Houses In Charleston SC: Interest Rate Update

If you are searching for houses in Charleston SC, you will likely need a mortgage to purchase.

Here is a quick look at interest rates–where they are, where they are heading, and how they impact you, the home buyer.

Interest rates currently are around 4%. They were expected to increase higher this year, and although they have been on the rise over the last few months, they aren’t as high as was projected.

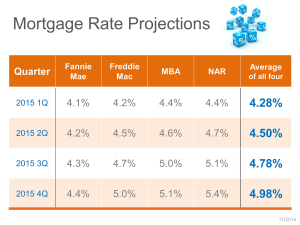

The graph below shows some of the projections for 2015 from some of the top industry experts.

These include Freddie Mac, Fannie Mae, The National Association of Realtors and the Mortgage Bankers Association.

This is from December of last year:

As you can see, rates aren’t as high as was expected.

However, that doesn’t mean they won’t increase over the rest of 2015 and into 2016.

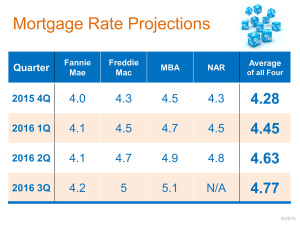

The next graph shows the rise in interest rates over the last few months:

The Fed is expected to raise rates around the end of Summer/Early fall.

