Erasing Misconceptions About How Much Down Payment Is Needed To Buy A Home

If you are thinking about buying a home, then you have probably asked yourself “How much do I need for a down payment?”.

Based on a recent survey, many would be buyers mistakenly believe that more is needed for a down payment than is really necessary.

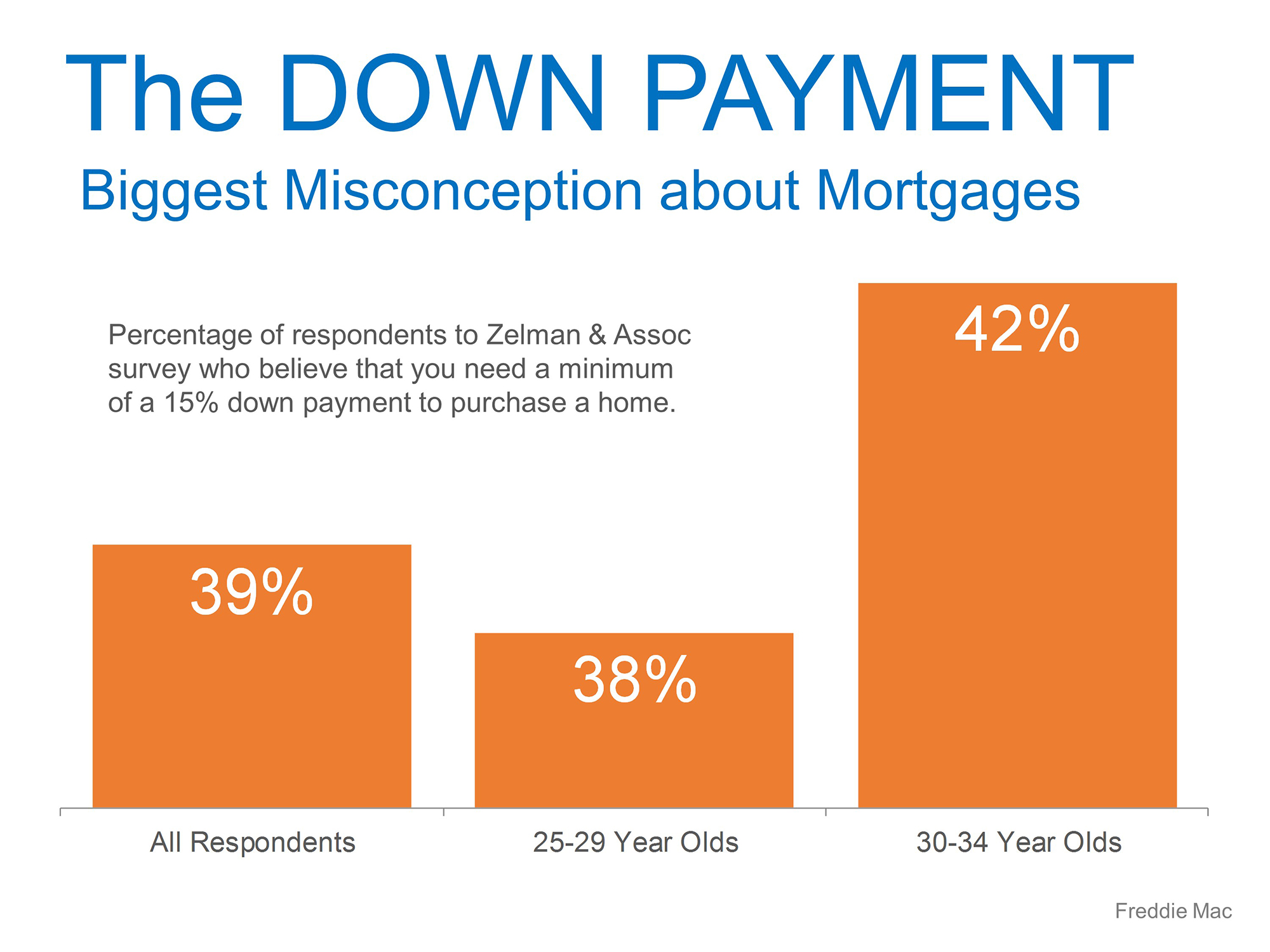

Zelman & Associates surveyed potential home buyers to see how much they felt they needed for a down payment.

A surprising number of respondents mistakenly believed that in order to buy a home, a down payment of 15% or greater was required.

They broke down the results by age group, split into The Millennial Generation as well as Generation Y.

