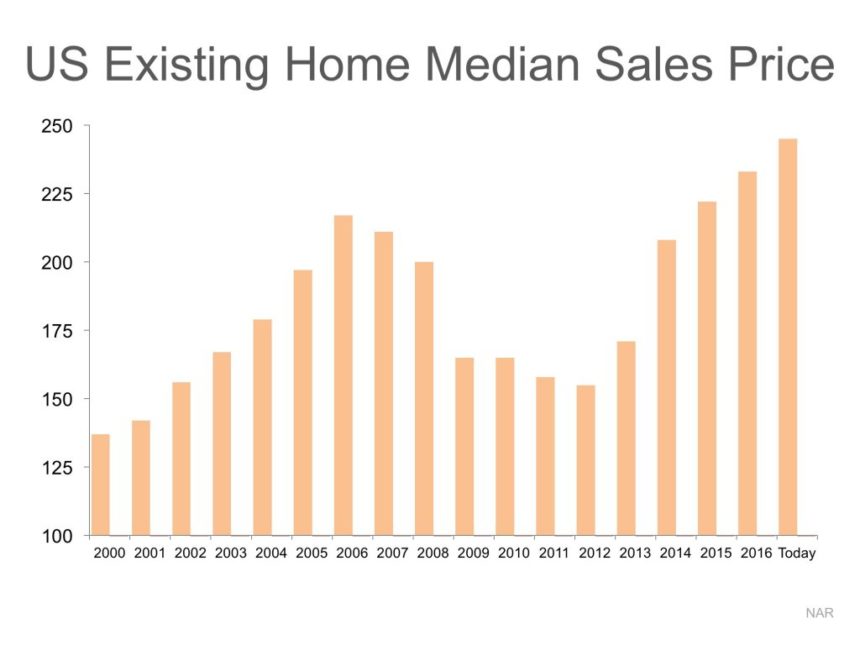

Here is a look at the Average Median Sales Price of US homes going back to 2000:

You can see very clearly what has happened in the housing market in this Millennium. The big build up, the crash, and the recovery to date.

What If The Bubble & Bust Didn’t Occur?

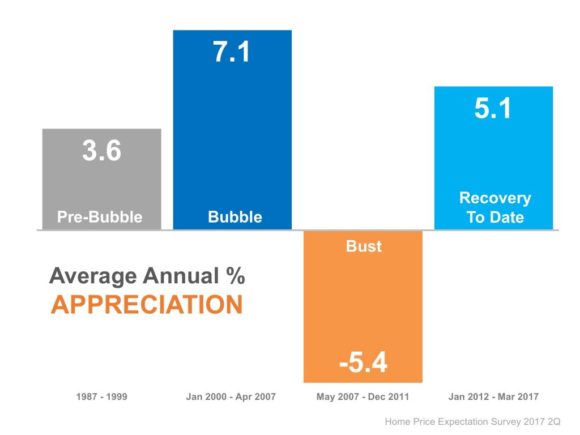

Historically, the housing market has behaved like any other market–it’s had its ups and downs. But over time, it has gone up. In fact, historically, the rate of appreciation for the US real estate market has averaged around 3%-4% a year.

In the years leading up to the real estate boom (1987-1999), the Average Annual Rate of Appreciation was 3.6%.

In the years leading up to the real estate boom (1987-1999), the Average Annual Rate of Appreciation was 3.6%.