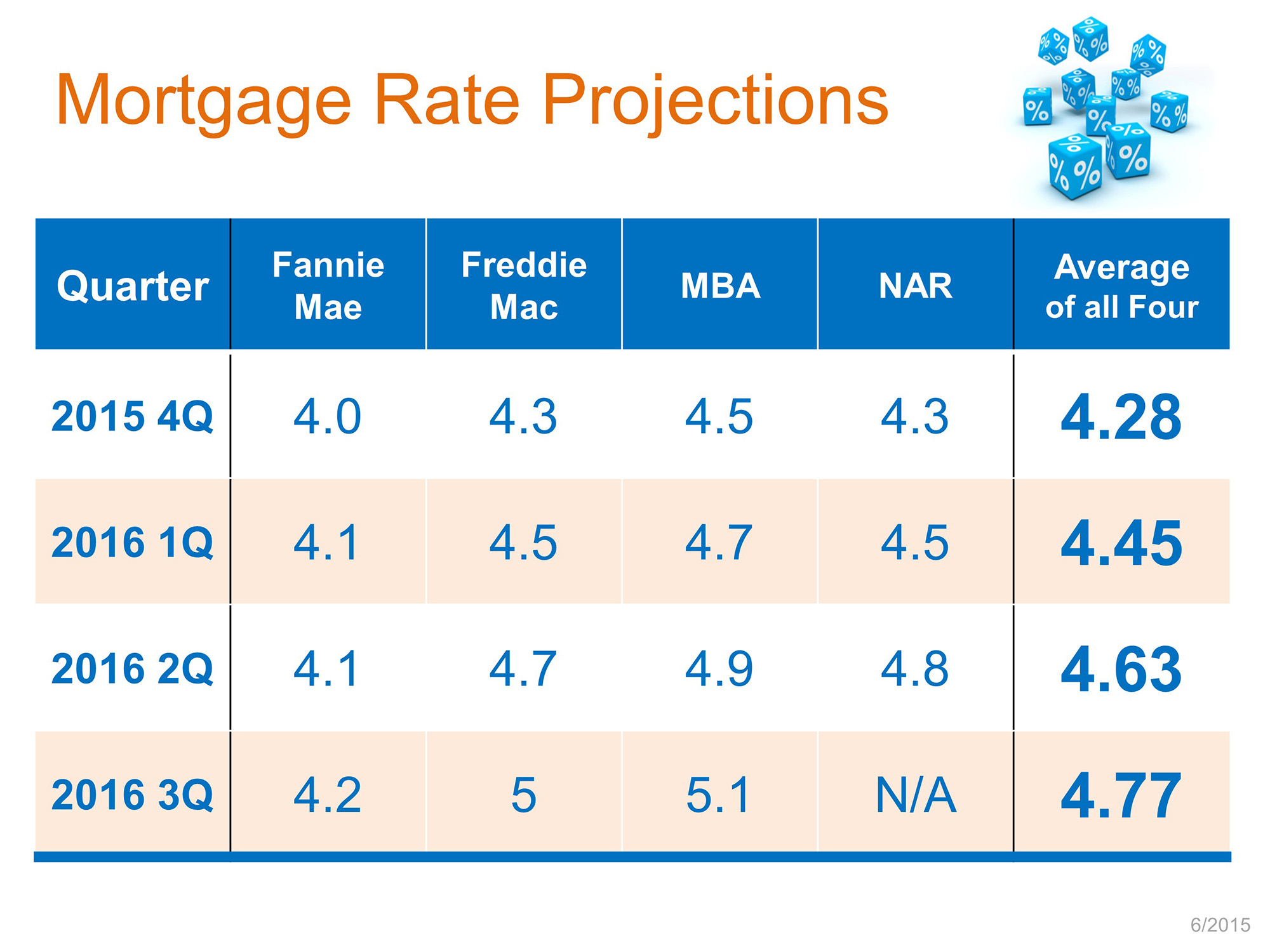

Here are the latest projections from the experts for where (and how much) interest rates are expected to rise:

By this time next year, we could see rates increase by .75%.

From where we were earlier this year, rates could increase by a full point.

So, just what kind of impact could this have on buyers?

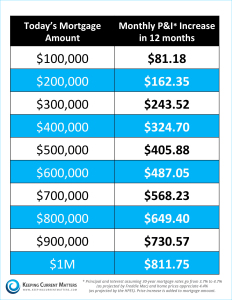

The simple answer is it will cost you more to buy a house because your monthly payment will increase due to a higher interest rate.

The house you like today will cost you more next year. Here is another graph that shows the difference in payment an increase in interest rate makes:

Another factor working against you if you wait to buy–home values are still increasing.

A $200,000 home today will cost more in a year–just how much is hard to say, but nationally home values are increasing at roughly 5%.

So, using that number, a $200,000 home today could cost $210,000 in a year.

This means today’s buyers are facing a double whammy–homes will cost more in a year, and interest rates will also be higher making monthly payments higher as well.

This could impact buyers. It is possible that some buyers could get priced out of the market.

Homes that appeal to you today and that are currently in your price range may not be an option in a year.

You might have to settle for less home if you wait.

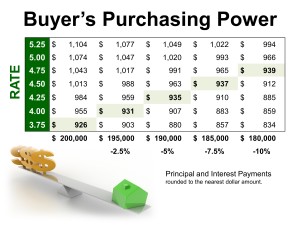

This next graph is a really cool one. It illustrates how increasing interest rates and home values impact a buyer’s purchasing power.

It shows a $200,000 house (today) and the impacts of increasing home values and interest rates.

Say a buyer wants to keep their monthly mortgage payment under $1,000/month.

This graph shows how much the buyer loses in order to keep the monthly payment around the same amount:

However, all of this is not to pressure buyers into buying now.

You can see that waiting can have a negative impact, but if you are not ready to buy now, then waiting won’t keep you from buying a home later.

There is some good news for buyers.

Just because you didn’t buy in the last year, doesn’t mean you missed out.

Even if home values are higher than they were a year or 6 months ago, and just because interest rates aren’t as low as they were earlier this year, this is still a great market to buy in.

