One benefit available to military home buyers (both veteran and active duty) is the VA Loan. If you are thinking about buying a home, here is a list of the biggest mistakes you could make, and how to avoid them.

For more helpful tips, you can check out the following helpful articles:

“28 Must Read VA Loan Tips To Help You Land Your Dream Home” by Chris Birk at VeteransUnited.com.

“The 5 Biggest Mistakes Veteran and Military Home Buyers Make” by Angela Colley at Realtor.com.

“8 Biggest Mistakes Veteran and Active Military Home Buyers Make” by Lee Nelson MyMortgageInsider.com.

According to the “8 Biggest Mistakes”:

“These loans are not harder to get like some people say. It’s not inflexible like other loans either,” she says. But Novak, principal broker and owner of Novak Advantage Real Estate, has found that with all the home buyers she has worked with through the years, there are more misconceptions about the VA loans than any other type of mortgage.

“It is interesting that these misconceptions come from both the buyer and the seller side,” she says. So, without the right information, people make mistakes and bad decisions.”

Buying A Home To Buy A Home

It is true that now is a great time to buy a home–interest rates remain near their historic lows and home values are continuously rising. That doesn’t necessarily mean that it is a good time to buy for you.

How long will you be stationed here? It is important to learn as much information about the current market locally before making the plunge.

What is the local market going to look like in 3 or 5 years? Keep in mind that you will need to see at least 6% appreciation (roughly) just to break even on the sale of your home.

Even if you will only be in a location for 3 years or so, it doesn’t necessarily mean that you can’t or shouldn’t purchase a home.

Planning on staying longer? Keep in mind that things change. You might have kids, you might have more kids, your orders could change as well.

If you are thinking about keeping your home and renting it out when you leave, then be sure to think through every possibility–it might not be a bad idea to talk to your realtor and/or a property manager about being a landlord. It is not as easy as collecting a rent check every month.

PRO TIP: Unless you plan on leaving the military and staying in Charleston, it is a good idea to look at your home as an investment. From Angela Colley’s article:

“By searching in high-demand areas or choosing a popular home style and size (like 1,500 to 2,000 square feet), you’ll give yourself a better chance at resale if you need to move later. Or, you can hang on to it and rent it out.

“[My clients and I] often go out and look for their first rental home, not just a home for their family,” Fraser says. “With so many in transition, they’re able to purchase a home and it becomes an investment property for them when they go on to their next duty station or they move.”

Work With A VA Loan Specialist

About one in three home-buying veterans don’t know they have a home loan benefit, according to the VA.

While most banks and lenders offer VA Loans, it is advisable that you work with someone that specializes in VA Loans. Your local bank is usually not the best option.

VA Loans are different from other loans, and if you choose to use someone that doesn’t handle them every day, you could be setting yourself up for a rough experience.

Two great VA Loan specialists that I work with and highly recommend are Phil Crescenzo and Veterans United Home Loans.

Get Pre-Approval From The Beginning

It is important to know where you stand before you begin to look for your home. VA Loans offer no money down loans, low-interest rates, don’t require mortgage insurance, and are more forgiving when it comes to credit requirements.

However, you will want to still speak with your VA Loan specialist to see if there are any credit issues you might want/need to address.

For instance, even though you do not need a down payment, you might want to pay down some credit card debt so that you qualify for a lower interest rate.

A VA Loan specialist can not only let you know what you qualify for, they can help you determine how much home you can afford and wjat your monthly payment will be.

They can also show you ways to improve your credit so you can qualify for the lowest rate.

It is also important to know that home sellers will require proof of pre-approval before seriously considering any offer.

Your VA Loan specialist can also help you obtain your Certificate Of Eligibility (COE).

Save Up Some Money

While you do not need it for a down payment, home buying still takes money.

You will need to pay for a home inspection and the VA Appraisal, and these are required to be paid upfront.

It is also a good idea to save up some money because once you own a house, any repairs become your responsibility.

Better to be prepared and not need it than to be surprised empty handed.

Don’t Forget About Closing Costs

These fees are associated costs of home buying. They include lender’s fees, attorney’s fees, taxes, and escrows.

The good news is you can usually negotiate with the seller to pay some or all of your closing costs. There’s no limit to how much they can contribute to cover loan-related costs.

In addition, sellers can pay up to 4% of the purchase price to pay for things like prepaid property taxes and insurance.

There is also the VA Funding Fee. This fee is usually rolled into your loan (or can be negotiated to be paid by the seller), so you do not have to worry about out of pocket expense at the closing table.

However, it will impact your monthly payment, so it is something to account for.

From Veterans United’s Chris Birk:

“You can ask the seller to pay all of your closing costs, regardless of the the total amount. The VA does cap what a seller can contribute in concessions — which are things like paying your prepaid taxes and insurance or the VA Funding Fee — at 4 percent of the loan amount.

But feel free to ask for the moon when it comes to the closing costs. There’s no guarantee the seller will bite, but you won’t know if you don’t ask.”