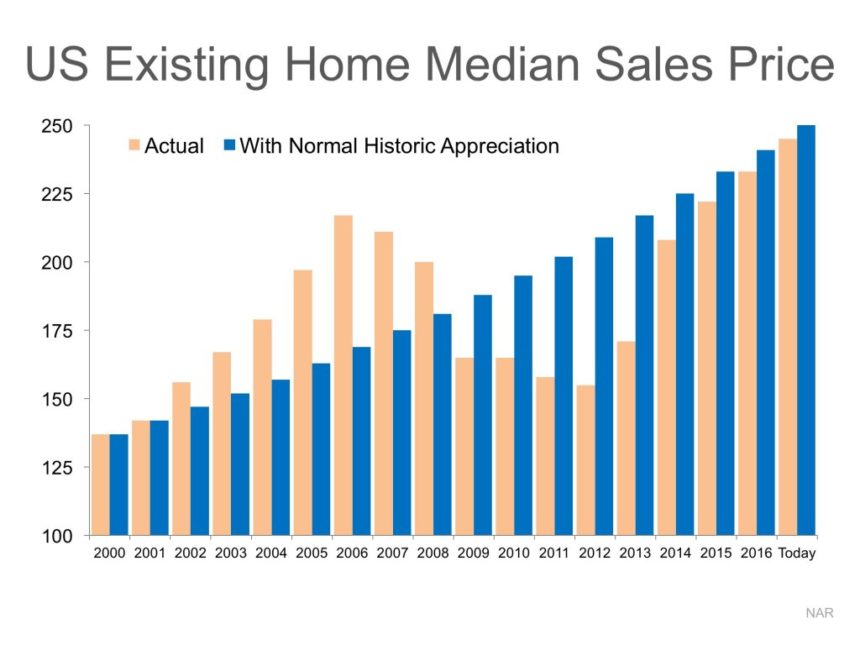

Taking that into account, if the big boom and bust had never happened, and real estate had continued to appreciate at the normal 3.6% rate all these years, here is what the Average Median Sales Price of homes in the US would look like (in blue):

Basically, the current housing market is just about where it should be, had the boom and bust never happened.

We are not quite back to where the market would have been with normal appreciation.

As prices begin to reach peak levels again, it might seem logical that the only direction to go is downhill.

However, this graph includes the anomaly of the price bubble and the correction (the housing crash).

If we look at home prices, most homes haven’t even returned to prices seen a decade ago.

Trulia just released a report that explained:

“When it comes to the value of individual homes, the U.S. housing market has yet to recover. In fact, just 34.2% of homes nationally have seen their value surpass their pre-recession peak.”

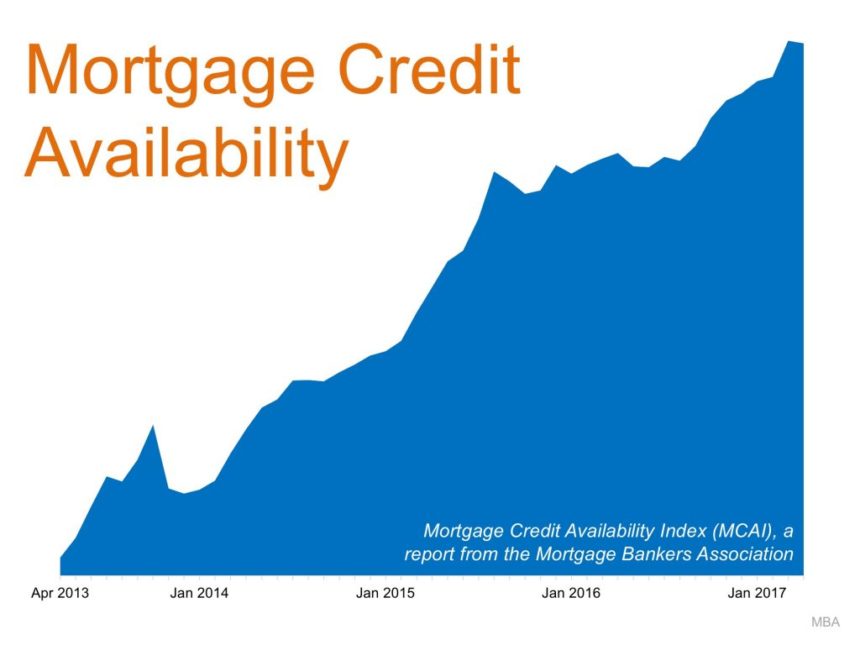

2. Here is a look at lending standards based on the Mortgage Credit Availability Index released monthly by the Mortgage Bankers Association:

Yes, it is easier to get a mortgage today than it was 4 or 5 years ago.