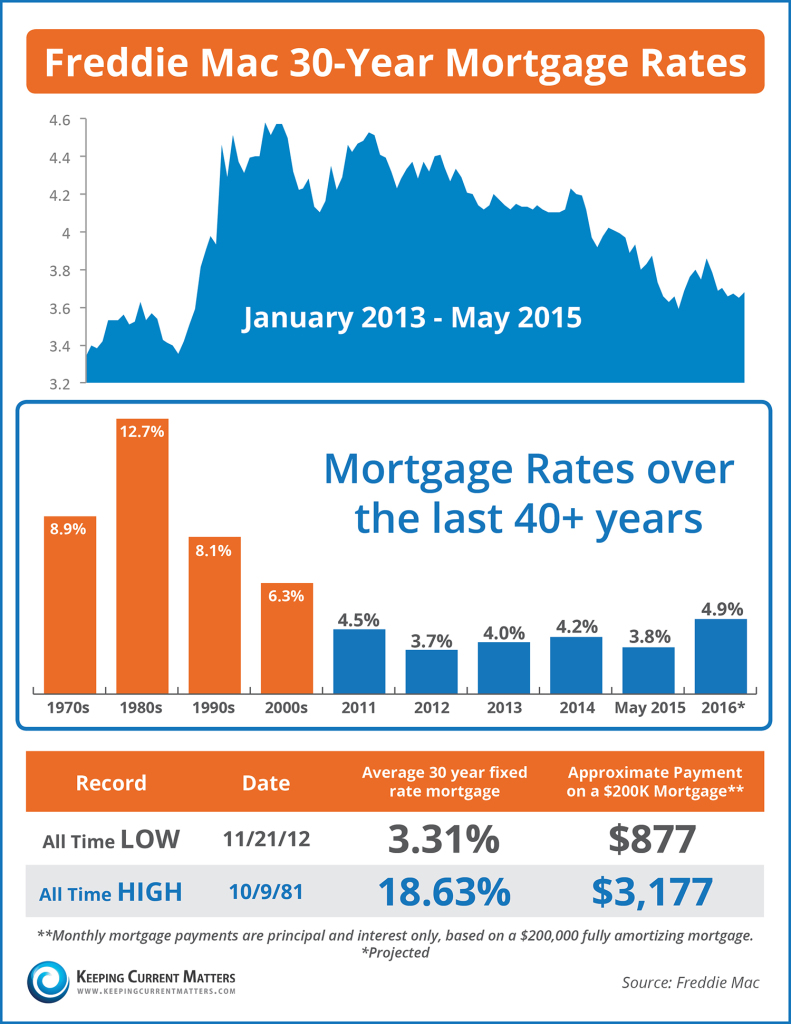

Interest rates hit their historic lows sometime in 2012. However,up through today interest rates remain close to their historic lows.

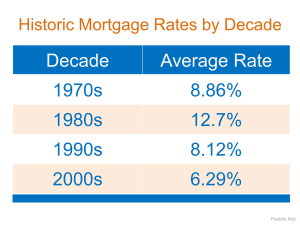

Here is a look at the average interest rate over the last few decades for some perspective:

Keep in mind, we are around 4% currently.

So, while you may not get an interest rate under 4%, even if you wait a year to buy, and assuming interest rates increase as projected, you will still have an interest rate below 5%.

This next graph breaks this down even further, showing the average interest rate not only for the previous decades, but also for each year since 2011.

You can also compare what a mortgage payment would be at the highest interest rate over the last 40 years versus the lowest interest rate:

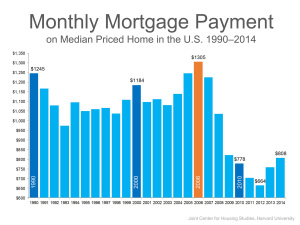

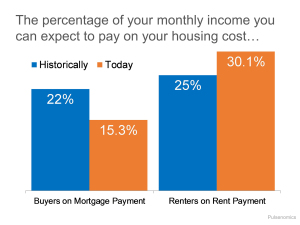

There is more good news for today’s buyers. Owning a home is cheaper than renting.

Owning a home is cheaper today than it has been in over a generation.

Home ownership is also cheaper than renting because your monthly payment is less of your monthly income.

That number is also the lowest it has been in years:

So, do not feel as though you may have missed out because you didn’t buy sooner.

As you can see, it will cost more to wait.

However, if you do wait, you do not have to feel like you missed out.

You will spend more, but even in a year this will still be a great market to buy a home.

Stay tuned, in an upcoming post I will go even deeper showing you why buying a home makes so much sense, and some of the advantages today’s buyer has that buyers just a year ago didn’t have.

In the meantime, if you are thinking about buying a home in Charleston SC then bee sure to visit my website.

Whether you are buying today, in a couple months, or not until 2016, there is plenty of information and resources to help you in your home search.

When you start searching for houses in Charleston SC, my Pam Marshall Realtor website is your one stop shop online to help you with the home buying process.

Leave a Reply