Not Knowing You Might Pay Closing Costs

There seems to be a misconception that in these 100 percent VA loans, the seller pays the buyer’s closing costs. That is not true.

Buyers are responsible for their own closing costs, but they can be negotiated to be paid by the seller.

From Colley:

“The market is so competitive these days that when I talk with my VA buyers, I tell them about lender-paid closing costs that keeps them competitive with other offers. Their interest rate would be a little higher,” Novak says. Closing costs are usually 2 to 3 percent of the loan amount.”

Believing A VA Appraisal Is A Substitute For An Inspection

The VA Appraisal is a little more in depth than a normal appraisal.

Normal home appraisals look to assign a value on the house in comparison to similar homes in the area.

The VA Appraisal does this as well, but extra steps are taken to insure the home meets VA standards

The VA wants veterans purchasing homes that are “move-in ready.”

To that end, independent VA appraisers have to make sure your home purchase meets a set of minimum property requirements as part of the VA appraisal process.

However, this is not a substitute for a home inspection. A home inspection is more thorough. Although not required, you should always get one anyway.

After all, this will probably be the biggest purchase you ever make, so you will want to spend a little money upfront to make sure you don’t have expensive issues down the line.

The home inspection allows you to renegotiate items with the seller and helps ensure you don’t get stuck with serious issues.

A VA appraisal is required for any VA mortgage, but people get confused because the Veteran’s Administration calls it the VA Appraisal Inspection.

The appraisal is for the protection of the lender, while the inspection is for the protection of the home buyer.

Work With A Realtor That Understands VA Loans

You will first want to work with a Realtor that represents you. The seller will have an agent representing them, and you should have one representing you as well.

It does not cost the buyer anything to utilize the services of a Realtor.

However, not all agents are the same.

You will want an agent that has experience working with the VA and understands the process.

For instance, some homes will not meet the VA requirements which means they will not approve the mortgage.

If an agent does not understand what to look for in a home, then you could be setting yourself up for a lot of aggravation (and money lost).

From Colley’s article:

“I see a lot of people go with an agent who doesn’t understand the VA system,” says Katie Fraser, a Realtor with Trident Realty Group Northwest in Seattle.

“The VA won’t underwrite [just] any house. It is a huge, huge, huge deal to use an agent who understands the VA system, the VA appraisal process, and what that all really looks like.”

When you’re buying through the VA, you’ll need to find a home that meets VA property requirements.

A VA appraiser will have specific criteria; for instance, fixer-uppers (and even some newer homes) won’t qualify.

Save yourself the headache of making an offer on a house that may not get approved, and work with a VA-experienced Realtor from the start.”

There are more reasons why military personnel and veterans should work with a Realtor that has experience working with VA Loans. Besides understanding the process, they are also passionate about serving those who served.

Research Home Buying Online

There are a lot of great resources online that can help you better understand the home buying process, applyiing for a VA Loan, and the current real estate market.

Another great article I came across is by Kate Horrell over at Spousebuzz.com, “11 Reasons NOT To Buy A House…And 7 Why You Should”.

You can also learn more about the current market trends and what the future projections are at this blog or this blog.

You can also download several free real estate guides, and learn more about me on my Pam Marshall Realtor website.

I love working with military buyers, and understand the VA Loan process so that your home buying experience will be less stressful.

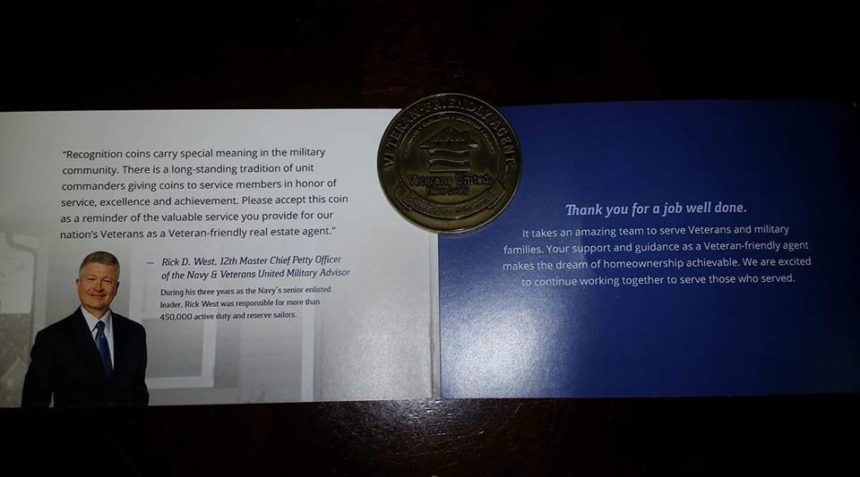

The award pictured above was given to me for my work with veterans and military personnel by Veterans United.

In addition, I have a member of my team that was Veterans United’s top Realtor in the Charleston area in 2012 and 2013.

Leave a Reply