This is important because these age groups represent a large number of potential first time home buyers, especially the Millennials. Overall, 39% of the respondents believed that you need at least 15% for a down payment on a home.

The reality is far from this perception. In today’s real estate market, you can purchase a home for as little as 3% down, and in certain cases you can purchase for no money down.

Mortgage Insurance

However, putting more down makes financial sense. The more money you put down will decrease your monthly payment.

If you put 20% down, then you save even more money because you will avoid Mortgage Insurance.

Mortgage Insurance is added to loans that exceed 80% of the home’s value and is built in protection for the lender.

It protects them from borrowers defaulting on the loan. Borrowers with less than 20% equity in a home are more likely to default.

Mortgage Insurance is good for home buyers because it allows homeowners to get into a house at good mortgage rates with less than 20% down

Mortgage Insurance rates vary, depending on factors such as how much your down payment is and your credit score.

This can add anywhere from $30/month to more than $100/month to your mortgage payment per $100,000 borrowed.

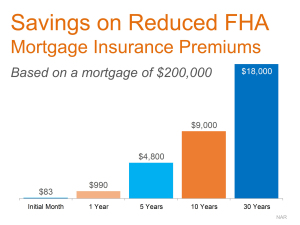

The good news for home buyers is that the FHA recently dropped Mortgage Insurance rates, which in turn will reduce monthly mortgage payments for buyers.

So, Just How Much Do I Need For A Down Payment?

The FHA also announced that the minimum down payment required dropped, from 3.5% to 3%.

Active Duty, Reservist, and Veteran Military servicemen and servicewomen have loans available to them through the Department of Veterans Affairs (VA). VA loans do not require a down payment at all.

There is also loans available through the United States Department of Agriculture Rural Development (USDA) that require no money down. These loans are not available in suburban areas, and are limited to outlying rural areas.

Another option for home buyers is Conventional Loans. Typically, these loans only require 5% down.

The Millennial Home Buyer

Getting back to the Zelman & Associate survey I referenced earlier, it is important that potential home buyers are aware that they do not need 10%, 15% or 20% to purchase a home.

It is especially an issue for Millennial buyers.

This market segment represents the largest generation and could have a huge impact on the housing market.

If more Millennials are aware of what it takes to buy a home, then that could give the housing market a big boost.

Without these buyers, it can have a detrimental affect on the market.

A recent study by Nomura found that the biggest obstacle holding back many would be first time home buyers is not a lack of down payment or bad credit.

Rather, it is the perception that they do not have enough for a down payment or believe their credit is not sufficient.

A simple call to a mortgage loan officer can alleviate these misconceptions.

If an applicant’s credit will not allow them to qualify today, an action plan can be created to get their credit remedied as fast as possible, so they can buy a home–usually within a year.

How Big Of A Deal Is The Down Payment?

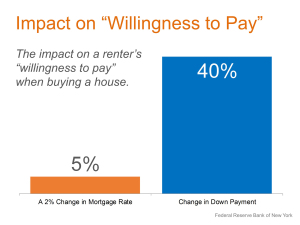

A recent study by the Federal Reserve Bank of New York showed just how much an issue the down payment is for potential home buyers.

In the study, respondents were given two hypothetical scenarios to determine their “willingness to pay” for a home.

In the first scenario, a 20% down payment was required. Half of the respondents would have a 4.5% interest rate, the other half would have a 6.5% interest rate.

In the second scenario, the interest rate remained the same for all respondents. However, they could choose any down payment they wanted, as long as it was at least 5%.

The study found that a switch in Interest Rate by 2% (from 4.5% to 6.5%) had a minimal affect on the respondent’s “willingness to pay” for their hypothetical new home.

Only 5% said they would not be willing to still buy a home if the interest rate increased by 2%.

However, when the required down payment was decreased from 20% to 5%, respondents “willingness to pay” increased by 40%.

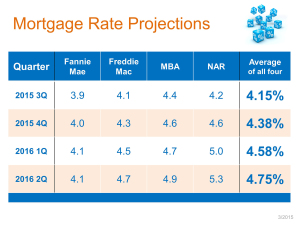

One worry in the current housing market is the potential for interest rates to increase.

Most industry experts predict higher interest rates by the end of 2015–in some cases a full point increase or more.

There is concern that this increase could slow down the housing market.

However, based on these surveys, it appears that the bigger obstacle for the housing market is the down payment misconception.

So, if you know anyone thinking about buying a house, and they ask “How much do I need for a down payment?”, chances are the answer is less than they think.

If you are thinking about buying a house in Charleston SC, then bee sure to visit my Pam Marshall Realtor website.

Leave a Reply