Buying A Home: First Home Buying Tips Charleston SC (Pt 2)

Here’s the rest of the post I started yesterday. You can see Part 1 here.

4) Have All Your Financial Documents Together Before Pre Approval

Just as a mortgage pre approval is being proactive to buying a home, getting your financial docs in order first is being even more proactive.

Just as a mortgage pre approval is being proactive to buying a home, getting your financial docs in order first is being even more proactive.

You will want to keep copies of your most recent pay stubs (at least 2 weeks), tax returns (last 2 years), as well as bank statements for savings accounts and investment accounts.

Having all this documentation and having it organized will make the whole home buying experience much quicker and smoother. This documentation is required by the lender, and they will want updated info along the whole process as well.

This can be a big part of the stress in buying a home, so why not be proactive and eliminate it right from the start?

5) You Can Shop Around, But Be Wary

Be careful where you get your mortgage quotes from. Not all lenders are the same. No one has exclusive low interest rates–lenders pretty much offer the same interest rates.

They also offer many of the same loan programs. The danger of shopping around is that it is easy to compare one quote to another and think that the better offer is the one with lowest rate. This can be a big mistake.

When comparing quotes, make sure you are comparing apples to apples. Lenders need more information from you than simply credit scores to determine what mortgage makes sense for you. Other factors will determine what interest rate you can qualify for.

It is ok to shop around–in fact, credit bureaus allow you up to a 45 day window in which multiple inquiries for mortgage loans are only treated as one. This will keep your credit from being dinged more than once.

However, just be smart when you shop around. A lower interest rate on the wrong mortgage program can wind up costing you a lot more.

5) Start Saving

If you haven’t already started setting some money aside, then you need to start asap. Tax season is upon us, so perhaps you have a refund.

If you haven’t already started setting some money aside, then you need to start asap. Tax season is upon us, so perhaps you have a refund.

You will need money for a down payment. How much?

There has been a misconception that you needed 10% or 20%.

If you can come up with a 20% down payment, you will not have to pay Private Mortgage Insurance.

However, you do not need 20% for a down payment. Conventional loans only require 5%, and FHA only requires 3%. FHA loans are the most popular amongst first time buyers. Recently, FHA lowered their PMI rates as well as their required down payment.

6) Speaking Of Down Payment, Where To Get Money For It?

Hopefully you have been saving for a down payment. But there are options. If you are Active Duty, Reservist, or Veteran of the Military, you can use a VA loan that requires 0% down.

In some rural, outer areas you can also get a 0% USDA loan.

FHA allows for family members to “gift” you the down payment. Be sure to talk to a loan officer about how to set this up properly.

FHA allows for family members to “gift” you the down payment. Be sure to talk to a loan officer about how to set this up properly.

Lenders want to see the money “seasoned” (in your account for a minimum amount of time) and “sourced” (paper trail of where the money came from). This is important because if not set up properly, then the lender may not allow the gift money to be used.

You will need to check with a CPA for the most recent details, but the IRS will allow parents to gift their child up to $11,000 each year, tax free.

There are also some first time home buyer grants that will pay for your down payment and closing costs.

7) Other Costs

You will need money for Earnest Money, Closing Costs, Home Inspection and the Appraisal.

Earnest Money, also called Good Faith Money, is a deposit you put down when you make an offer. It shows the seller that you are offering in Good Faith, or that you are a serious buyer.

This money is held in an escrow account, and can be used towards your loan, your closing costs, or sometimes can be refunded back to you (in whole or in part) at the closing table. Budget $1000 for this, although that amount can vary.

Closing Costs are all of the costs associated with the loan, the attorney who will perform title work and the closing, as well as recording fees.

This is generally 3% of the purchase price–however, most first time home buyers have the sellers pay these at closing.

You will need a home inspection, as well as an appraisal. These are paid at the time they are performed, and can run $500-$1000.

You will need a home inspection, as well as an appraisal. These are paid at the time they are performed, and can run $500-$1000.

In addition to your down payment, you will want to have about $2000 set aside for inspections.

Home ownership involves a lot more than simply the mortgage. However, being a little proactive can help make things much easier to digest, and less stressful.

Your monthly mortgage payment can cover your loan costs, as well as the taxes and insurance. Saving up money is always a good idea in general, especially when you own a home.

You never know when something might come up–one day the dishwasher stops running. Gone are the days of calling the landlord because now you are the landlord.

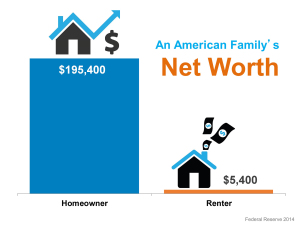

However, there are many benefits of owning a home. Home owners enjoy a higher net worth than renters.

However, there are many benefits of owning a home. Home owners enjoy a higher net worth than renters.

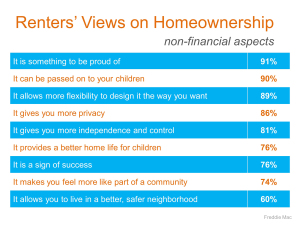

Having your own home means it is your home–you can decorate it however you like.

You can pick what area of town you want to live in, what neighborhood.

Best of all, your monthly housing payment is set for 30 years and will not increase.

Rents are always increasing.

Owning your own home gives you safety and security.

The process can be stressful, but it doesn’t have to be.

Choosing the right real estate agent is also very important. Not all agents have the patience to work with first time buyers.

You need an agent that will explain the process to you so you will know all of the surprises before they happen. They can help you be proactive and set you up for success.

Bee sure to visit my Pam Marshall Realtor website. There is a lot of helpful first home buying tips Charleston SC like my buyers guides and videos.

You can also search the Charleston MLS and sign up for a free list of homes that match your criteria. This is a great resource if you are buying a home in Charleston SC.

Leave a Reply