However, that is because after the market crash and mortgage meltdown, lenders tightened up their lending guidelines. In fact, they tightened them up too much.

Just as they had been far too lenient before, they became far too strict afterwards. If you didn’t have flawless credit, you didn’t get a loan.

Once again it was necessary for a market correction, and lenders eased their lending requirements to more reasonable standards.

Today Mortgages Are Not Handed Out Like Candy On Halloween

Does this mean that we are heading back down that same path?

Though standards have become more reasonable over the last few years, they are nowhere near where they were in the early 2000s:

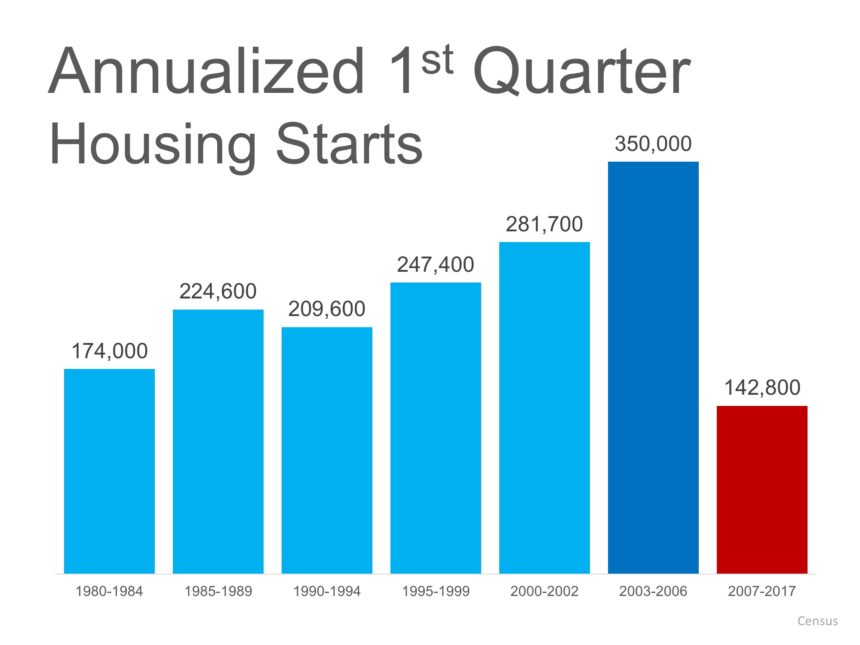

3. Builders have certainly taken notice of the market, and are building as fast as they can to meet the demand.

But, as you can see by the following graph, they are nowhere near the levels of building that we saw in 2006. They aren’t even near the levels we saw as far back as 2001.

Here’s another infographic that shows that in today’s market, builders are not over building.

Average annual housing starts in the first quarter of this year were not just below numbers recorded in 2002-2006, they are below starts going all the way back to 1980.

3. Distressed Properties Are Not A Major Factor Of The Current Market

This is easily explained by this infographic:

Repeat After Me: There’s No Housing Bubble!

In today’s market there is no reason to panic over the headlines about prices “exceeding peak levels”. Home values are right in line with where they should be.

Before the market crash a decade ago, the demand for housing was artificially boosted by lending standards that were far too lenient.

Today, the demand for housing is legitimate, and lending standards are not nearly as loose as they were a decade ago.

Today’s price increases, unlike those a decade ago, are the result of simple economics: qualified buyer demand exceeding the current inventory of homes available for sale.

Mortgage lending standards are appropriate, and new construction levels are still lower than they have been in decades.

Distressed properties are not a factor, and home prices haven’t even fully recovered.

Fears of a housing bubble are over-exaggerated.

Stay tuned to the latest real estate news, here or here.

If you are looking to buy or sell, then be sure to check out my Pam Marshall Realtor website.

Leave a Reply